Analysis of Macroeconomic Reports:

There are no macroeconomic events scheduled for Friday. Fundamental developments will also be limited, but it's entirely unclear which factors influence price formation. The pound and the euro had reasons to fall on Wednesday and Thursday. However, such reasons also existed earlier, when both currencies rose actively, even without corrections. Therefore, the likelihood of another flat day on Friday is high, and trading decisions must be made based solely on technical signals. And of course, Trump could once again stir up market volatility.

Analysis of Fundamental Events:

There is no point in discussing fundamental events other than Trump's trade war, even though the escalation has been paused. A renewed decline in the dollar could occur if Trump resumes introducing or raising tariffs. Any escalation could lead to a new wave of dollar weakness, while any de-escalation should support the dollar. Yesterday, the U.S. president announced signing a trade agreement with the UK, which should have further strengthened the dollar against its rivals. Recall that if the dollar dropped sharply on escalation news, it should rise on de-escalation news. Therefore, any trade deal should be a supportive factor for the U.S. currency. However, the market is far more interested in deals with China and the EU.

General Conclusions:

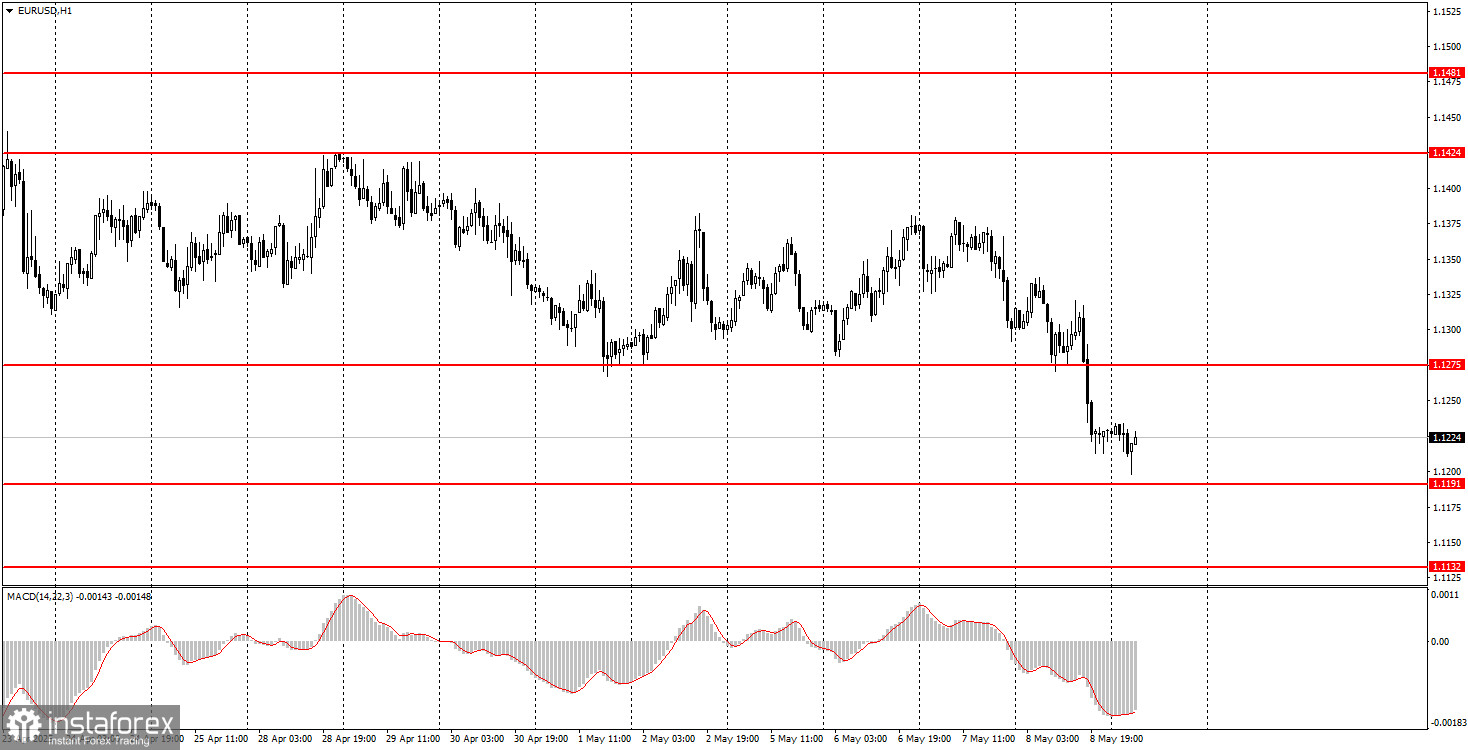

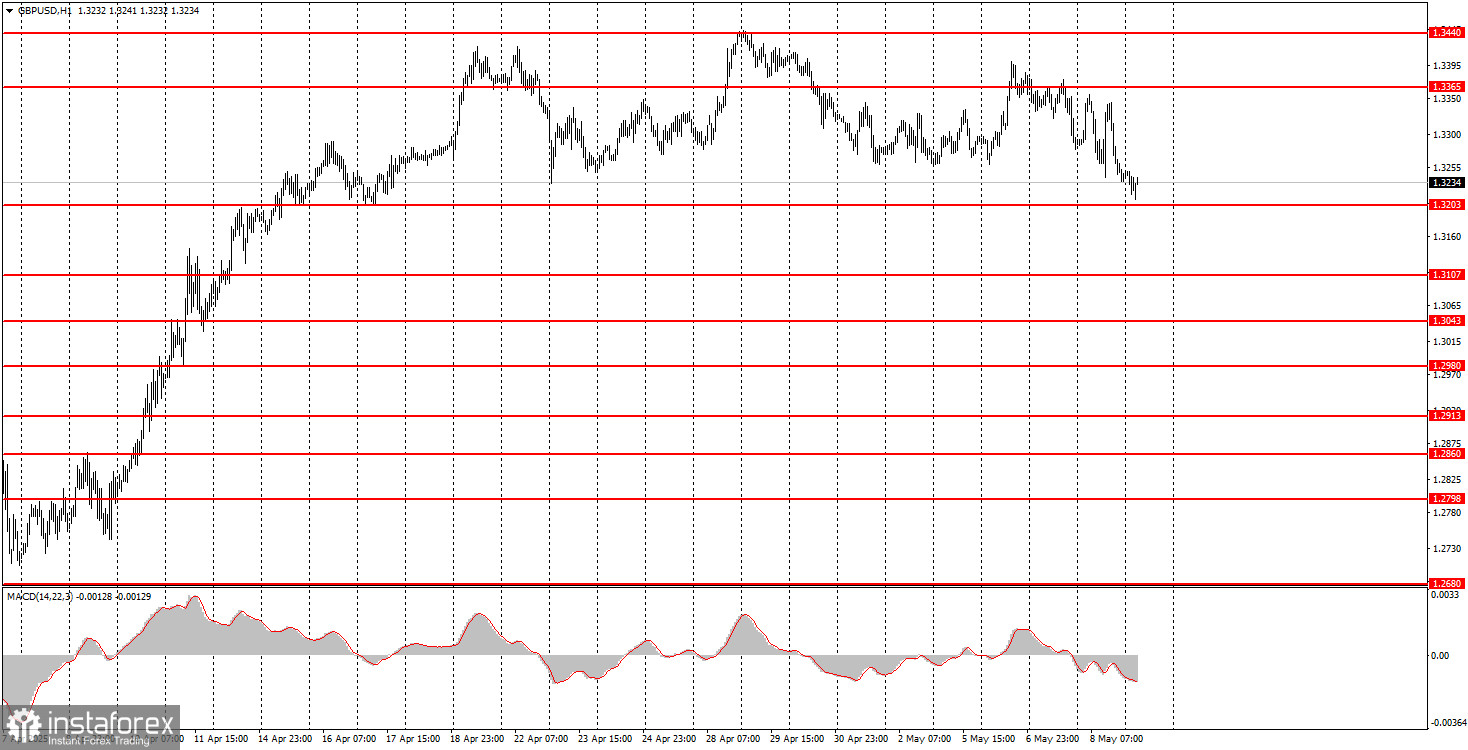

On the last trading day of the week, both currency pairs can move in either direction. The euro may continue to decline, but it's difficult to have confidence in a dollar rally at this point. As for the British pound, it remains within a sideways channel, so a rise from the lower boundary of that channel is more likely than a decline.

Key Rules for the Trading System:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15–20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: These are found in the economic calendar and can heavily influence price movements. Therefore, during their release, you should trade as cautiously as possible or exit the market to avoid a sharp reversal of the price against the previous movement.

Note for Beginner Forex Traders: Not every trade can be profitable. Developing a clear strategy and sound money management is key to long-term success in trading.