Trade Analysis and Tips for the Euro

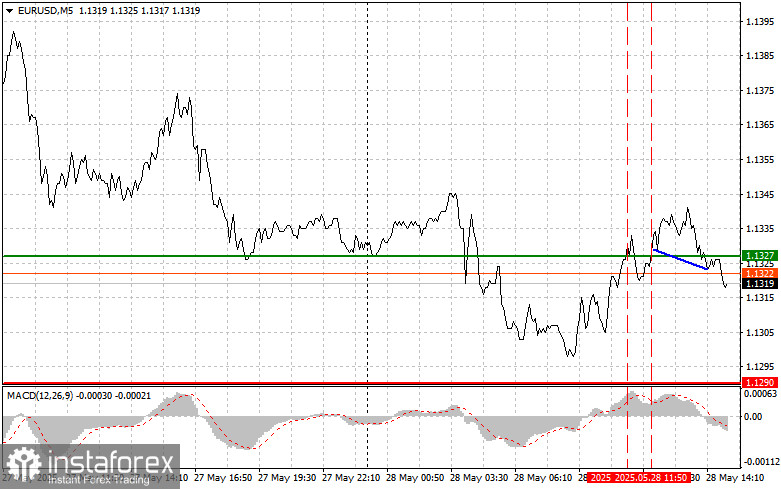

The first test of the 1.1327 level occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential after its drop during the Asian session. The second test of 1.1327 coincided with the MACD being in the overbought area, which allowed sell scenario #2 to play out, although the pair failed to see a significant decline.

Disappointing labor market data from Germany and fairly modest French GDP figures had little impact on the euro's value. However, the current stability of the euro may be short-lived. If future economic reports from the eurozone continue to disappoint, pressure on the single currency will likely intensify.

In the second half of the day, attention will shift to FOMC member Neel Kashkari's speech and the Richmond Fed Manufacturing Index release. Although these events may seem secondary in the context of broader economic concerns, they can offer insight into the Federal Reserve's current monetary policy stance. Market participants will closely analyze any signals pointing to a potential shift in the Fed's position, particularly as it continues to battle inflation and the risk of recession.

The Richmond Fed Manufacturing Index, as a regional indicator, reflects the condition of the industrial sector in one of the key U.S. economic districts. A decline in this metric may reinforce fears of a slowing economy, while an increase could support positive market sentiment.

The day's final event will be the release of the FOMC meeting minutes. However, I do not expect the contents to have a strong impact on the currency market, as the Fed's current strategy remains cautious and wait-and-see.

For intraday strategy, I will primarily rely on implementing scenarios #1 and #2.

Buy Signal

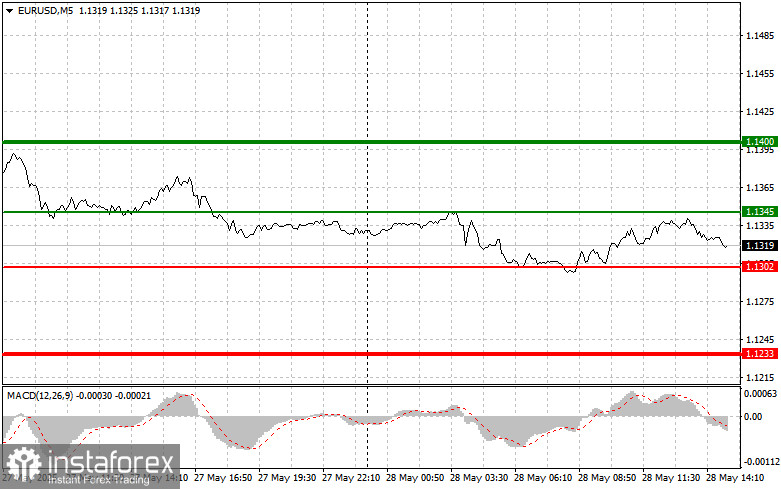

Scenario #1: Buy the euro today when the price reaches the 1.1345 area (green line on the chart) with a target of 1.1400. I plan to exit the market at 1.1400 and sell the euro in the opposite direction, aiming for a 30–35 point move from the entry point. A euro rally today is only likely after weak U.S. data.Important: Before buying, make sure the MACD is above the zero mark and just beginning to rise.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1302 level while the MACD is in the oversold zone. This would limit the pair's downside and lead to a market reversal to the upside. Growth toward the opposite levels of 1.1345 and 1.1400 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.1302 (red line on the chart). The target will be 1.1233, where I plan to exit the market and open long positions in the opposite direction (aiming for a 20–25 point rebound). Pressure on the pair could return after the data releases.Important: Before selling, ensure the MACD is below the zero mark and just beginning to decline.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.1345 level while the MACD is in the overbought zone. This will limit the pair's upside and lead to a downward reversal. A drop toward 1.1302 and 1.1233 can be expected.

What the Chart Shows:

- Thin green line – the entry price for buying the instrument

- Thick green line – the suggested Take Profit level or the point to fix profit manually, as further growth beyond this level is unlikely

- Thin red line – the entry price for selling the instrument

- Thick red line – the suggested Take Profit level or the point to fix profit manually, as further decline beyond this level is unlikely

- MACD indicator – when entering the market, it's important to be guided by overbought and oversold zones

Important: Beginner traders in the Forex market should be very cautious when deciding to enter trades. It's best to stay out of the market ahead of important fundamental reports to avoid sharp price swings. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't apply proper money management and trade with large volumes.

And remember: successful trading requires a clear plan like the one provided above. Making spontaneous decisions based on the current market situation is an inherently losing strategy for intraday traders.