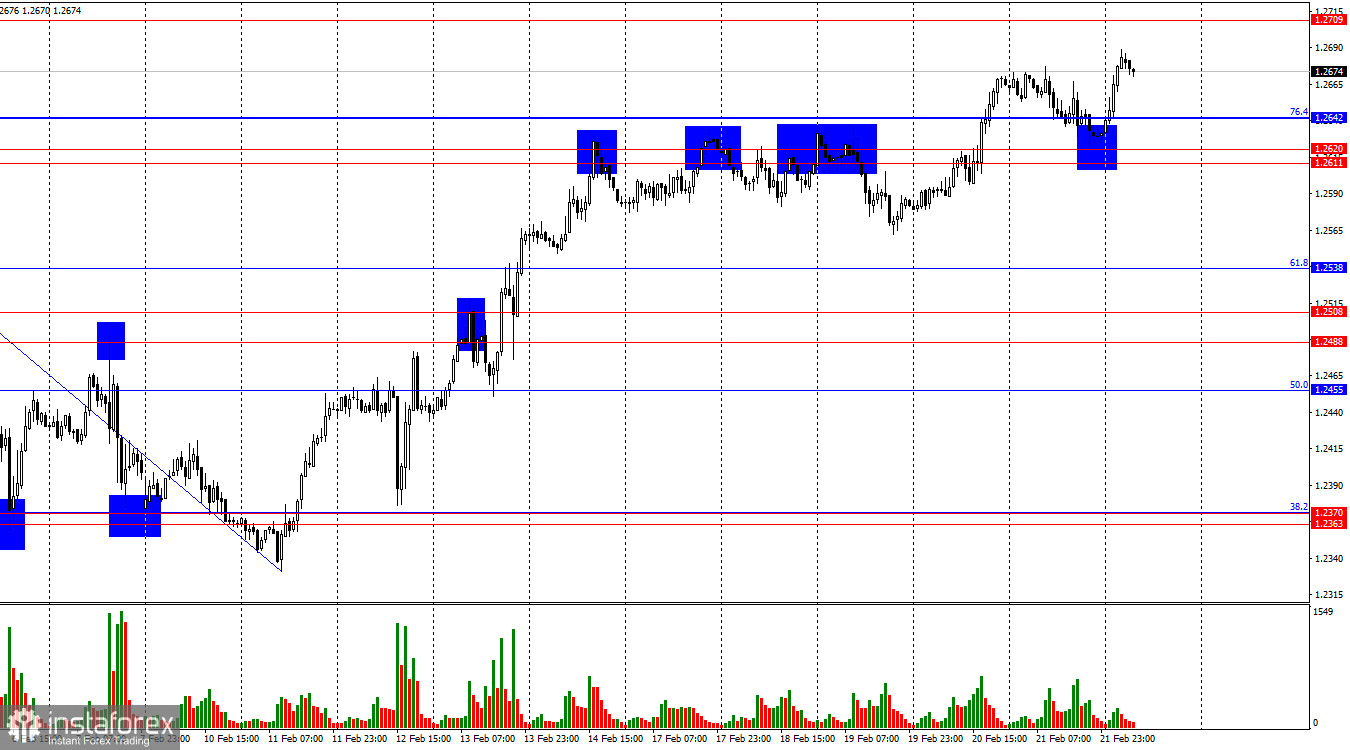

On the hourly chart, GBP/USD rebounded from the 1.2611 – 1.2620 support zone on Friday, reversing in favor of the pound and resuming growth toward 1.2709. To be precise, the upward movement took place late Sunday night, while Friday's session saw a gradual decline. Bullish traders have been in control for quite some time, occasionally supported by fundamental factors. Although UK economic data remains far from stellar, there has been a slight improvement.

The wave pattern is quite clear. The most recent downward wave did not break below the previous low, while the last upward wave exceeded the previous peak. This suggests that the bullish trend remains intact. However, recent waves vary significantly in size and structure, making it difficult to determine whether this trend will persist for another couple of weeks. Nevertheless, the pound has demonstrated strong growth recently.

Friday's fundamental background supported further gains for the pound, though bulls decided to take a short pause. Recent reports have shown strong inflation figures, decent employment data, and strong wage growth. Bulls had the opportunity to push higher throughout last week, and Friday was no exception, with retail sales data exceeding expectations. While PMI reports were weaker, the services sector still showed modest growth.

