Trump's tariffs on Mexico and Canada have had minimal impact on the yen, which has only decreased by 51 pips against the dollar since the session opened. The yen's weakening, indicated by the rise in USD/JPY, is also supported by the release of disappointing January manufacturing PMI data: 48.7, down from 49.6 in December.

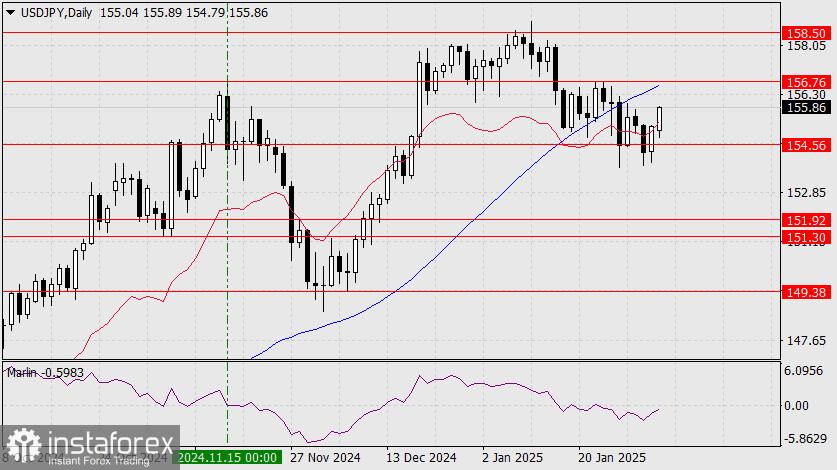

This upward movement aligns with the technical picture of a correction from the overall decline that began on January 10. The target for this correction is the 156.76 level, which was the peak on November 15 and is further reinforced by the MACD line. From this level, we anticipate a reversal back to 154.56. If the price manages to stay above 156.76, further growth towards 158.50 is possible, although this would still be below the January 10 peak. A break above the January 10 peak of 158.89 would complicate the technical outlook, opening up several medium-term growth scenarios; however, this remains an alternative scenario for now.

On the four-hour chart, the price has consolidated above both the balance and MACD indicator lines, and the Marlin oscillator is firmly in positive territory. We expect the price to test the 156.76 level.