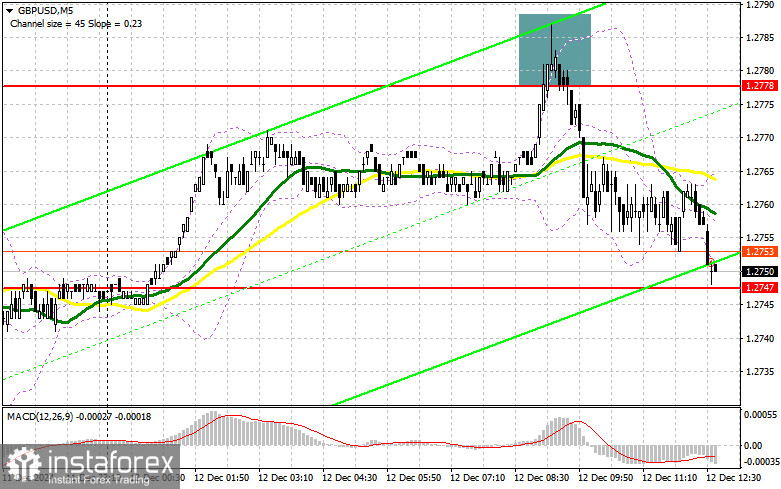

In my morning forecast, I highlighted the 1.2778 level as a key point for making trading decisions. Let's analyze the 5-minute chart to see what happened. The price rose and formed a false breakout around 1.2778, providing an excellent entry point for selling the pound, which led to a significant decline to the 1.2747 support level. This move yielded over 30 points of profit. The technical outlook for the second half of the day has been revised.

To Open Long Positions on GBP/USD:

Considering the sellers' active performance and the swift return of pressure on the pound, U.S. data could serve as an additional trigger for further GBP/USD selling, which I plan to capitalize on. In the second half of the day, we await data on initial jobless claims and the Producer Price Index (PPI) excluding food and energy, which will attract particular attention from traders. A strong labor market means a strong dollar, so good figures will likely increase pressure on GBP/USD.

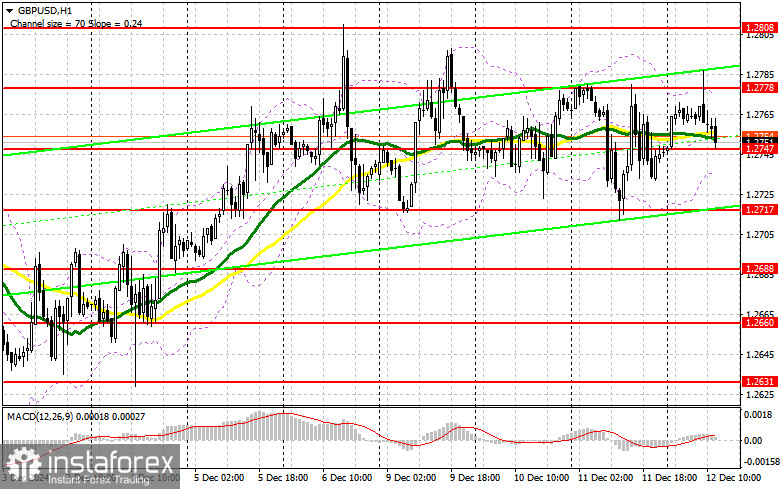

Only a defense of the new 1.2717 support level can preserve the pound's chances of growth. A false breakout there would provide a good entry point for long positions, aiming for a recovery to the 1.2747 resistance level. A breakout and retest from above this range would create another opportunity for buying, targeting a move back to 1.2778, where buyers faced challenges earlier today. The ultimate target would be the 1.2808 area, where I plan to take profits.

If GBP/USD declines and there is no buyer activity at 1.2717, buyers will lose all initiative, especially if strong U.S. data breaks the lower boundary of the sideways channel. In this case, I would only consider long positions after a false breakout at the next 1.2688 support level. I plan to open long positions on a direct rebound from 1.2660, aiming for an intraday correction of 30-35 points.

