Analysis of Trades and Advice on Trading the Euro Currency

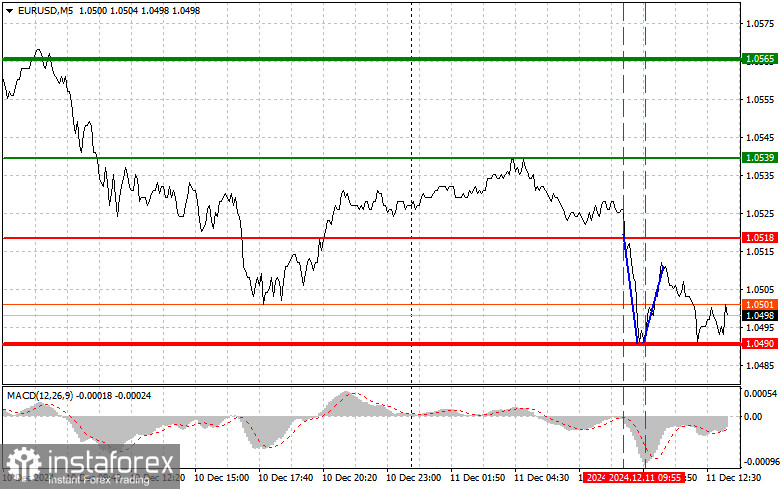

Testing the price level of 1.0518 coincided with the moment when the MACD indicator had just begun moving downward from the zero mark. This confirmed a correct entry point for selling the euro in continuation of the downward trend observed yesterday. As a result, the pair fell toward the target level of 1.0490. Buying from that level, following Scenario #2, allowed for additional profits of around 20 points.

The situation surrounding U.S. inflation requires careful analysis and quick action by the Federal Reserve. Today's data will help clarify the path forward. If price growth in the U.S. continues to exceed expectations, it could put additional pressure on the economy and force the regulator to consider tighter market conditions. In this scenario, rate-cutting decisions could take a backseat to avoid exacerbating inflation risks. Conversely, if the data aligns with economists' forecasts, it could pave the way for more aggressive policy easing, potentially weakening the dollar in the short term and allowing the euro to rise temporarily.

For the intraday strategy, I will rely more on the implementation of Scenario #1, disregarding MACD readings, as I expect strong and directional movements in the pair.

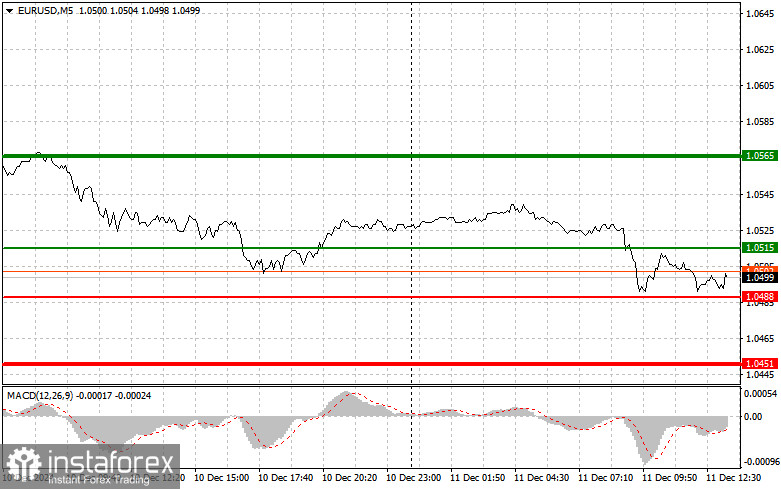

Buy Signal

- Scenario #1: Today, buying the euro is possible upon reaching the price level of 1.0515 (green line on the chart) with the aim of rising to 1.0565. At 1.0565, I plan to exit the market and sell the euro in the opposite direction, expecting a pullback of 30-35 points. A strong euro rally today can only be anticipated following news of falling inflation in the U.S.Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise.

- Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.0488 level, provided the MACD indicator is in the oversold zone. This would limit the pair's downward potential and lead to a market reversal upwards. A rise toward 1.0515 and 1.0565 can be expected.

Sell Signal

- Scenario #1: Selling the euro is planned after reaching the 1.0488 level (red line on the chart). The target will be 1.0451, where I plan to exit the market and immediately buy in the opposite direction, expecting a rebound of 20-25 points. Pressure on the pair will return in the event of a sharp rise in U.S. prices.Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline.

- Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.0515 level, provided the MACD indicator is in the overbought zone. This would limit the pair's upward potential and lead to a market reversal downward. A decline toward 1.0488 and 1.0451 can be expected.

Chart Key:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Suggested price for setting Take Profit or manually closing the trade, as further growth above this level is unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Suggested price for setting Take Profit or manually closing the trade, as further decline below this level is unlikely.

- MACD Indicator: At entry, pay attention to overbought and oversold zones.

Important: Beginner Forex traders should make market entry decisions very cautiously. Before the release of critical fundamental reports, it's best to stay out of the market to avoid being caught in sharp price fluctuations. If you choose to trade during news events, always place stop-loss orders to minimize losses. Without stop-loss orders, you risk quickly losing your entire deposit, especially if you trade large volumes without proper money management.

And remember, successful trading requires a clear trading plan, such as the one outlined above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for an intraday trader.