The U.S. president remains the world's primary source of market-moving headlines, sending financial markets swinging in both directions.

On Thursday, market participants eagerly priced in Donald Trump's personal tariff victory over South Korea, along with the associated benefits for the U.S. and downsides for the Koreans. This news led to increased demand for stocks, commodities, and raw materials, along with a limited strengthening of the U.S. dollar. But, as the saying goes, the music didn't play for long. Optimism quickly faded after the media reminded investors that August 1st was approaching—and at that point, Trump had secured no deals with other key economically strong and influential players such as China and India, which supply the U.S. with a wide range of essential goods.

Yesterday, Trump further stoked the fire by threatening not only China and India but also Brazil with high tariffs. He also intimidated them—as BRICS members—with punitive sanctions, especially targeting the Brazilians and Indians. Naturally, markets couldn't ignore this new round of U.S. confrontation with unyielding nations, resulting in a correction in U.S. equity markets, followed by declines this morning in the Asia-Pacific region.

And although none of this came as a surprise, market participants—like political analysts—are now closely following global developments, recognizing that such geopolitical shifts are currently the primary drivers of investor sentiment. Trump's wave of negativity has dampened the bullish enthusiasm of traders.

At the time of writing, Asian stock indices are showing negative dynamics, as are futures on European and U.S. indexes. Of course, the arrival of August 1st, accompanied by tariff threats from the aging hegemon, is putting pressure on markets—but the question is: how long will this negative sentiment last?

Unless Trump makes more comments about the "defiant countries," I believe the market's focus will gradually shift to more specific topics—one of which is the release of the U.S. employment report for July. According to consensus forecasts, the number of new nonfarm payroll jobs is expected to rise by 106,000, down from 147,000 a month earlier. In addition, the unemployment rate is projected to increase from 4.1% to 4.2%, while average hourly earnings are expected to grow by 3.8% year-over-year (up from 3.7%) and by 0.3% in July (compared to 0.2% in June).

Beyond that, market attention will also turn to last month's Manufacturing PMI, which is expected to fall below the symbolic threshold of 50 to 49.5—down from 52.9.

How will markets react to this news?

Given the backdrop of renewed U.S. confrontation with powerful producer nations, investors will likely still shift their attention to the U.S. reports. If the data worsens the overall picture, it could lead market participants to believe that the Federal Reserve will be forced to cut interest rates by 0.25% in September. This anticipated move could change sentiment in the markets and halt or even reverse the sell-off that began yesterday.

If the number of new jobs turns out to be slightly higher, the U.S. dollar may receive local support, and the dollar index could climb back above the 100.00 level, which it is currently below.

Such an outcome could also calm equity investors, reducing the losses from yesterday and today that resulted from the new, though somewhat expected, wave of U.S. confrontation with China and India.

Forecast of the Day

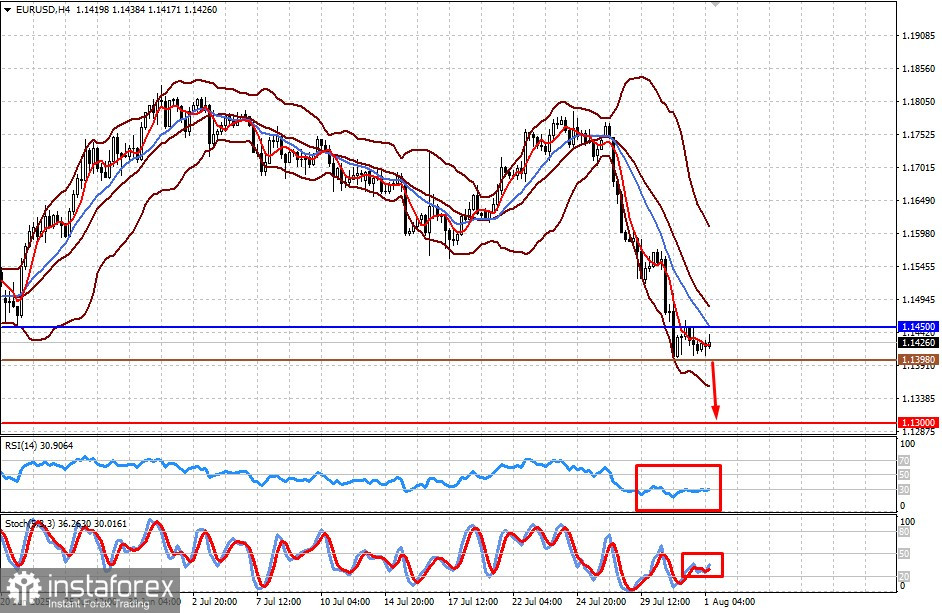

EUR/USD

The pair remains under negative pressure due to the prospective economic burden on the EU imposed by its suzerain—the U.S.—through damaging customs tariffs and enforced financing of the U.S. economy via massive investment inflows. Against this backdrop, and with the release of the U.S. employment report, the pair may resume its decline toward 1.1300. A sell level could be around 1.1398.

AUD/USD

The pair is also declining amid the trade war between the U.S. and China, Australia's key trading partner in the region. The negative impact of the tariff conflict, combined with a likely strengthening of the dollar, could push the pair further down to 0.6360. A potential sell level is 0.6416.