Macroeconomic Reports Overview

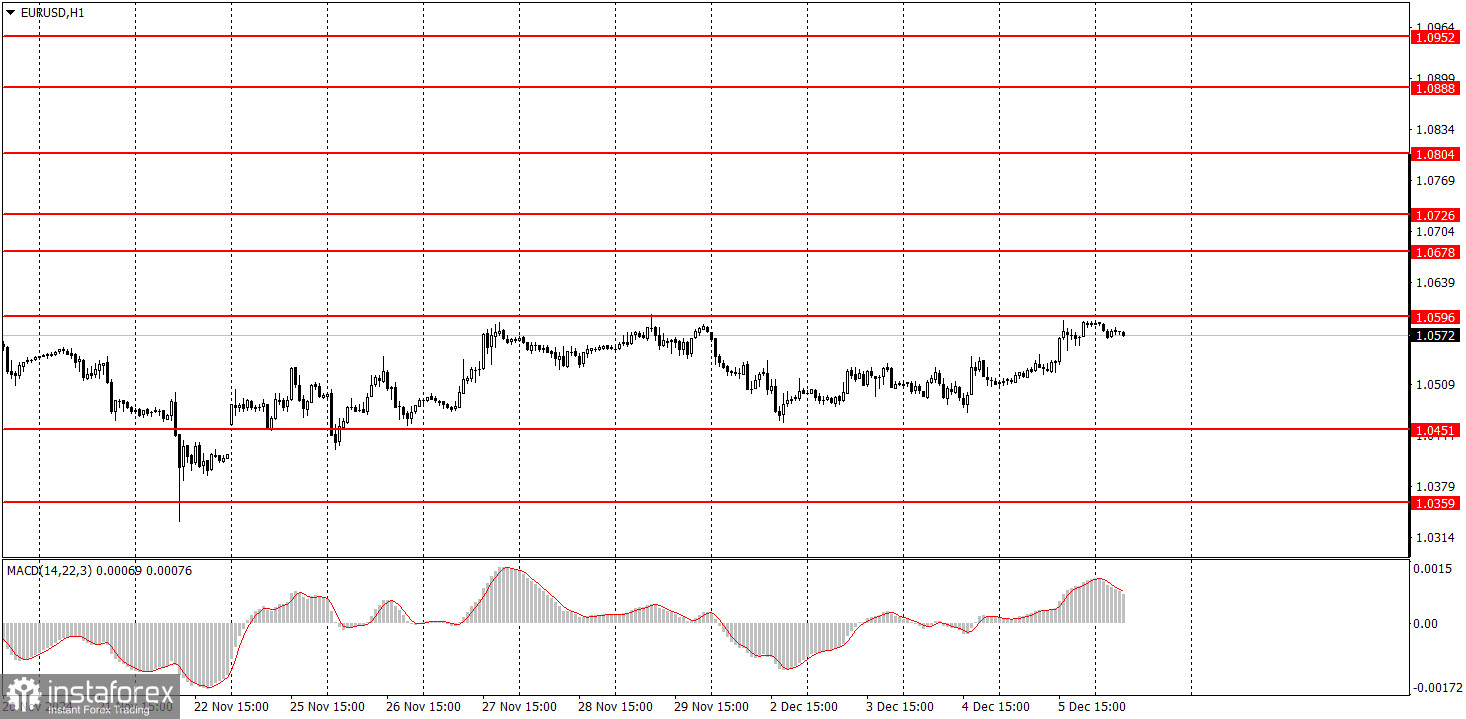

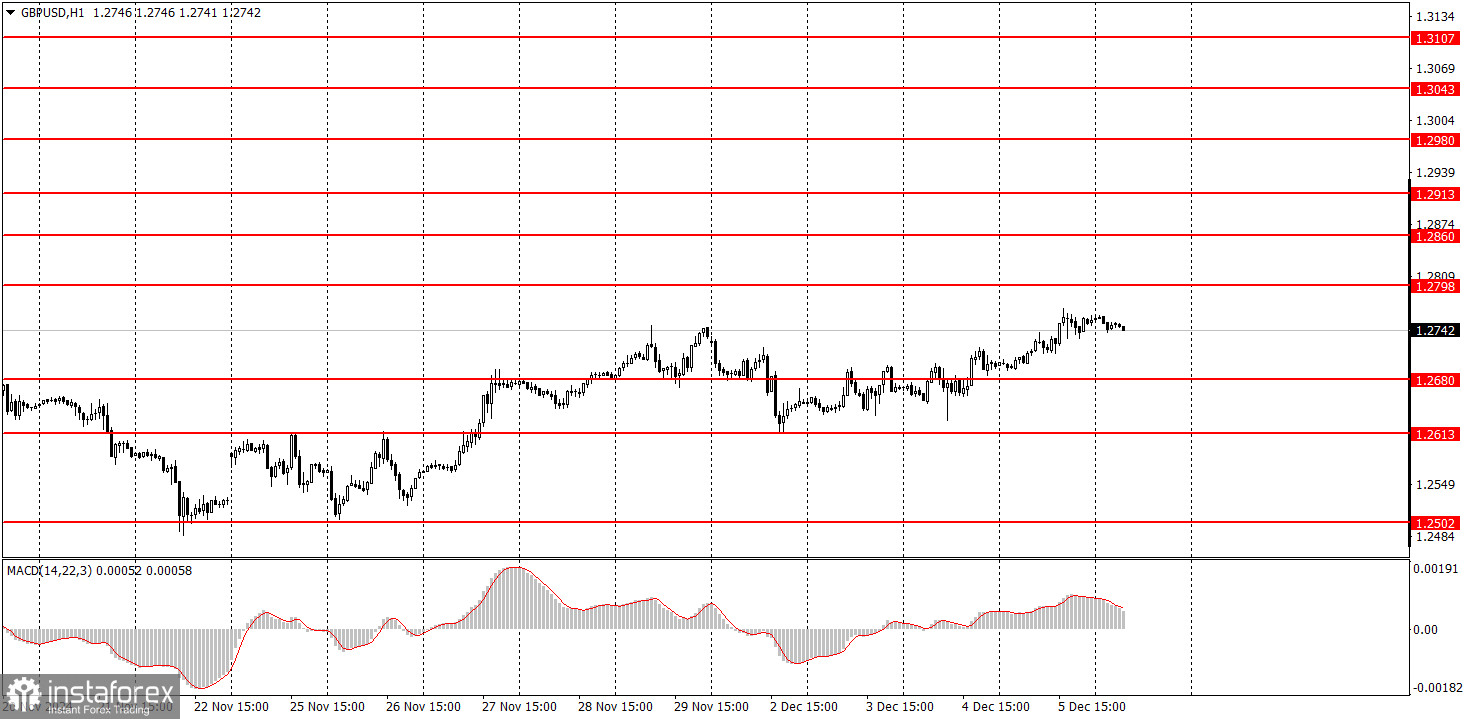

Friday's calendar is packed with significant macroeconomic data, primarily from the United States. The U.S. NonFarm Payrolls and unemployment rate reports are expected to attract market attention. These are critical enough to drive 100+ pip movements in EUR/USD and GBP/USD. Reports on average hourly earnings and consumer sentiment are also notable, but they will take a backseat to the labor market data. Meanwhile, the Eurozone GDP final estimate for Q3 could provoke a reaction only if there's a significant deviation from forecasts.

Fundamental Events Overview

Key fundamental events for Friday include speeches by Federal Reserve representatives Michelle Bowman, Mary Daly, and Austan Goolsbee, scheduled for late evening. These officials will likely comment on the latest labor market and unemployment data. There's no certainty that the Fed will reduce the key rate by 0.25% in December. If today's labor market data is robust and next week's inflation figures indicate acceleration, the likelihood of monetary policy easing in December will diminish. Such a scenario could strongly support the U.S. dollar.

General Conclusions

For the week's final trading day, the euro is expected to remain within its sideways range, while the pound could continue its mild upward correction. Given the heavy slate of macroeconomic and fundamental events, markets should be prepared for volatility during the U.S. trading session, with the direction of movements hinged entirely on the nature of the U.S. data.

Key Rules for the Trading System:

- Signal strength is determined by the time it takes for a signal to form (bounce or breakout of a level). The shorter the time, the stronger the signal.

- If two or more false signals are generated near a level, subsequent signals from that level should be ignored.

- In a flat market, any pair may produce numerous false signals or none at all. In such cases, it's better to stop trading at the first signs of consolidation.

- Trades should be opened during the European session through the middle of the American session. All trades should be manually closed thereafter.

- On the hourly timeframe, trades based on MACD signals should only be executed during periods of strong volatility and trends confirmed by trendlines or trend channels.

- If two levels are very close (5–20 pips apart), they should be treated as a support or resistance zone.

- After a 15–20 pip movement in the correct direction, set a Stop Loss at breakeven.

What's on the Charts:

Support and Resistance Levels: Targets for opening buy or sell orders. These are ideal points for setting Take Profit levels.

Red Lines: Trendlines or channels reflecting the current trend direction and indicating the preferred trading direction.

MACD Indicator (14,22,3): A histogram and signal line serving as auxiliary indicators and sources of signals.

Key News Events and Reports: Always listed in the economic calendar, these can significantly impact currency pair movements. Exercise caution or exit the market during such events to avoid sharp price reversals.

Every trade cannot be profitable. The key to long-term success in Forex trading lies in developing a clear strategy and effective money management.