As Bitcoin and Ethereum remain within their sideways channels, continuing to recover from any pressure applied by large players, it's worth taking a closer look at yesterday's Q4 report from MicroStrategy, the largest institutional holder of cryptocurrency assets.

Mixed Q4 results: bet on Bitcoin's long-term bull market

MicroStrategy's Q4 earnings report painted a mixed picture, emphasizing that its success heavily depends on a long-term Bitcoin bull market. The fact that the company's Bitcoin holdings nearly doubled in just three months speaks for itself.

Q4 operating expenses reached $1.103 billion, surging 693% year-over-year. The company reported a net loss of $670.8 million, or $3.03 per share. Total revenue stood at $120.7 million, falling $3 million short of consensus estimates and down 3% year-over-year. As of December 31, 2024, MicroStrategy held $38.1 million in cash, lower than the $46.8 million from the previous year.

Currently, MicroStrategy owns 471,107 BTC, valued at approximately $44 billion. Q4 2024 saw the largest quarterly Bitcoin acquisition in the company's history, with 218,887 BTC purchased for $20.5 billion. The company reported a BTC annual yield of 74.3%, a key metric it uses to evaluate the effectiveness of its Bitcoin strategy.

"We successfully executed our $20 billion capital investment plan well ahead of schedule and led the digital transformation of capital in financial markets," CEO Phong Le said in a press release. "Looking ahead to the rest of 2025, we are well-positioned for further growth, backed by strong institutional and retail investor support for our strategic vision."

Last month, MicroStrategy announced plans to offer 2.5 million STRK shares, but its latest earnings report revealed that the company had issued 7.3 million shares at a public offering price of $80 per share. STRK provides a fixed dividend yield of 8% and is expected to generate around $563.4 million in net proceeds from the sale.

The role of companies like MicroStrategy in supporting and driving the cryptocurrency market forward is undeniable. The more institutional players enter the market, the stronger and more resilient it will become.

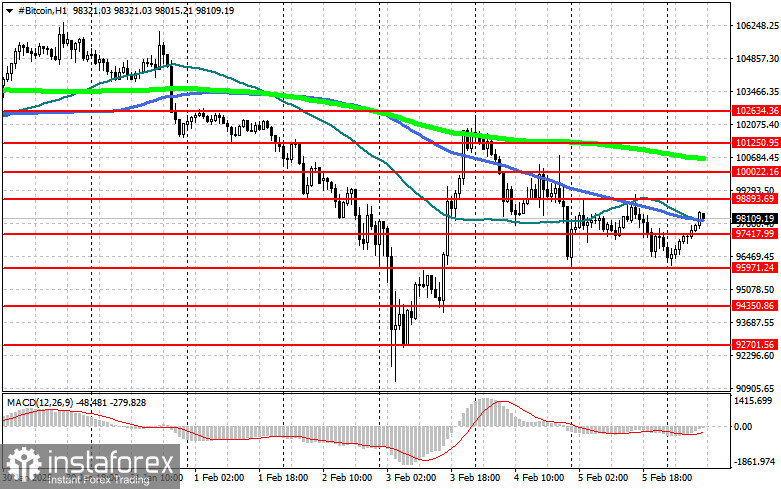

Bitcoin technical outlook

Currently, Bitcoin buyers are aiming for a return to the $98,800 level, which would open a direct path to $100,000, with $101,200 within close reach.

Key resistance levels: $98,800 – a break above this level clears the way to $100,000 $101,200 – a short-term bullish target $102,600 – the final upside target, a breakout above which would signal a return to a medium-term bull market

Key support levels: $97,400 – buyers expected to defend this area $95,900 – a break below could push BTC further down $94,300 – a critical support zone $92,700 – the final bearish target

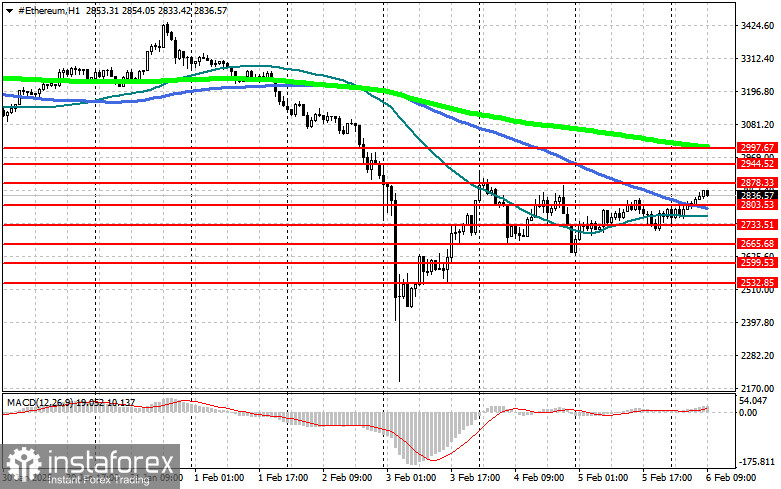

Ethereum technical outlook

For Ethereum, a clear consolidation above $2,878 opens a direct path to $2,944, with $2,997 within close range.

Key resistance levels: $2,878 – holding above this level strengthens bullish momentum $2,944 – the next target $2,997 – the final resistance before a potential yearly high at $3,033, a breakout above which would confirm a return to a medium-term bullish market

Key support levels: $2,803 – expected buying interest in case of a correction $2,733 – a breakdown below this level could accelerate the decline $2,665 – the final downside target

With Bitcoin and Ethereum continuing to hold their ground, institutional interest remains one of the strongest drivers of the crypto market's future growth.