Trade Review and Tips for Trading the Euro

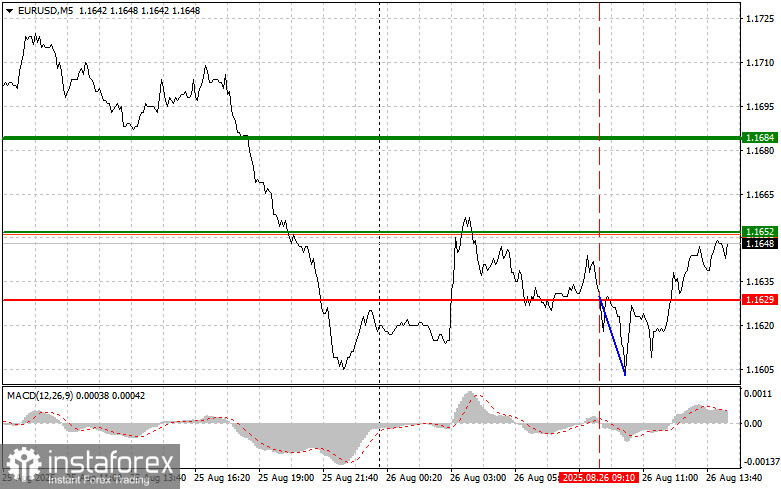

The price test of 1.1629 occurred when the MACD indicator had just begun moving downward from the zero line, which confirmed a correct entry point for selling the euro. As a result, the pair declined by 25 points.

As expected, in the absence of significant economic data from the euro area, the European currency managed to hold near the daily low, even showing some growth during the first half of trading. At the same time, investors are closely monitoring developments in the United States. Today, the key focus is on consumer confidence, durable goods orders, and housing price dynamics. The Consumer Confidence Index is one of the most important gauges of economic sentiment, reflecting the degree of optimism or pessimism among U.S. households regarding the current economic climate and their outlook for the future. Durable goods orders also serve as an important indicator of the state of the U.S. economy.

An increase in orders usually signals rising business investment and confidence in economic prospects, while a decline may foreshadow slowing growth. The housing price index reflects changes in residential real estate values. Rising home prices may indicate improving economic conditions and stronger consumer confidence, while a decline can signal emerging economic difficulties.

It is important to emphasize that these indicators are interconnected. For example, high consumer confidence can stimulate demand for durable goods, resulting in stronger orders. Rising housing prices can also positively influence consumer confidence, as Americans feel wealthier when the value of their assets increases. Therefore, a combined rise across all these indicators would provide strong support for the U.S. dollar, potentially triggering a sell-off in EUR/USD.

As for intraday strategy, I will primarily rely on Scenarios #1 and #2.

Buy Signal

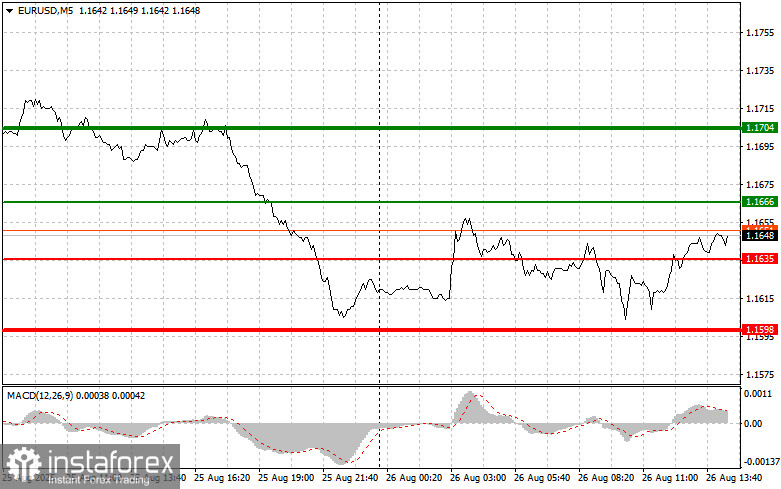

Scenario #1: Today, buying the euro is possible at 1.1666 (green line on the chart), targeting growth toward 1.1704. At 1.1704, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30–35 point move from the entry point. A strong rise in the euro can be expected after weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero line and only just beginning to rise from it.

Scenario #2: I also plan to buy the euro today in the case of two consecutive tests of 1.1635, at a time when the MACD indicator is in the oversold area. This would limit the pair's downward potential and lead to a market reversal upward. Growth toward the opposite levels of 1.1666 and 1.1704 can then be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching 1.1635 (red line on the chart). The target will be 1.1598, where I plan to exit sales and immediately buy in the opposite direction, aiming for a 20–25 point rebound. Selling pressure will return if U.S. data proves strong. Important! Before selling, make sure the MACD indicator is below the zero line and only just beginning to decline from it.

Scenario #2: I also plan to sell the euro today in the case of two consecutive tests of 1.1666, at a time when the MACD indicator is in the overbought area. This would limit the pair's upward potential and trigger a reversal downward. A decline toward the opposite levels of 1.1635 and 1.1598 can then be expected.

What's on the chart:

- Thin green line – entry price for buying the instrument;

- Thick green line – estimated price for placing Take Profit or fixing profit manually, as further growth above this level is unlikely;

- Thin red line – entry price for selling the instrument;

- Thick red line – estimated price for placing Take Profit or fixing profit manually, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to follow overbought and oversold zones.

Important. Beginner Forex traders must be very cautious when deciding on market entries. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always use stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you neglect money management and trade large volumes.

And remember: successful trading requires a clear trading plan, like the one outlined above. Spontaneous decisions based only on the current market situation are an inherently losing strategy for an intraday trader.