At the start of the new week during the Asian session, the EUR/USD pair attempted to attract buyers, but this was unsuccessful.

The euro received support from easing concerns about a trade war between the EU and the US. Concessions offered by the European Commission may help avoid reciprocal tariffs, which supports overall optimism. However, prevailing risk-off sentiment continues to support the US dollar as a safe-haven currency, limiting the growth potential of EUR/USD. Additionally, the release of preliminary consumer inflation data in Germany failed to support the euro.

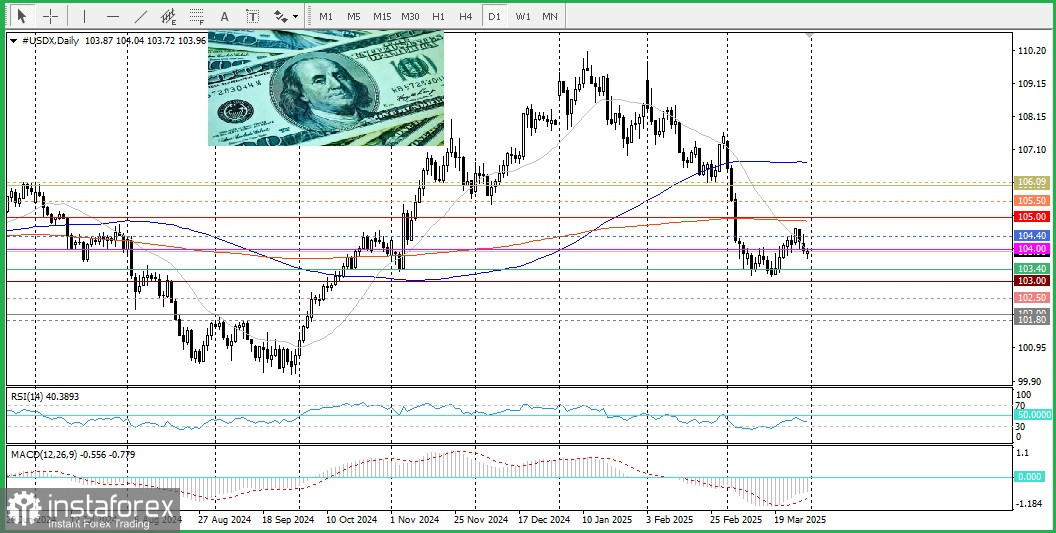

The US dollar remains under pressure amid concerns of stagflation, creating favorable conditions for the euro. Inflation data published on Friday, such as the Core Personal Consumption Expenditures (PCE) Price Index, showed an increase, but it did not spark much optimism among dollar bulls. In addition, inflation expectations captured in the University of Michigan survey reached their highest level in two and a half years. This complicated the Federal Reserve's position, adding uncertainty surrounding President Donald Trump's trade policy, thereby allowing the Fed to adopt a wait-and-see approach regarding further monetary easing, especially considering that no rate cuts are expected at the July meeting.

From a technical standpoint, key support is located at the psychological level of 1.0800, with resistance at 1.0850. A break above this resistance would open the way toward the next round level at 1.0900. Sustained strength beyond that level would help EUR/USD reach the monthly high. Given that oscillators on the daily chart remain firmly in positive territory, such a move is quite plausible.

On the other hand, weakness below the 1.0800 mark will likely find support near 1.0780. A drop below that would push prices toward the 200-day SMA. Below that lies the round level of 1.0700, and a further drop past this point could shift momentum in favor of the bears.

Today, traders should watch the release of Germany's Core Consumer Price Index (CPI), which is scheduled during the early North American session, for new trading opportunities.