While Bitcoin remains in a very dangerous position, seemingly ready to sharply slide at any moment toward the $105,000 area and then to $100,000, some companies have stated that BTC has already reached its peak for this market cycle.

According to Glassnode data and based on previous market cycles, the company does not rule out the possibility that the current cycle's BTC peak has already been passed. Pantera Capital, following its own model based on Bitcoin halving cycles, also believes that the maximum price level for this cycle may have already been reached.

Such forecasts from reputable analytical firms are prompting many to reassess the future direction of the crypto market. Investors will likely study the presented arguments carefully, trying to evaluate the risks and opportunities in the current market environment.

A key factor in the accuracy of these forecasts is the historical cyclicality of the cryptocurrency market. Models developed by Glassnode and Pantera Capital are based on patterns observed in previous boom-and-bust cycles. However, it's important to understand that each cycle has its own unique characteristics, influenced by macroeconomic factors, regulatory changes, and technological advancements.

So, despite warnings from analysts, we cannot completely rule out a scenario where BTC makes a new surge, surpassing previous all-time highs.

Alternative view: BTC no longer follows cycles

There's another group of experts who believe that the growing involvement of institutional investors, corporations, and sovereign wealth funds — all steadily accumulating BTC — has rendered the traditional cycle theory in the crypto world outdated. According to them, sharp BTC crashes are becoming increasingly unlikely.

This argument carries significant weight. The entrance of large players with vast financial resources and long-term investment horizons can indeed help stabilize the market and reduce volatility. The recent inflow into spot ETFs speaks for itself. Institutional investors are generally less prone to panic selling and tend to view BTC as a promising asset for portfolio diversification.

Additionally, an increasing number of corporations are integrating BTC into their operations — using it for payments, reserves, and capital raising. This further boosts demand for BTC and contributes to its recognition as a legitimate asset.

Sovereign wealth funds, managing the assets of entire nations, are also showing interest in BTC, signaling its growing importance in the global financial system. Their investments could serve as a powerful catalyst for BTC's further growth.

Trading recommendations

Bitcoin

Buyers are currently targeting a return to the $110,600 level, which would open the way to $112,100, and from there it's a short move to $113,700. The ultimate target in an uptrend would be around $116,000 — a break above this level would confirm bullish market strength.

In case of a decline, buyers are expected at $108,200. A drop below this level could quickly send BTC to $106,100, with a final downside target of around $103,400.

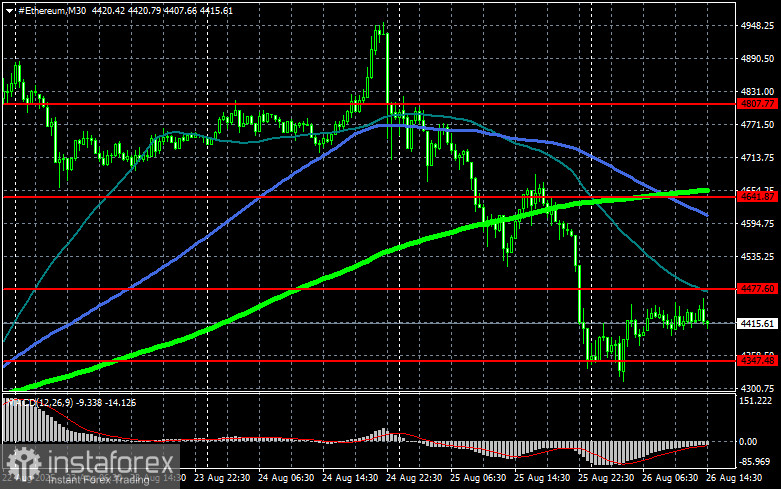

Ethereum

A solid breakout above $4,477 opens the path toward $4,641, with a final bullish target near $4,807. A break above this high would confirm a strong bullish trend and growing buyer interest.

If ETH drops, buyers are expected around $4,347. A move below this level could quickly push ETH down to $4,215, with a deeper target near $4,077.

What's on the chart

- The red lines represent support and resistance levels, where price is expected to either pause or react sharply.

- The green line shows the 50-day moving average.

- The blue line is the 100-day moving average.

- The lime line is the 200-day moving average.

Price testing or crossing any of these moving averages often either halts movement or injects fresh momentum into the market.