Trade Review and Tips for Trading the British Pound

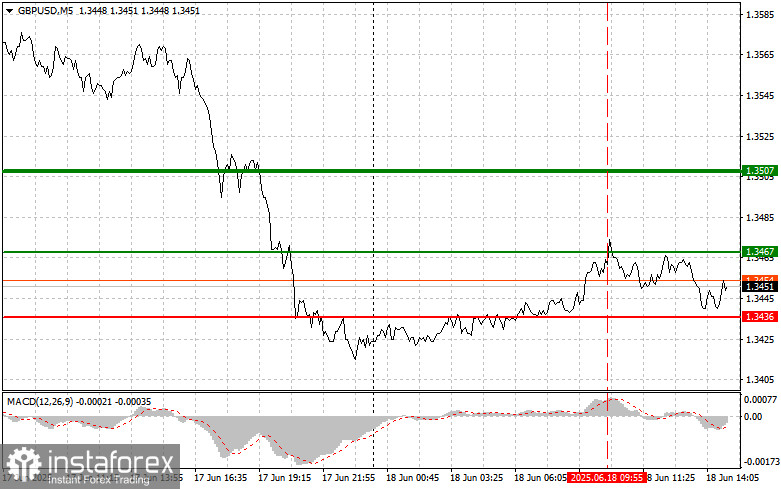

The test of the 1.3467 level in the first half of the day coincided with the MACD indicator rising significantly above the zero mark, which limited the pair's upward potential.

UK inflation data did not surprise and fully matched economists' forecasts, which limited the pound's upward potential in the first half of the day. However, the market's restrained reaction to the inflation figures may be misleading. The British pound remains vulnerable to broader U.S. dollar dynamics, which, in turn, depend on signals from the Federal Reserve. Any strengthening in the Fed's rhetoric about the need for a continued cautious approach to rates in response to inflation will inevitably boost the dollar and weaken the pound. Moreover, external geopolitical instability also puts pressure on the pound. Escalation of conflict in the Middle East could drive energy prices higher, further fueling inflation and forcing the Fed to act more aggressively. This scenario could create a vicious cycle, where slowing economic growth is accompanied by high inflation, leading to a stronger U.S. dollar in the short term.

As for the intraday strategy, I will rely primarily on the implementation of Scenarios #1 and #2.

Buy Signal

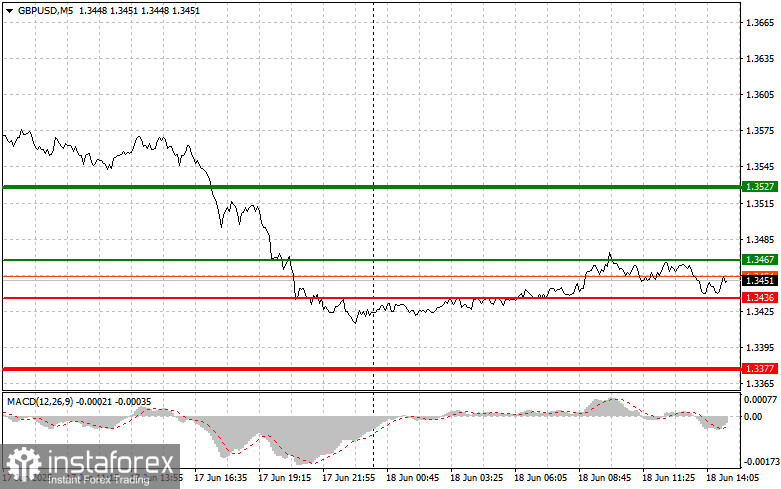

Scenario #1: I plan to buy the pound today at the entry point around 1.3467 (green line on the chart), targeting a rise to 1.3527 (thicker green line). Around 1.3527, I will exit long positions and open short positions in the opposite direction (expecting a 30–35 point reversal from this level). Pound growth today is more likely after weak U.S. data. Important: Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound today if the price tests 1.3436 twice in a row, while the MACD is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upward. A rise toward 1.3467 and 1.3527 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after the 1.3436 level (red line) is updated, which will trigger a quick decline in the pair. The main target for sellers will be 1.3377, where I will exit shorts and immediately open long positions in the opposite direction (expecting a 20–25 point rebound). Sellers will become active in case of strong U.S. data. Important: Before selling, make sure the MACD is below the zero mark and just beginning to fall from it.

Scenario #2: I also plan to sell the pound today if the price tests 1.3467 twice in a row, while the MACD is in the overbought zone. This will limit the pair's upward potential and trigger a downward market reversal. A decline toward 1.3436 and 1.3377 can be expected.

Chart Details:

- Thin green line – entry price for buying the instrument

- Thick green line – suggested level for Take Profit or manual profit-taking, as further growth is unlikely above this level

- Thin red line – entry price for selling the instrument

- Thick red line – suggested level for Take Profit or manual profit-taking, as further decline is unlikely below this level

- MACD indicator – use overbought and oversold zones to guide entries

Important: Beginner Forex traders should be very cautious when deciding to enter the market. It is best to stay out before the release of key fundamental reports to avoid sudden price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, your entire deposit can be lost quickly, especially if you ignore money management and trade large volumes.

And remember: successful trading requires a clear trading plan like the one provided above. Spontaneous decisions based on current market sentiment are an inherently losing strategy for intraday traders.