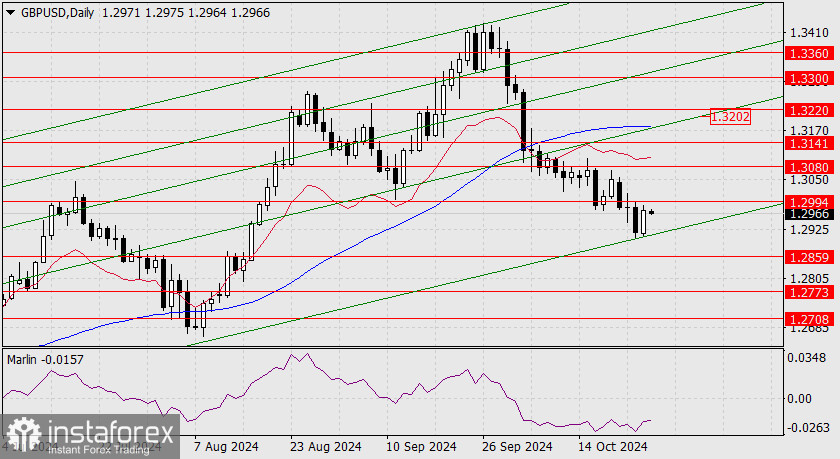

On the daily chart, we are adjusting the price channel due to the price breaking the lower boundary on the 23rd. In a corrective rise, the price aims for the nearest embedded line of this channel at the point where it intersects with the MACD line, within the range of 1.3202/20. This range might be reached right around the day of the U.S. presidential elections.

Beyond that, the pound faces complete uncertainty, entirely dependent on the intentions of major market players about this event. Even the Federal Reserve's rate decision meeting, which has been postponed by a day, may either become a secondary factor or align with the actions of these key players.

A breakout above the resistance at 1.2994 (1.3001—the September 11th low) opens up a target of 1.3080. The Marlin oscillator seems to be "unfrozen" and is now supporting the price's upward movement.

The price is rising above the MACD indicator line on the four-hour chart, and Marlin has moved into the growth territory. We anticipate further development of the short-term rise.