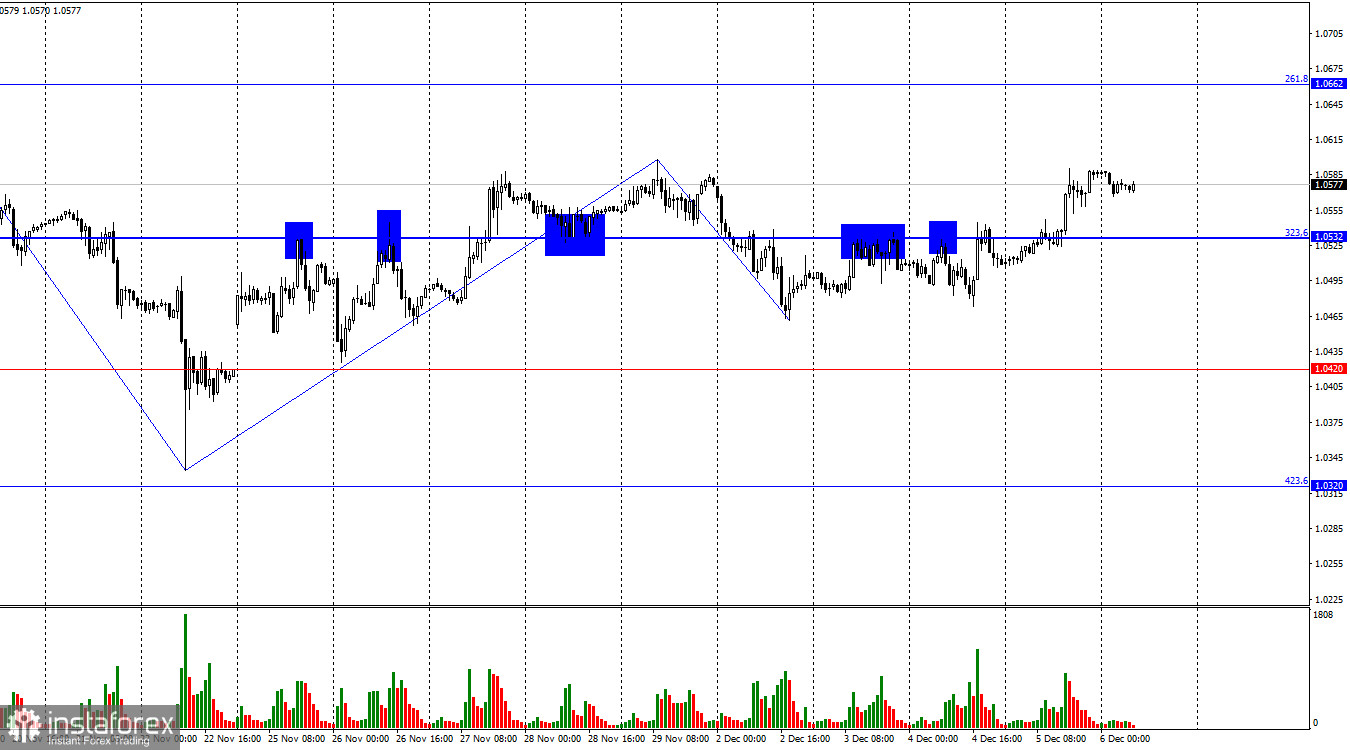

The wave structure is clear:

- The most recent completed upward wave failed to break the previous high.

- The most recent downward wave didn't breach the last low.

This indicates the continuation of the bearish trend. Bulls have lost momentum in the market and are unable to regain control. For the bearish trend to reverse, the pair must rise above 1.0611, a level it has yet to breach.

Thursday's news was relatively weak, but earlier in the week, there were numerous reports. Traders seem to have either dismissed the news as unimportant, focused entirely on Friday's upcoming data, or found the reports themselves underwhelming.

Key takeaways from earlier in the week include:

- ISM reports from the US were mixed, showing growth in manufacturing but a decline in services.

- The ADP employment report met expectations.

- The JOLTS job openings report exceeded forecasts.

- Jerome Powell signaled a cautious Federal Reserve approach, emphasizing a pause over further easing.

- Christine Lagarde emphasized Europe's economic fragility, suggesting the need for continued monetary easing.

Despite these developments, bulls have had opportunities to regain momentum this week. If today's Nonfarm Payrolls (NFP) and unemployment rate data are strong, the market may conclude that buying the US dollar is the only rational option.

