Trade Review and Tips for Trading the Euro

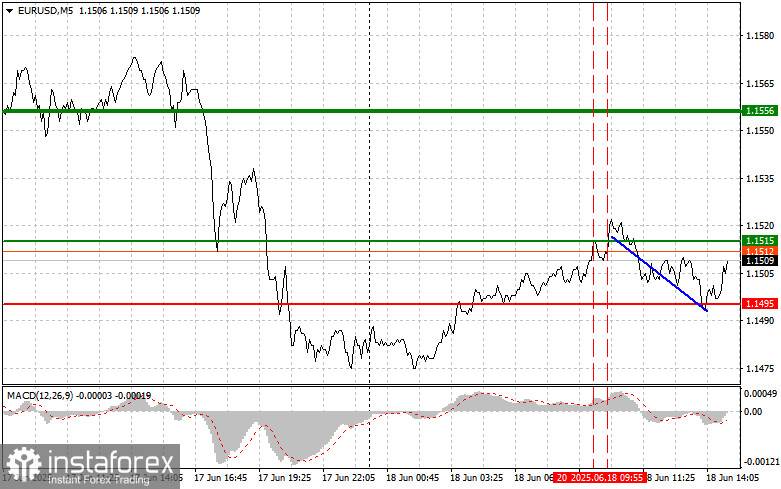

The first test of the 1.1515 level during the first half of the day coincided with the MACD indicator rising significantly above the zero line, which limited the pair's upward potential. For this reason, I didn't buy the euro. The second test of 1.1515 shortly after, while the MACD was in the overbought zone, activated Scenario #2 for a sell trade, which resulted in a 20-point decline in the pair.

Euro area inflation data aligned with analysts' expectations. Since inflation remains below the 2% target, the European Central Bank has the flexibility to adopt a neutral stance, which it may formalize at the upcoming meeting. However, this apparent stability brings both hidden risks and potential benefits. On one hand, subdued inflation allows the ECB room to respond to possible economic downturns. On the other hand, the risk of inflation rising due to Middle East tensions is higher than ever. Ultimately, the effectiveness of ECB policy will depend on its ability to balance domestic and external factors and its readiness to employ unconventional measures in uncertain conditions.

The upcoming U.S. data on initial jobless claims and building permits will be important. These indicators reflect the health of the U.S. economy and significantly impact global markets. Initial jobless claims show the current state of the labor market. Building permits, in turn, are a leading indicator of future economic activity and reflect construction companies' investment intentions. An increase suggests optimism and potential growth in housing demand, while a decline may indicate a slowdown in the sector.

Nonetheless, the final word will come from the Federal Reserve Chair. If Jerome Powell highlights inflation risks tied to Middle East developments, the U.S. dollar may strengthen sharply against the euro, leading to a drop in EUR/USD.

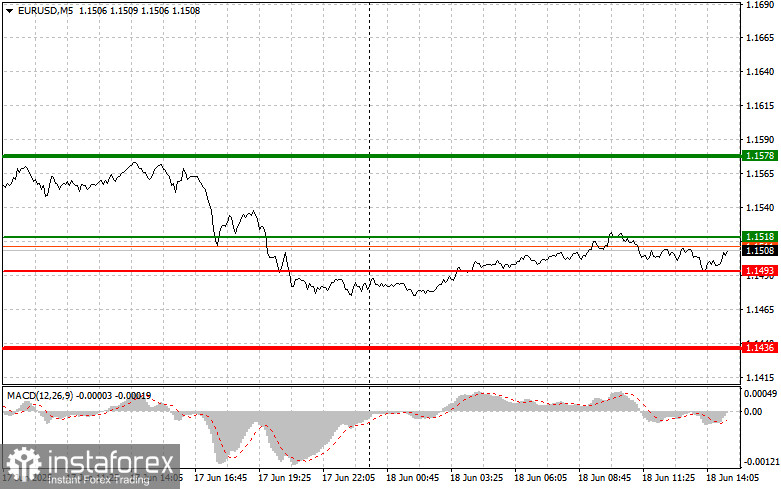

As for the intraday strategy, I will primarily rely on Scenarios #1 and #2.

Buy Signal

Scenario #1: Buy the euro today upon reaching 1.1518 (green line on the chart), aiming for a rise to 1.1578. At 1.1578, I plan to exit the long position and consider a short position in the opposite direction, targeting a 30–35 point pullback. A euro rise today is likely only after weak U.S. data.Important: Before buying, make sure the MACD is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the euro after two consecutive tests of the 1.1493 level, when the MACD is in the oversold zone. This would limit the pair's downward potential and prompt a market reversal to the upside. Growth toward 1.1518 and 1.1578 can then be expected.

Sell Signal

Scenario #1: I plan to sell the euro after it reaches 1.1493 (red line on the chart), targeting a decline to 1.1436. At 1.1436, I will exit short positions and consider long positions in the opposite direction, aiming for a 20–25 point rebound. Selling pressure on the pair may return if U.S. data comes in strong.Important: Before selling, ensure the MACD is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the euro today after two consecutive tests of 1.1518, when the MACD is in the overbought zone. This would limit the pair's upward potential and result in a market reversal to the downside, with a possible decline toward 1.1493 and 1.1436.

What's on the chart:

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: Suggested level for placing Take Profit orders or manually closing positions, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: Suggested level for placing Take Profit orders or manually closing positions, as further declines below this level are unlikely.

- MACD indicator: Use overbought/oversold zones to guide market entries.

Important: Beginner Forex traders should be extremely cautious when deciding on market entries. It's best to stay out of the market before the release of key fundamental reports to avoid sharp price swings. If you choose to trade during news events, always set stop-loss orders to minimize losses. Without stop-losses, you can lose your entire deposit quickly—especially if you trade large volumes and ignore risk management.

And remember: successful trading requires a clear plan like the one provided above. Making spontaneous decisions based on the current market situation is a losing strategy for intraday traders.