After a significant upward movement, gold prices have now stalled just below the $2,900 per ounce mark. This pause is influenced by two key factors: a slight weakening of the U.S. dollar and market anticipation surrounding upcoming phone negotiations between Xi Jinping and Donald Trump regarding the U.S.-China trade conflict.

Market sentiment suggests an expectation of reduced tensions, which may lead to profit-taking following gold's recent rally. This could result in a corrective pullback. If substantial agreements are reached during the discussions, it could provide further justification for a deeper decline in gold prices.

Technical picture and trading idea:

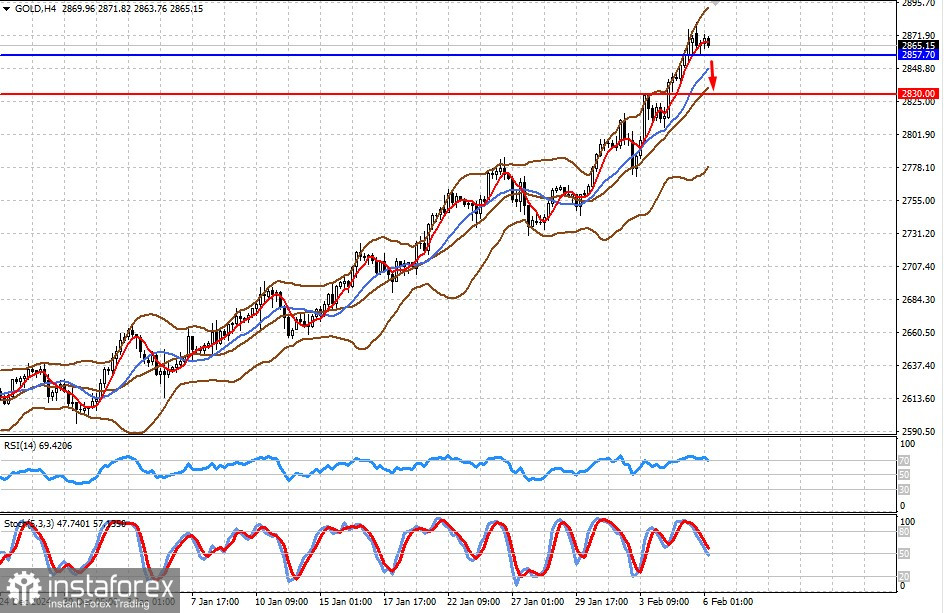

The price is above the middle line of the Bollinger Bands and below the 5-day Simple Moving Average (SMA), while still remaining above the 14-day SMA. The SMA 5 crossover indicates a potential sell signal. Additionally, the RSI is moving out of the overbought zone, reinforcing a bearish signal. The Stochastic Oscillator has also crossed below the 50% level, suggesting the possibility of further downside movement.

If gold prices decline below the support level of $2,857.70, it may trigger a drop toward $2,830.00.