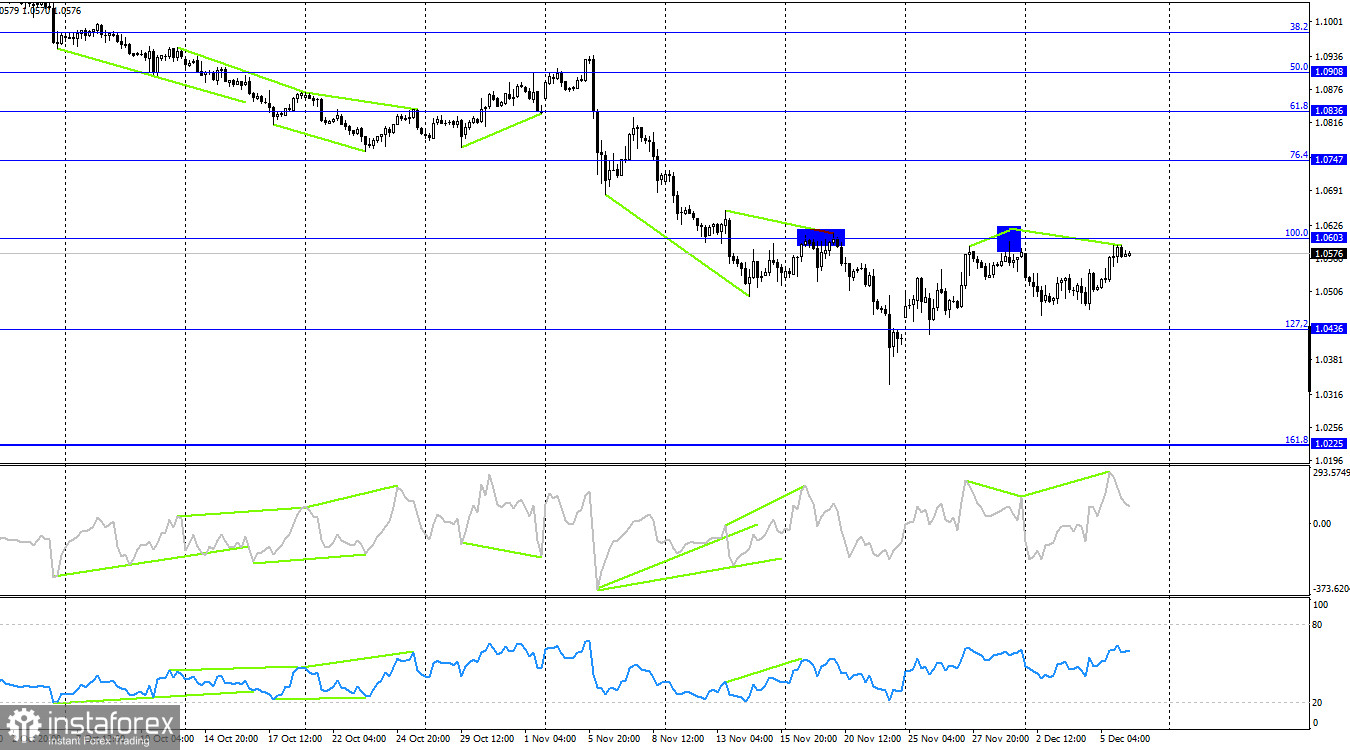

On the 4-hour chart, the pair has returned to the 100.0% Fibonacci retracement level at 1.0603. A second rebound from this level could strengthen the US dollar and result in a decline toward the 127.2% retracement level at 1.0436. A bearish divergence has already formed on the CCI indicator. Consolidation above 1.0603 could signal further euro growth toward the next retracement level at 76.4% (1.0747).