Overnight, the market reacted to election results in Germany, signaling a shift in power. Although the British pound is not directly affected, and the UK is no longer part of the EU, the euro gained strength, and the pound followed suit, capitalizing on the market's momentum. No significant economic data is expected on Monday.

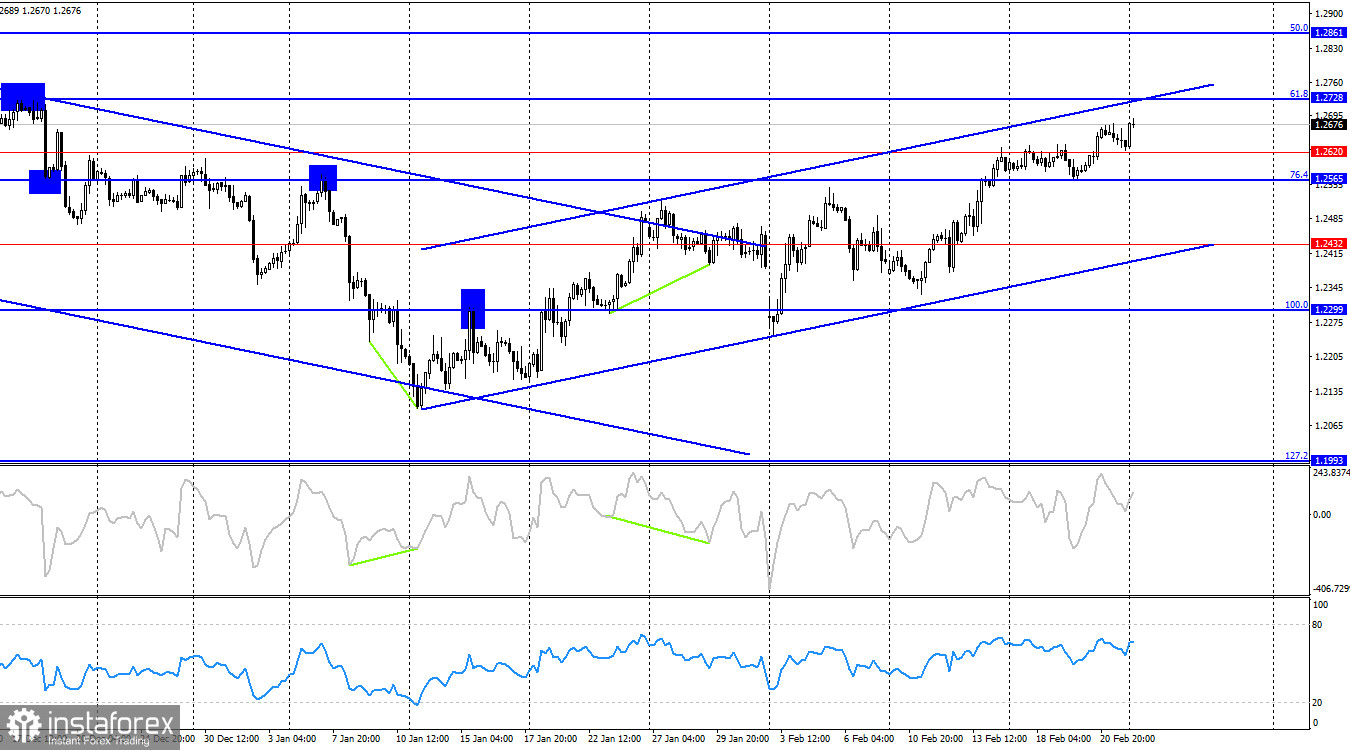

On the 4-hour chart, the pair continues to rise and has confirmed a breakout above the 1.2565 – 1.2620 resistance zone. The next target for growth is the 61.8% Fibonacci level at 1.2728. The ascending trend channel suggests that bullish sentiment remains dominant. No divergence signals are currently visible on any indicators. A reversal and further decline for the pound would only be considered if the pair breaks below the channel.

