Analysis of Trades and Trading Tips for the Euro

The price test at 1.0404 occurred when the MACD indicator had just started moving downward from the zero mark, confirming the correct entry point for selling the euro. As a result, the pair moved down by about 20 pips but failed to reach the target level.

Short-term volatility triggered by the threat of new tariffs quickly gave way to relative calm. Investors seem to have considered the time lag before these measures take effect, allowing different governments room for maneuver and negotiations. However, fundamental uncertainty surrounding U.S. trade policy remains a significant limiting factor for further euro strengthening.

Today, pressure on the euro may increase in the first half of the day due to the release of data on the Eurozone's Q4 2024 GDP change and employment levels. Investors will closely monitor these figures to assess the Eurozone's economic condition and the European Central Bank's future monetary policy outlook. If the data comes in weaker than expected, speculation about potential rate cuts could intensify, exerting additional pressure on the euro.

At the same time, it is essential to consider that exchange rate movements are influenced not only by macroeconomic data but also by geopolitical factors and the performance of other currencies, particularly the U.S. dollar. Traders should remain vigilant and account for all market-moving factors when making trading decisions. It is crucial to remember that forecasts are probabilistic, and actual developments may differ.

Regarding the intraday strategy, I will focus more on the implementation of Scenarios #1 and #2.

Buy Signal

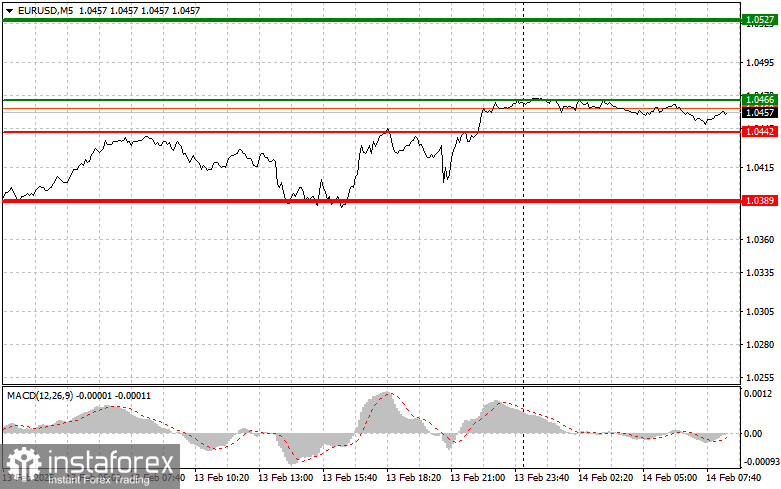

Scenario #1: Buying the euro today is possible if the price reaches the 1.0466 level (green line on the chart), with a target of rising to 1.0527. At 1.0527, I plan to exit the market and initiate a short position in anticipation of a 30-35 pip retracement. Counting on euro appreciation in the first half of the day is reasonable only if GDP data is strong. Important! Before entering a buy trade, ensure that the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: Another buying opportunity arises if the price tests 1.0442 twice while the MACD indicator is in the oversold zone. This setup would limit the pair's downside potential and trigger a market reversal to the upside. A rise toward the 1.0466 and 1.0527 levels can be expected.

Sell Signal

Scenario #1: Selling the euro is planned upon reaching the 1.0442 level (red line on the chart), with a target of 1.0389, where I intend to exit the trade and immediately open a buy position (anticipating a 20-25 pip retracement from the level). Selling pressure on the pair will return if economic data disappoints. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: Another selling opportunity arises if the price tests 1.0466 twice while the MACD indicator is in the overbought zone. This setup would limit the pair's upside potential and trigger a market reversal to the downside. A decline toward 1.0442 and 1.0389 is expected.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.