GBP/USD

Analysis: Since the beginning of the year, the British pound has been moving upward. Since mid-July, the pair has been trading sideways near a resistance zone, forming an intermediate correction. This correction now appears complete. The upward segment starting August 1 likely represents only a retracement.

Forecast: The bearish trend is expected to conclude this week. A reversal and resumption of growth are likely near the support zone. The weekly price range is defined by the nearby reversal zones.

Potential Reversal Zones

- Resistance: 1.3380 / 1.3430

- Support: 1.3180 / 1.3130

Recommendations:

- Buying: May be considered after confirmed signals near support from your trading systems.

- Selling: Safer to use smaller positions during individual sessions.

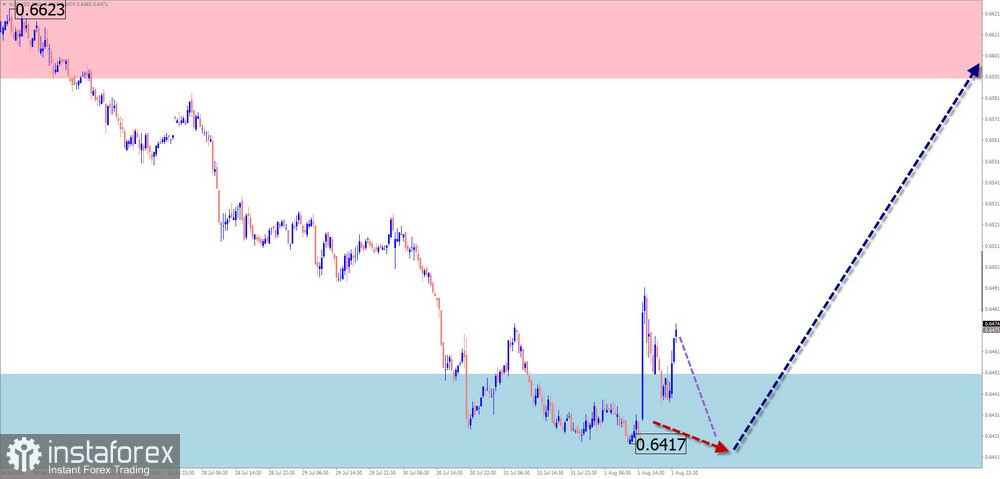

AUD/USD

Analysis: The ongoing upward trend in the Australian dollar began in early April. Recent weeks have seen a pullback. The final segment of the wave is forming, with its middle phase now in progress.

Forecast: The upward movement may conclude near the resistance zone in the coming days, followed by a downward reversal toward the support zone.

Potential Reversal Zones

- Resistance: 0.6590 / 0.6640

- Support: 0.6450 / 0.6400

Recommendations:

- Buying: High risk and could lead to losses.

- Selling: May be considered after reversal signals appear near resistance.

USD/CHF

Analysis: Since late April, a corrective upward wave has guided short-term movement in the Swiss franc. This wave forms a shifting flat structure, with the middle segment of the final part (C) still incomplete.

Forecast: The bearish movement may end near the support zone in the coming days. Increased volatility and a price reversal toward resistance are expected in the second half of the week.

Potential Reversal Zones

- Resistance: 0.8170 / 0.8220

- Support: 0.7940 / 0.7890

Recommendations:

- Buying: Premature until confirmed signals appear near support.

- Selling: High risk and may result in losses.

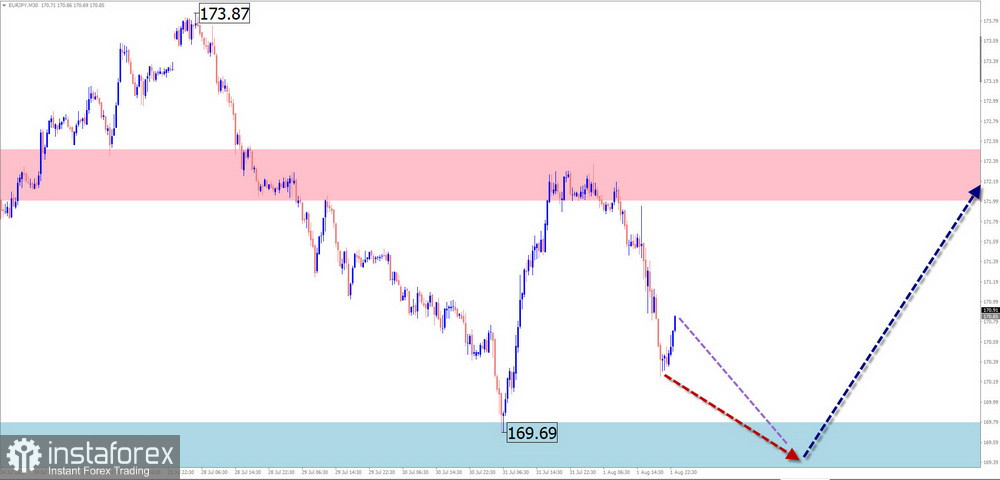

EUR/JPY

Analysis: The short-term trend in the euro/yen cross remains upward. A corrective wave that began in late June is nearing completion. The pair has reached the upper boundary of the potential reversal zone, but no clear reversal signals are evident yet.

Forecast: Price may move sideways along the support zone in the coming days, with a possible brief breach of the lower boundary. A resumption of the upward trend is expected thereafter.

Potential Reversal Zones

- Resistance: 172.00 / 172.50

- Support: 169.80 / 169.30

Recommendations:

- Selling: Very risky and likely unprofitable.

