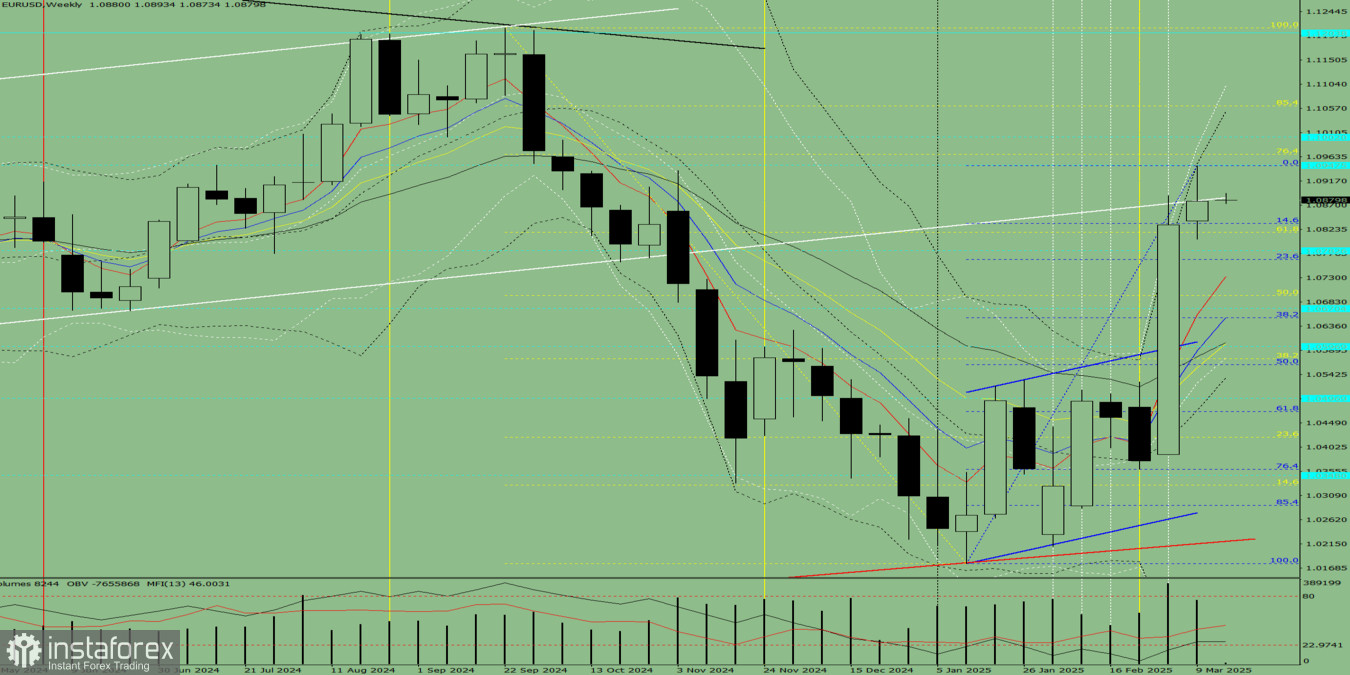

Trend Analysis (Fig. 1):

This week, from the 1.0878 level (previous weekly candle close), the market may initially move downward toward 1.0835 – the 14.6% retracement level (blue dashed line). After testing this level, the price is expected to resume its upward movement toward 1.1002 – a historical resistance level (blue dashed line).

Fig. 1 (Weekly Chart)

Comprehensive Analysis:

- Indicator analysis: Bullish

- Fibonacci levels: Bullish

- Volume analysis: Bullish

- Candlestick analysis: Bullish

- Trend analysis: Bullish

- Bollinger Bands: Bullish

- Monthly chart: Bullish

Conclusion from Comprehensive Analysis:

The EUR/USD pair is expected to follow an upward trend during the week. The weekly candle is likely to have a lower shadow (Monday – downward movement) and a second upper shadow (Friday – downward movement), indicating initial weakness before resuming an uptrend.

Alternative Scenario:

If the pair moves downward from the 1.0878 level (previous weekly close), it may target 1.0765 – the 23.6% retracement level (blue dashed line). If this level is tested, the price may resume its upward movement toward 1.0947 – the upper fractal level (blue dashed line).