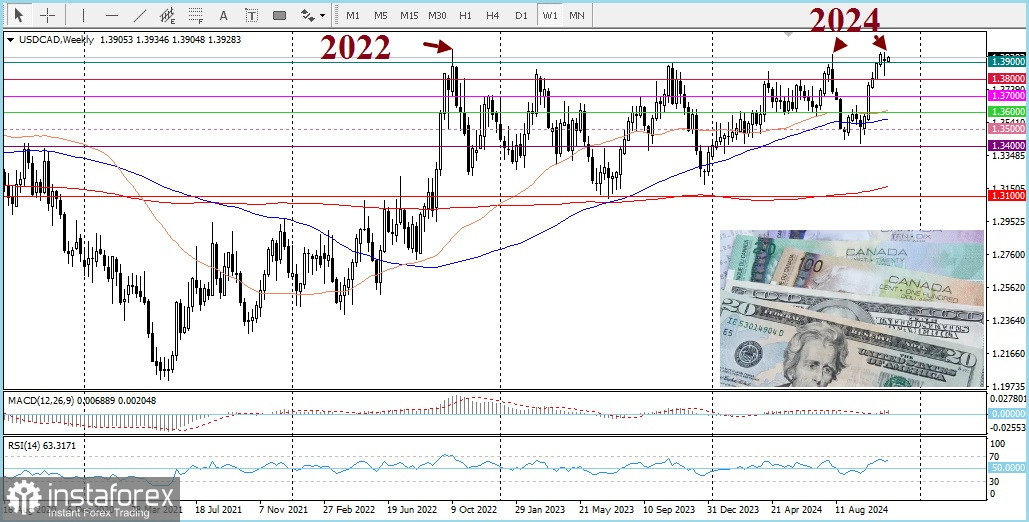

For the second consecutive day, the USD/CAD pair is gaining upward momentum, supported by a strong US dollar.

Spot prices remain supported by various factors, staying close to the highest levels since October 2022, which were retested last week. Crude oil prices have fallen amid disappointment over China's fiscal stimulus measures and weaker-than-expected inflation data in China, which have reduced hopes for a recovery in fuel demand from the world's largest importer.

Mixed employment data from Canada released on Friday did not lower market expectations for further monetary easing by the Bank of Canada. This continues to weigh on the commodity-linked Canadian dollar while supporting the USD/CAD pair alongside increased US dollar buying.

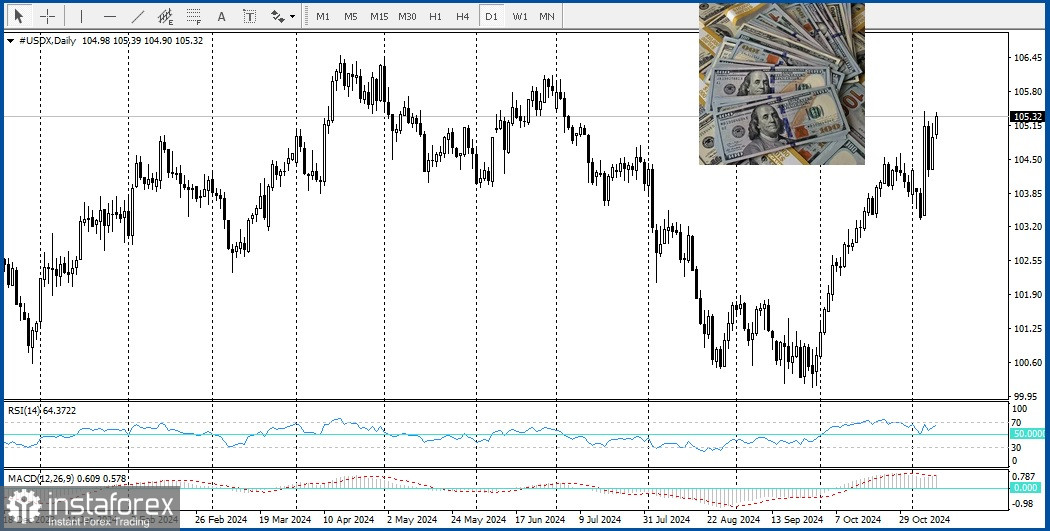

The US Dollar Index, which tracks the greenback against a basket of currencies, is once again approaching its four-month high reached last week. This is driven by optimism surrounding the expansionary policies proposed by US President-elect Donald Trump.

Trump's proposed 10% tariff on imports from all countries could stoke inflation, potentially limiting the Federal Reserve's ability to pursue more aggressive monetary easing. This continues to support higher US Treasury yields, which, when coupled with cautious market sentiment, benefits the US dollar.

Despite these gains, dollar bulls may take a breather ahead of key events. These include the release of US consumer inflation data and speeches by several influential Federal Open Market Committee (FOMC) members, such as Federal Reserve Chair Jerome Powell.

The fundamental backdrop suggests that the path of least resistance for the US dollar and USD/CAD remains upward. Any price corrections are likely to be seen as opportunities for strategic purchases, albeit potentially limited due to the partial holiday in the US and Canada.