Analysis of Trades and Trading Tips for the British Pound

The price test at 1.2486 coincided with the moment the MACD indicator began to move downward from the zero mark, confirming a suitable entry point for selling the pound. As a result, the pair declined by approximately 30 pips. Additionally, buying on a rebound from 1.2459 allowed traders to gain about 40 pips in profit.

Active buying of the pound, following strong UK GDP data, clearly indicates a sustained demand for risk assets. Recent progress in resolving the Russia-Ukraine conflict is also encouraging purchases. However, the impact of these developments may be short-lived. The pound's resilience will depend on further UK macroeconomic data and the Bank of England's stance on future monetary policy. Given that the BoE plans to continue cutting rates, any potential growth for the pound appears limited.

A crucial factor to consider is global inflation and the actions of other central banks. The influence of geopolitical factors and decisions made by Donald Trump's administration should not be underestimated, especially as the situation regarding tariffs remains volatile and subject to rapid changes. With no significant UK economic data scheduled for today, caution is advised when considering long positions.

Regarding the intraday strategy, I will primarily rely on the execution of Scenarios #1 and #2.

Buy Signal

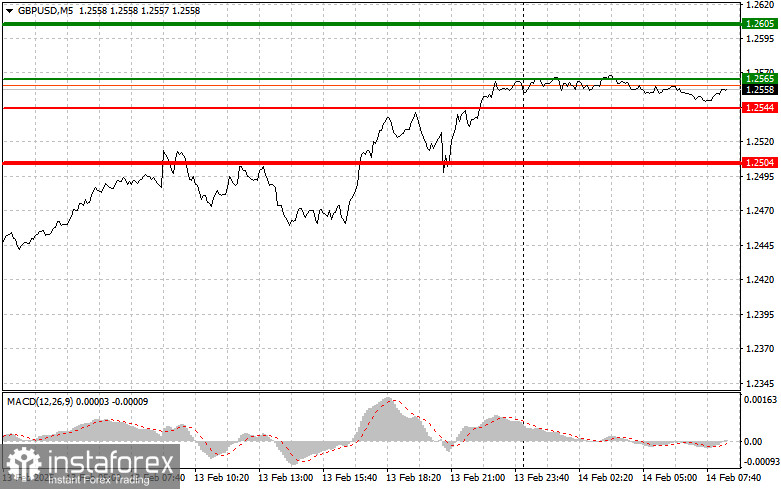

Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.2565 (green line on the chart) with a target of 1.2605 (thicker green line). At 1.2605, I plan to exit long positions and initiate short positions in anticipation of a 30-35 pip retracement. The pound's growth can be expected as part of the ongoing uptrend. Important! Before entering a buy trade, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: Buying the pound is also an option if the price tests 1.2544 twice while the MACD indicator is in the oversold zone. This setup would limit the pair's downside potential and trigger a market reversal to the upside. A rise toward the opposite levels, 1.2565 and 1.2605, is expected.

Sell Signal

Scenario #1: Selling the pound is planned after breaking below 1.2544 (red line on the chart), which could lead to a rapid decline in the pair. The key target for sellers will be 1.2504, where I intend to exit short positions and immediately enter long positions (expecting a 20-25 pip retracement from the level). It is preferable to sell the pound at the highest possible levels. Important! Before selling, ensure that the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: Selling the pound is also an option if the price tests 1.2565 twice while the MACD indicator is in the overbought zone. This setup would limit the pair's upside potential and trigger a market reversal to the downside. A decline toward 1.2544 and 1.2504 can be expected.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.