Analysis of Trades and Tips for Trading the British Pound

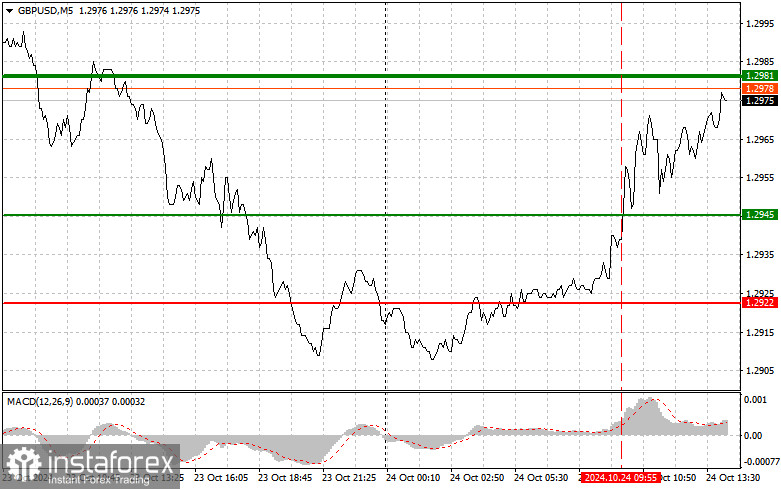

The test of the 1.2945 price level coincided with the moment when the MACD indicator had risen significantly above the zero line, which limited the pair's upward potential—especially against the backdrop of weak UK PMI data. Despite this, the pair rose, but it failed to reach the 1.2981 level for selling. Data on U.S. initial jobless claims and new home sales are expected to have minimal impact, as the focus is on U.S. economic activity. The Manufacturing PMI, Services PMI, and Composite PMI are the data points that will trigger volatility, and in the case of very strong figures, the pound could quickly lose its gains. If the data is not strong, the pair will likely continue its upward correction throughout the day. As for the intraday strategy, I will focus more on executing Scenarios #1 and #2.

Buy Signal

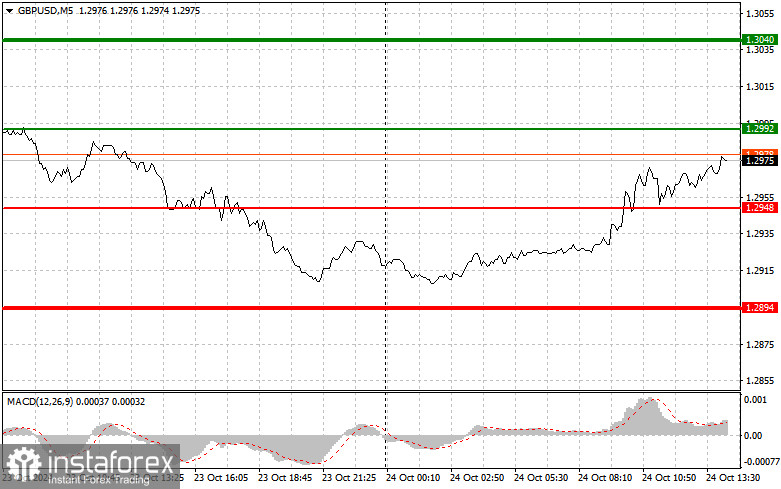

Scenario #1: Today, I plan to buy the pound upon reaching the entry point around 1.2992 (green line on the chart) with a target of rising to 1.3040 (thicker green line on the chart). At 1.3040, I plan to exit the buys and open sells in the opposite direction, aiming for a move of 30-35 points back from that level. A rise in the pound today can only be expected if U.S. data is weak. Important: Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.2948 price level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upwards. A rise to the resistance levels of 1.2992 and 1.3040 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound after it breaks below the 1.2948 level (red line on the chart). This break is expected to lead to a quick drop in the pair. The key target for sellers will be the 1.2894 level, where I plan to exit the sells and immediately open buys in the opposite direction, expecting a move of 20-25 points back from that level. Sellers are likely to act if the data is strong. Important: Before selling, ensure that the MACD indicator is below the zero line and just beginning its decline.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.2992 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downwards. A drop can be expected to the resistance levels of 1.2948 and 1.2894.

What's on the Chart:

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: Approximate price where you can place a Take Profit or manually secure profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: Approximate price where you can place a Take Profit or manually secure profits, as further declines below this level are unlikely.

- MACD Indicator: When entering the market, it is important to pay attention to overbought and oversold zones.

Important: Beginner traders in the forex market should be very cautious when making decisions to enter the market. It is best to stay out of the market before the release of significant fundamental reports to avoid getting caught in sharp price movements. If you decide to trade during news releases, always use stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember, successful trading requires a clear trading plan, like the example provided above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.