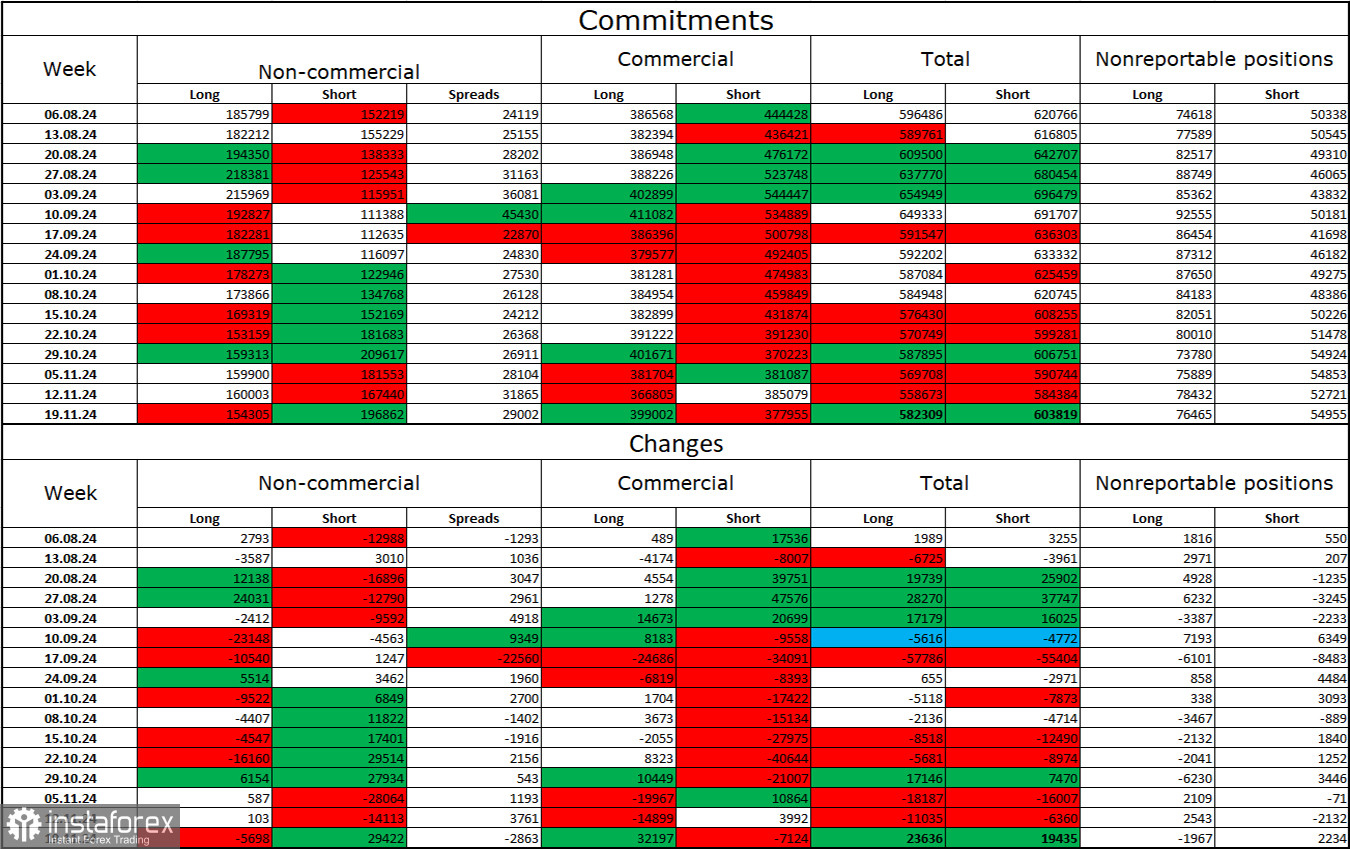

Commitments of Traders (COT) Report

The latest COT data shows:

- Speculators closed 5,698 long positions and opened 29,422 short positions.

- Sentiment among the Non-commercial group remains bearish, which supports further declines in the pair.

- Long positions held by speculators now total 154,000, compared to 197,000 short positions.

For 10 consecutive weeks, institutional traders have reduced their euro positions. This suggests the establishment of a new bearish trend. With expectations of Federal Reserve easing already priced in, there's no immediate reason for widespread dollar selling. While new factors could emerge, the US dollar's growth currently seems more likely.

Key Economic Calendar Events

- Eurozone – GDP growth rate (Q3) at 10:00 UTC.

- US – Nonfarm Payrolls (13:30 UTC).

- US – Unemployment Rate (13:30 UTC).

- US – Average Hourly Earnings (13:30 UTC).

- US – Michigan Consumer Sentiment Index (15:00 UTC).

December 6 features at least two critical events that could significantly influence market sentiment, especially in the second half of the day.

Forecast and Trading Advice for EUR/USD

Sell recommendations:New short positions can be considered if the pair rebounds from 1.0603 on the 4-hour chart, targeting 1.0420 and 1.0320.

Buy recommendations:Buying could be considered if the pair closes above 1.0532 on the hourly chart, but this signal appears weak, and bullish positions remain uncertain.

Fibonacci Levels

- Hourly chart: Based on 1.1003 – 1.1214.

- 4-hour chart: Based on 1.0603 – 1.1214.