To Open Short Positions on GBP/USD:

If the pound rises after the data, protecting the nearest 1.2778 resistance level will be the sellers' priority. A false breakout at this level would provide a good entry point for short positions, targeting a decline to the 1.2747 support level, which is being contested as of writing. A breakout and retest from below this range, combined with news of rising U.S. inflation, could trigger stop-loss orders and open the path to 1.2717 and 1.2688, dealing a significant blow to the bulls' positions. The ultimate target would be 1.2660, where I plan to take profits.

If demand for the pound returns in the second half of the day, likely only after weak U.S. data, and GBP/USD rises with no seller activity at 1.2778, buyers will have a good chance of building a bullish market. Sellers would then retreat to the 1.2808 resistance area. I would only sell there after a false breakout. If the pair fails to move downward, I would look for short positions on a rebound from 1.2827, targeting a correction of 30-35 points.

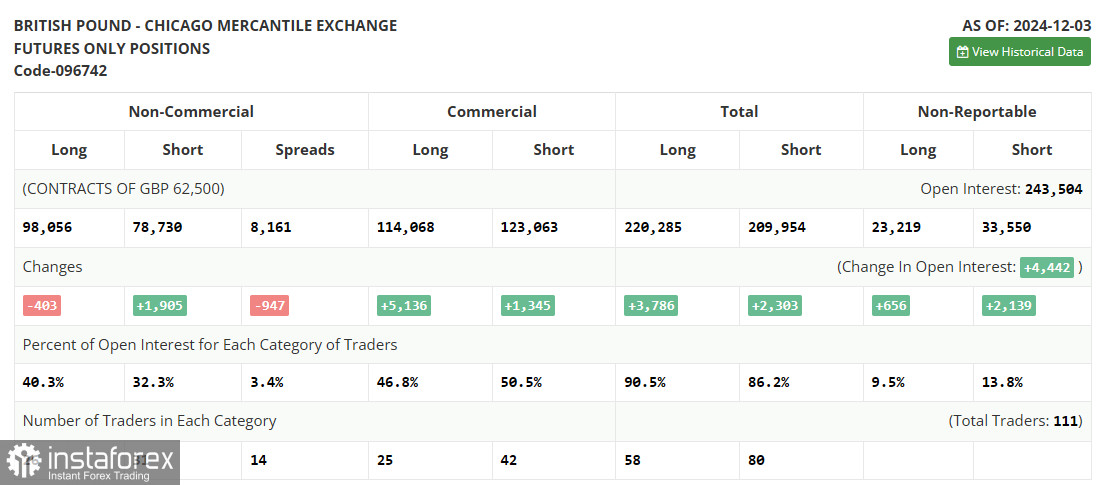

Commitments of Traders (COT) Report:

The COT report for December 3 showed a decline in long positions and growth in short positions. The future actions of the Bank of England regarding interest rates remain uncertain. However, weak GDP data expected in the near future could revive discussions of rate cuts, adding pressure on the pound against the dollar. If this doesn't happen, buyers could have a chance for more substantial GBP/USD growth.

- Long non-commercial positions decreased by 403, to 98,056.

- Short non-commercial positions increased by 1,905, to 78,730.

- The gap between long and short positions narrowed by 947.

Indicator Signals:

Moving AveragesTrading is occurring near the 30- and 50-day moving averages, indicating a sideways market.

Note: The moving average periods and prices are based on the hourly (H1) chart and may differ from the daily (D1) chart's classic definitions.

Bollinger BandsIf the pair declines, the lower boundary of the indicator near 1.2740 will act as support.

Indicator Descriptions:

- Moving Average (MA): Smooths volatility and noise to define the current trend.

- 50-period MA is marked in yellow.

- 30-period MA is marked in green.

- MACD: Measures the convergence/divergence of moving averages.

- Fast EMA: 12-period

- Slow EMA: 26-period

- SMA: 9-period

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators like individual traders, hedge funds, and institutions trading for speculative purposes.

- Long positions: Total open long positions by non-commercial traders.

- Short positions: Total open short positions by non-commercial traders.

- Net non-commercial position: Difference between short and long positions.