Trade Analysis and Tips for the British Pound

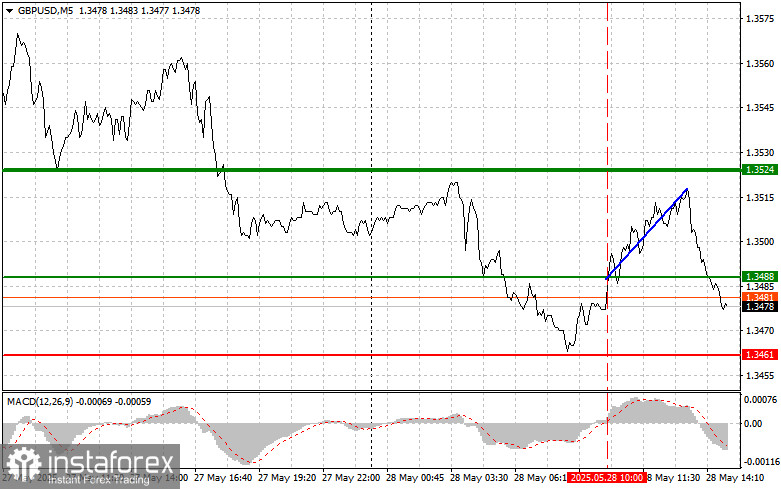

The test of the 1.3488 level in the first half of the day occurred just as the MACD indicator began moving upward from the zero line, confirming a proper market entry point. As a result, the pair rose by more than 30 points.

The key event of the day will be the release of the FOMC meeting minutes. This document is certain to attract close attention from global investors as it provides deeper insight into the discussions and arguments behind the latest decisions by the U.S. central bank. As a reminder, the Fed left interest rates unchanged at its recent meeting. Traders will be looking for any hints of disagreement within the Federal Open Market Committee regarding the future trajectory of interest rates. Additionally, the minutes may shed light on how the Fed views the impact of geopolitical instability and trade tensions on the U.S. economy. Should the Fed acknowledge these factors as significant risks, it could lead to revised forecasts for growth and inflation.

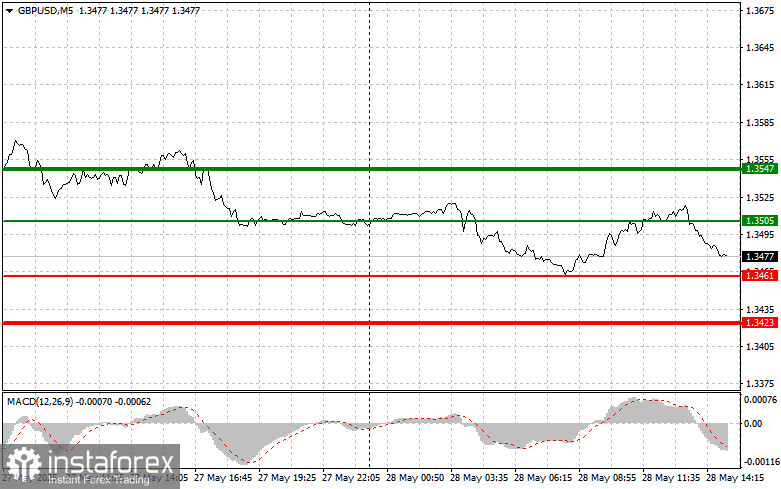

For intraday strategy, I will primarily rely on implementing scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today upon reaching the entry point at 1.3505 (green line on the chart) with the goal of rising to 1.3547 (thicker green line on the chart). I plan to exit long positions and initiate sales in the opposite direction from 1.3547, targeting a 30–35 point retracement. A pound rally today is likely only after weak U.S. data.Important: Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise.

Scenario #2: I also plan to buy the pound in case of two consecutive tests of the 1.3461 level while the MACD is in the oversold zone. This would limit the pair's downside and lead to a reversal upward. A rise to the opposing levels of 1.3505 and 1.3547 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after breaking below 1.3461 (red line on the chart), which could lead to a rapid drop in the pair. The main target for sellers will be the 1.3423 level, where I plan to exit shorts and initiate long positions in the opposite direction (expecting a 20–25 point rebound). Sellers are unlikely to be very active today.Important: Before selling, ensure that the MACD indicator is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell the pound in the event of two consecutive tests of the 1.3505 level while the MACD is in the overbought zone. This will limit the pair's upward potential and trigger a reversal to the downside. A drop toward 1.3461 and 1.3423 can be expected.

What the Chart Shows:

- Thin green line – entry price for buying the trading instrument

- Thick green line – suggested Take Profit level or a point to fix profit manually, as further growth above this level is unlikely

- Thin red line – entry price for selling the trading instrument

- Thick red line – suggested Take Profit level or a point to fix profit manually, as further decline below this level is unlikely

- MACD indicator – when entering the market, it is important to follow overbought and oversold zones

Important: Beginner traders on the Forex market should be very cautious when deciding to enter trades. It is best to stay out of the market ahead of major fundamental releases to avoid getting caught in sharp price movements. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use proper money management and trade with large volumes.

And remember, successful trading requires a clear plan like the one presented above. Making spontaneous trading decisions based on current market conditions is an inherently losing strategy for intraday traders.