- Buying: May be considered after confirmed reversal signals near support.

AUD/JPY

Analysis: The trend in the Australian dollar/yen pair has been upward since early April. Over the past three weeks, a stretched flat correction has formed and is now entering its final phase.

Forecast: Price may remain within a narrow range between nearby reversal zones. A bearish bias is more likely in the early days, with potential pressure on the support zone. Increased volatility and a possible rebound are expected closer to the weekend.

Potential Reversal Zones

- Resistance: 100.00 / 100.50

- Support: 95.00 / 94.50

Recommendations:

- Selling: Has little potential and carries risk.

- Buying: May become relevant after confirmed reversal signals near support.

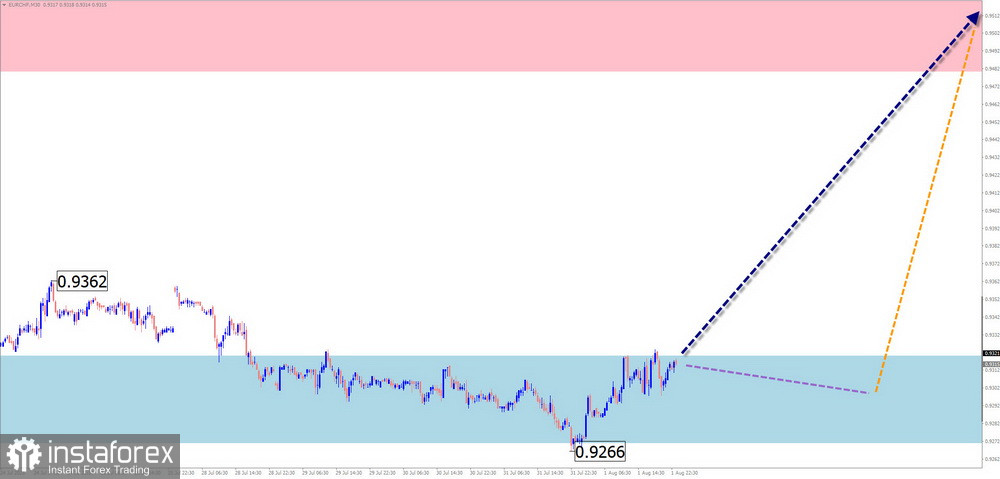

EUR/CHF

Analysis: Since early June, the euro/franc pair has formed a shifting flat upward wave. In late June, prices began to decline, forming an incomplete corrective wave (B). Last week, the pair rebounded from the upper boundary of the potential reversal zone.

Forecast: Sideways movement is expected early in the week along the support levels. The probability of a reversal and resumption of the upward trend increases in the second half of the week.

Potential Reversal Zones

- Resistance: 0.9480 / 0.9530

- Support: 0.9320 / 0.9270

Recommendations:

- Selling: Lacks potential and may result in losses.

- Buying: Premature until confirmed reversal signals appear near support.

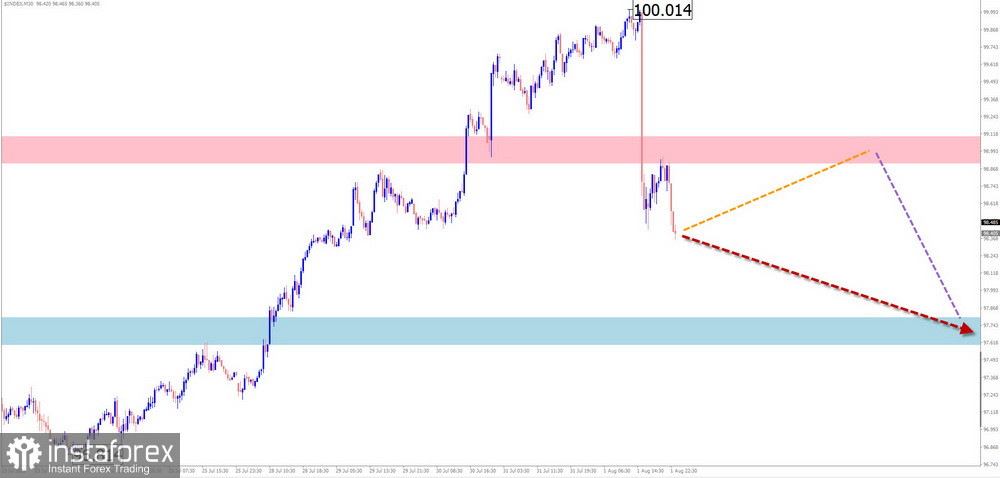

US Dollar Index

Analysis: The U.S. Dollar Index continues to decline. The current correction has been underway since early April and remains incomplete. In recent days, the index has retreated from a strong resistance zone.

Forecast: Sideways movement is likely early in the week, possibly with a brief upward move toward resistance. A reversal and renewed decline toward the lower boundary of the price channel may follow.

Potential Reversal Zones

- Resistance: 98.90 / 99.10

- Support: 97.80 / 97.60

Recommendations: The weakening of the U.S. dollar in major pairs continues but is likely temporary. Toward the end of the week, monitor for signals indicating the end of buying activity and the potential resumption of selling in major currencies.

Note: In simplified wave analysis (SWA), all waves consist of three parts (A-B-C). Only the last incomplete wave is analyzed on each time frame. Solid arrows represent completed structures; dotted arrows indicate expected movements.

Important: The wave algorithm does not account for the duration of price movements over time.