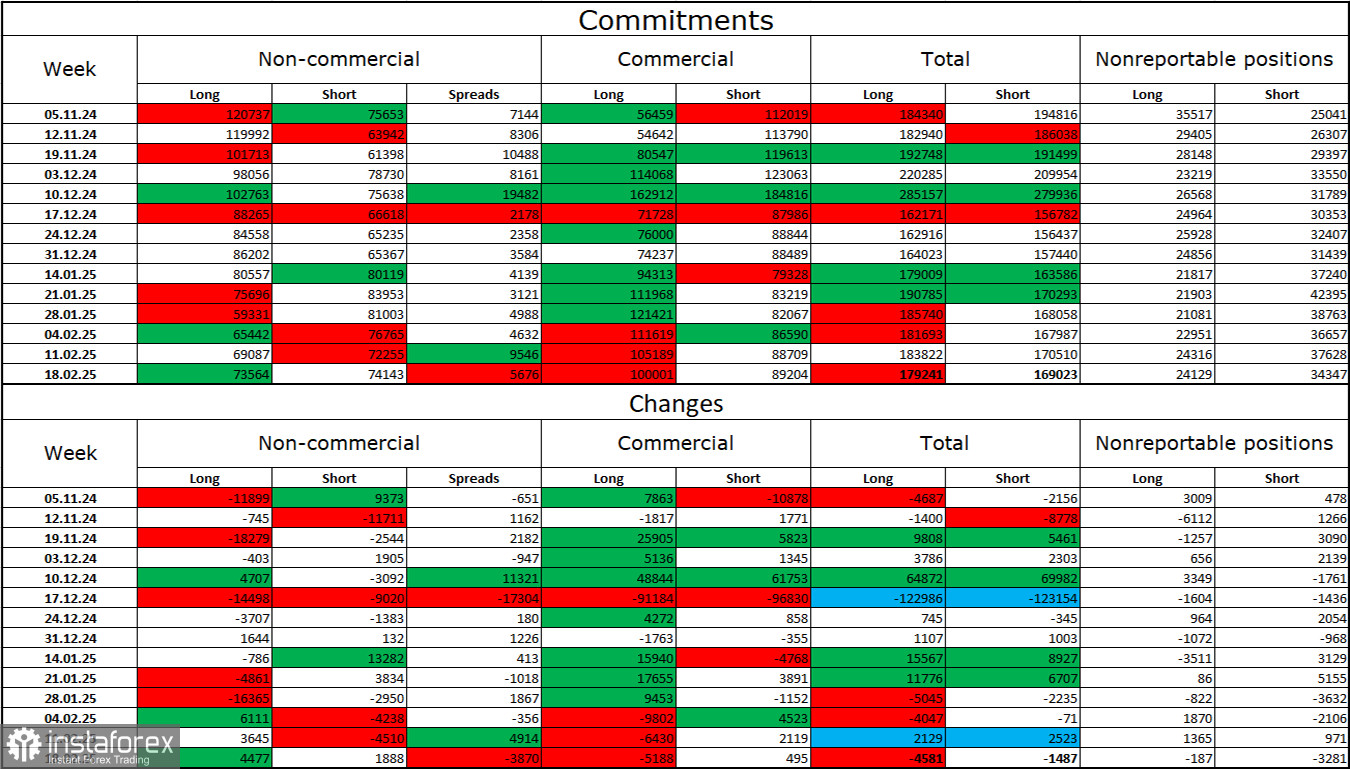

Commitments of Traders (COT) Report

The latest COT report indicates a less bearish sentiment among non-commercial traders. Long positions increased by 4,477, while short positions increased by 1,888. No clear advantage exists between bulls and bears, with 73,000 long positions versus 74,000 short positions.

Despite this, I believe the pound still has downward potential. The COT data suggests bears are gradually strengthening their positions, albeit at a slow pace. Over the past three months, long positions have fallen from 120,000 to 73,000 and short positions have remained stable, declining only slightly from 75,000 to 74,000.

Professional traders are likely to continue reducing long positions or increasing short exposure, as most of the pound's bullish factors have already played out. The recent positive UK data provided temporary support, but overall, technical analysis still signals potential for further growth in the short term.

Key Economic Events (UK & US Calendar)

- Monday: No major economic releases are scheduled.

- Fundamental impact: Minimal, meaning traders' sentiment will primarily drive price movements.

GBP/USD Forecast & Trading Recommendations

Selling opportunities: A rejection from 1.2709 on the hourly chart could provide a short trade setup targeting 1.2642.

Buying opportunities: I would avoid buying at current levels, despite continued bullish pressure.

Fibonacci Levels

- Hourly chart: 1.2809 – 1.2100

- 4-hour chart: 1.2299 – 1.3432