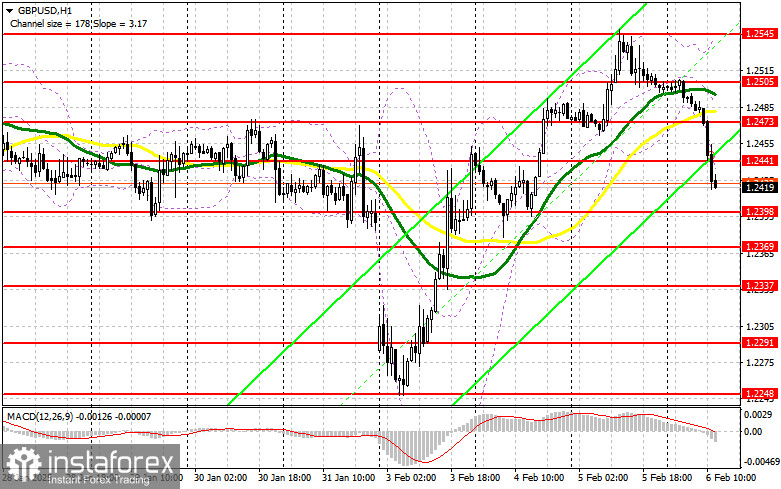

In my morning forecast, I focused on the 1.2421 level and planned to make trading decisions based on it. Let's analyze the 5-minute chart and see what happened. The decline and false breakout at this level provided an opportunity to enter long positions, but at the time of writing, the price had not moved higher, prompting me to exit the positions. The technical outlook has been revised for the second half of the session.

To open long positions in GBP/USD, you need:

Extremely weak UK construction PMI data has increased pressure on the pound, and with the upcoming Bank of England (BoE) meeting, where a rate cut is highly expected, interest in buying GBP/USD remains low.

The upcoming U.S. economic data may be less influential, as it will be released around the time BoE Governor Andrew Bailey speaks. The U.S. jobless claims report and speeches from FOMC members Christopher Waller and Mary Daly could also influence the pair's movement. Given the bearish market sentiment, I will only consider buying after a false breakout at the 1.2398 support level, which GBP/USD is currently approaching. Buy positions will target 1.2441 resistance. A break and retest of this level from above will confirm another buying opportunity, aiming for 1.2473, which could restore the bullish outlook for GBP/USD. The final target will be 1.2505, where I will take profit.

If GBP/USD continues to decline and buyers fail to hold 1.2398, selling pressure will intensify. In this scenario, a false breakout at 1.2369 will be the next opportunity to enter long positions. I will consider buying from 1.2337 only on a direct rebound, expecting a 30-35 point intraday correction.

To open short positions in GBP/USD, you need:

Pound sellers returned aggressively even before the BoE's rate decision. However, the key market driver will be Andrew Bailey's speech, which will determine GBP/USD's further direction. If the pound corrects higher following the BoE meeting, I will look to sell at 1.2441 resistance, provided a false breakout occurs. A break and retest of 1.2398 from below will confirm a sell entry, targeting 1.2369. The final target will be 1.2337, where I will lock in profits.

If the pound gains strength in the second half of the session and sellers fail to defend 1.2441, bulls may attempt a recovery. In this case, I will wait for a test of 1.2473, where the moving averages currently favor sellers. I will sell only if a false breakout forms. If no downward movement occurs, I will look to sell from 1.2505, expecting a 30-35 point pullback.

COT Report Analysis:

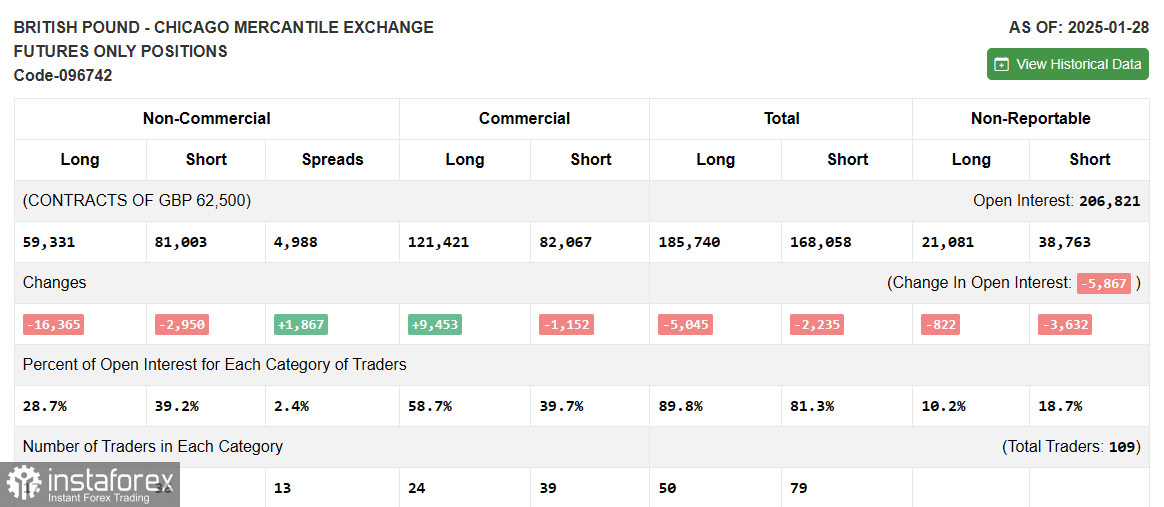

The Commitment of Traders (COT) report for January 28 showed a reduction in both long and short positions. Market sentiment continues to shift in favor of sellers, which is not surprising given the UK's rising inflation and contracting economy. With the Bank of England expected to cut rates, the outlook for GBP/USD remains bearish. Long non-commercial positions fell by 16,365 to 59,331, while short positions dropped only by 2,950 to 81,003. As a result, the gap between long and short positions widened by 1,867 contracts, reinforcing the bearish market sentiment.

Technical Indicators

Moving Averages

GBP/USD is trading below the 30- and 50-period moving averages, reinforcing the downtrend.

Bollinger Bands

The lower Bollinger Band near 1.2440 will act as support in case of further declines.

Key Indicator Descriptions:

- Moving Average (50-period, yellow line) – Identifies the overall trend by smoothing price volatility.

- Moving Average (30-period, green line) – Highlights shorter-term trends.

- MACD (Moving Average Convergence/Divergence):

- Fast EMA – 12-period

- Slow EMA – 26-period

- SMA – 9-period

- Bollinger Bands (20-period): Measures price volatility and overbought/oversold conditions.

- Non-commercial traders: Speculative traders (hedge funds, institutions) using futures for speculative purposes.

- Long non-commercial positions: Total long positions held by speculators.

- Short non-commercial positions: Total short positions held by speculators.

- Net non-commercial position: Difference between short and long positions among speculators.