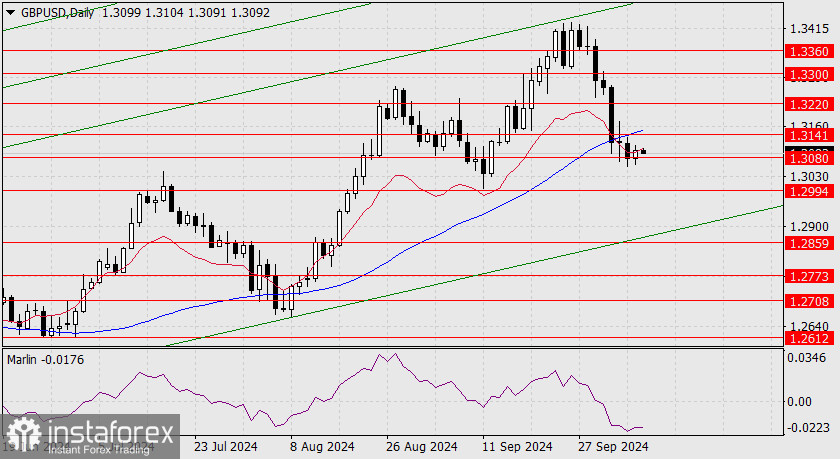

Yesterday, the British pound rose by 21 pips. The daily candle, which opened below the balance indicator line, ended the day above it. The session can also be characterized as bullish after an unsuccessful test of the 1.3080 support. Technically, a reversal is complicated because the bodies of the daily candles have remained below the MACD line for the last three days.

More time and additional external factors are required for a decisive (confirmed) breakout above the resistance level of 1.3141 and above the MACD line.

On the four-hour chart, the price is consolidating above the 1.3080 level, but overall, it remains within the range of 1.3080–1.3141. Before the consolidation ended, the Marlin oscillator had already moved into growth territory, reducing the likelihood of a downward breakout.

However, the price is still under significant pressure from the indicator lines on the H4 and daily charts. The risk of a price drop remains high as long as the quote stays below the 1.3141 resistance level. We await further developments.