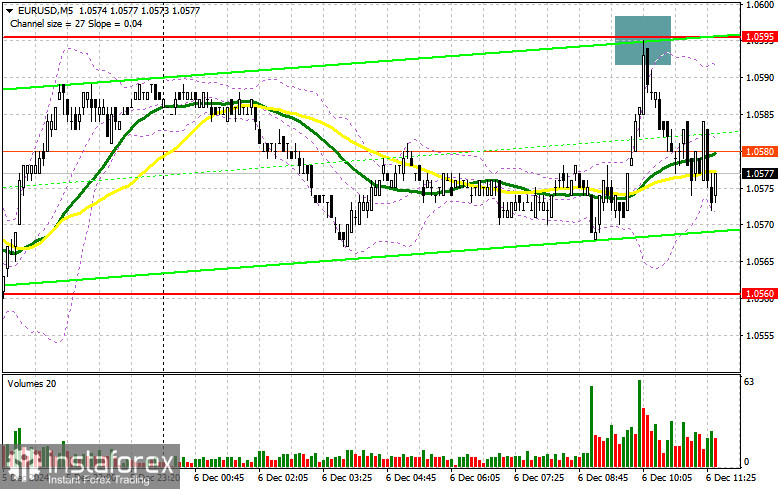

In my morning forecast, I highlighted the importance of the 1.0595 level and planned market entry decisions based on it. We will review the 5-minute chart to analyze the developments. The rise and subsequent formation of a false breakout near 1.0595 provided a good entry point for selling, leading to a 20-point decline in the EUR/USD pair by the time of writing. The technical analysis for the second half of the day remains unchanged.

To Open Long Positions on EUR/USD:

Today, the most critical U.S. labor market report is scheduled for release. The report will include data on the unemployment rate and changes in nonfarm payrolls. An increase in unemployment and a lower number of new jobs would create an opportunity to buy the euro and sell the dollar. Given recent statements by Fed Chair Jerome Powell, weak U.S. statistics could fuel expectations of interest rate cuts at the next Federal Reserve meeting. Conversely, strong data could result in a significant drop in the euro.

In the event of strong data, I will focus on the 1.0560 support level, which was not reached during the morning session. A false breakout at this level would create conditions to increase long positions, targeting a rise to 1.0595, a level that previously failed to break. A breakout and subsequent retest of this range would confirm a valid entry point for buying, aiming for an update to 1.0625. The ultimate goal would be the 1.0653 high, where I plan to take profit. Testing this level would further reinforce the euro's bullish trend.

If EUR/USD declines and there is no activity around 1.0560 in the second half of the day, pressure on the pair could increase, confining it to its current trading range. In such a scenario, I will only enter long positions after observing a false breakout near 1.0535. Alternatively, I plan to buy immediately on a rebound from 1.0507, targeting an intraday correction of 30–35 points.

To Open Short Positions on EUR/USD:

If unemployment data disappoints (indicating higher unemployment) and the pair rises, defending the 1.0595 resistance level will remain a key objective for sellers in the second half of the day. A false breakout at this level, similar to the one discussed earlier, would offer an entry point for short positions, targeting the 1.0560 support level, where the moving averages currently favor sellers. A breakout and consolidation below this range, followed by a retest from below, would provide another opportunity to sell, with the target being the 1.0535 low. The final target would be the 1.0507 area, where I plan to take profit.

If EUR/USD rises in the second half of the day and there is no bearish activity near 1.0595, I will delay selling until the pair tests the next resistance level at 1.0625. I also plan to sell there but only after a failed consolidation attempt. Alternatively, I will sell immediately on a rebound from 1.0653, targeting a 30–35 point downward correction.

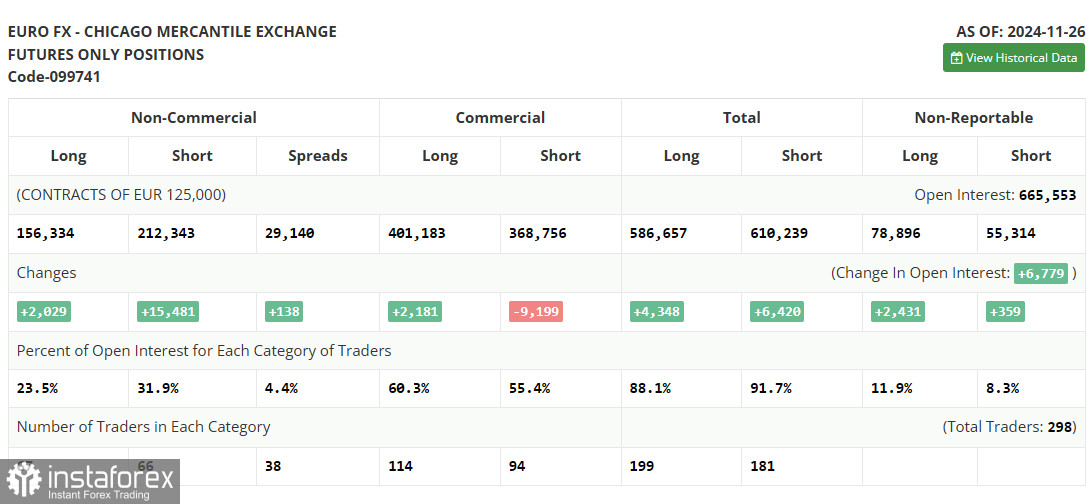

Commitment of Traders (COT) Report Insights:

As of November 26, the COT report showed the following:

- A significant increase in short positions (+15,481 to 212,343).

- A modest rise in long positions (+2,029 to 156,334).

Fed policies are increasingly leaning toward cautious rate cuts, which enhances the appeal of the U.S. dollar over risk assets such as the euro. The widening gap between long and short positions reflects a growing bearish sentiment toward the euro.

Indicator Signals:

Moving Averages

Trading is taking place above the 30- and 50-period moving averages, indicating attempts by the euro to continue its upward trend.

Note: The moving averages are analyzed on the hourly chart (H1) and differ from standard daily moving averages used on the D1 chart.

Bollinger Bands

In the event of a decline, the lower boundary of the Bollinger Bands near 1.0560 will act as support.

Indicator Descriptions:

- Moving Average (MA): Identifies current trends by smoothing volatility and noise.

- Period 50: Yellow on the chart.

- Period 30: Green on the chart.

- MACD (Moving Average Convergence/Divergence): A trend-following momentum indicator.

- Fast EMA: Period 12.

- Slow EMA: Period 26.

- SMA: Period 9.

- Bollinger Bands: A volatility indicator that identifies potential support and resistance levels.

- Period: 20.

- Non-commercial traders: Speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes.

- Long Non-commercial Positions: The total long positions held by non-commercial traders.

- Short Non-commercial Positions: The total short positions held by non-commercial traders.

- Net Non-commercial Position: The difference between short and long positions held by non-commercial traders.