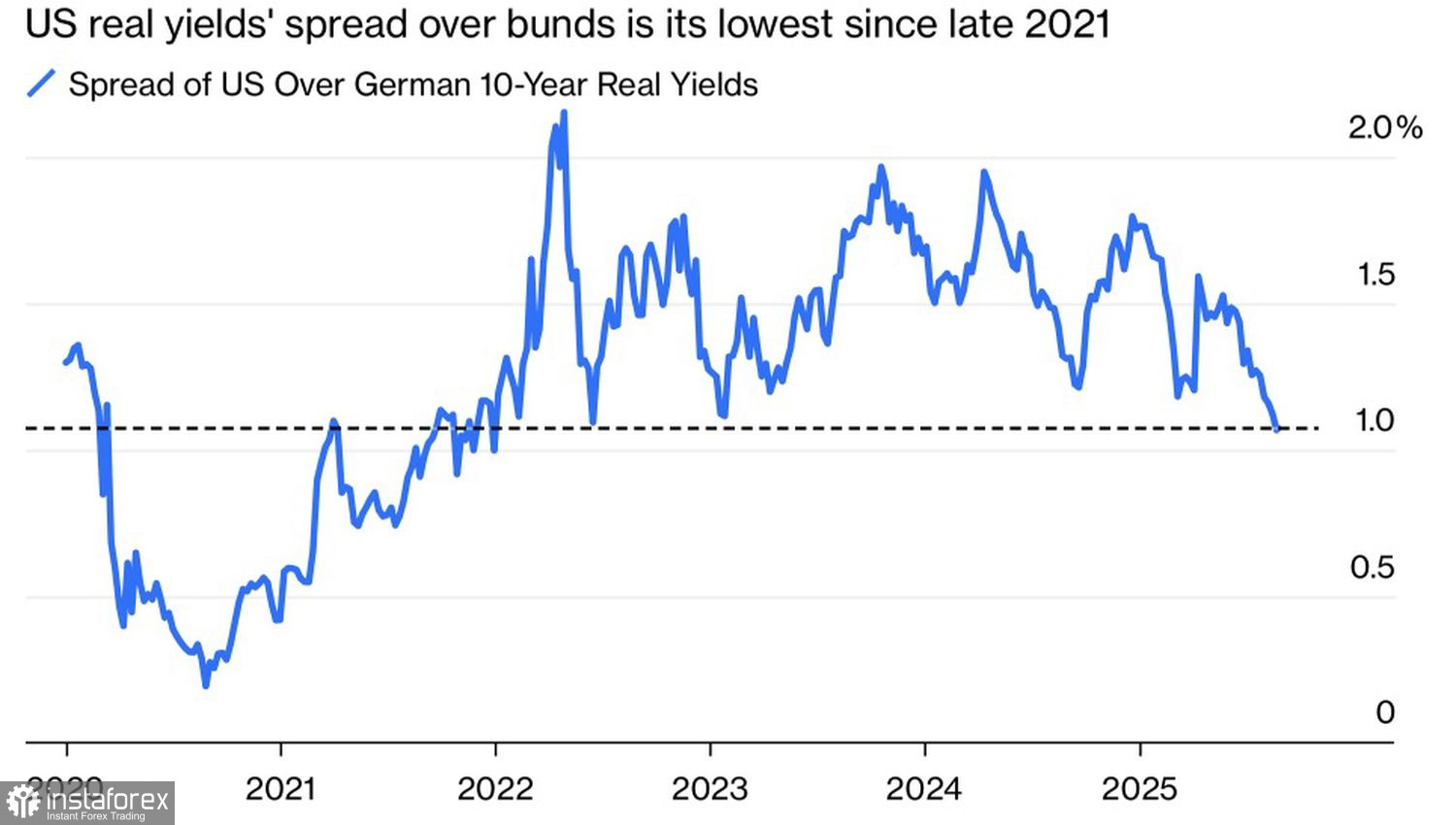

No one is immune to force majeure. It would seem the road north is open for EUR/USD. The Federal Reserve intends to resume a cycle of monetary expansion in September. Credit Agricole expects two cuts to the federal funds rate in 2025, down to 4%. The European Central Bank, on the other hand, is ready to end the process of monetary policy easing. The yield differential between US and German bonds is dropping to its lowest level since 2021. Is the dollar doomed? Not so fast!

Dynamics of the US-German Bond Yield Spread

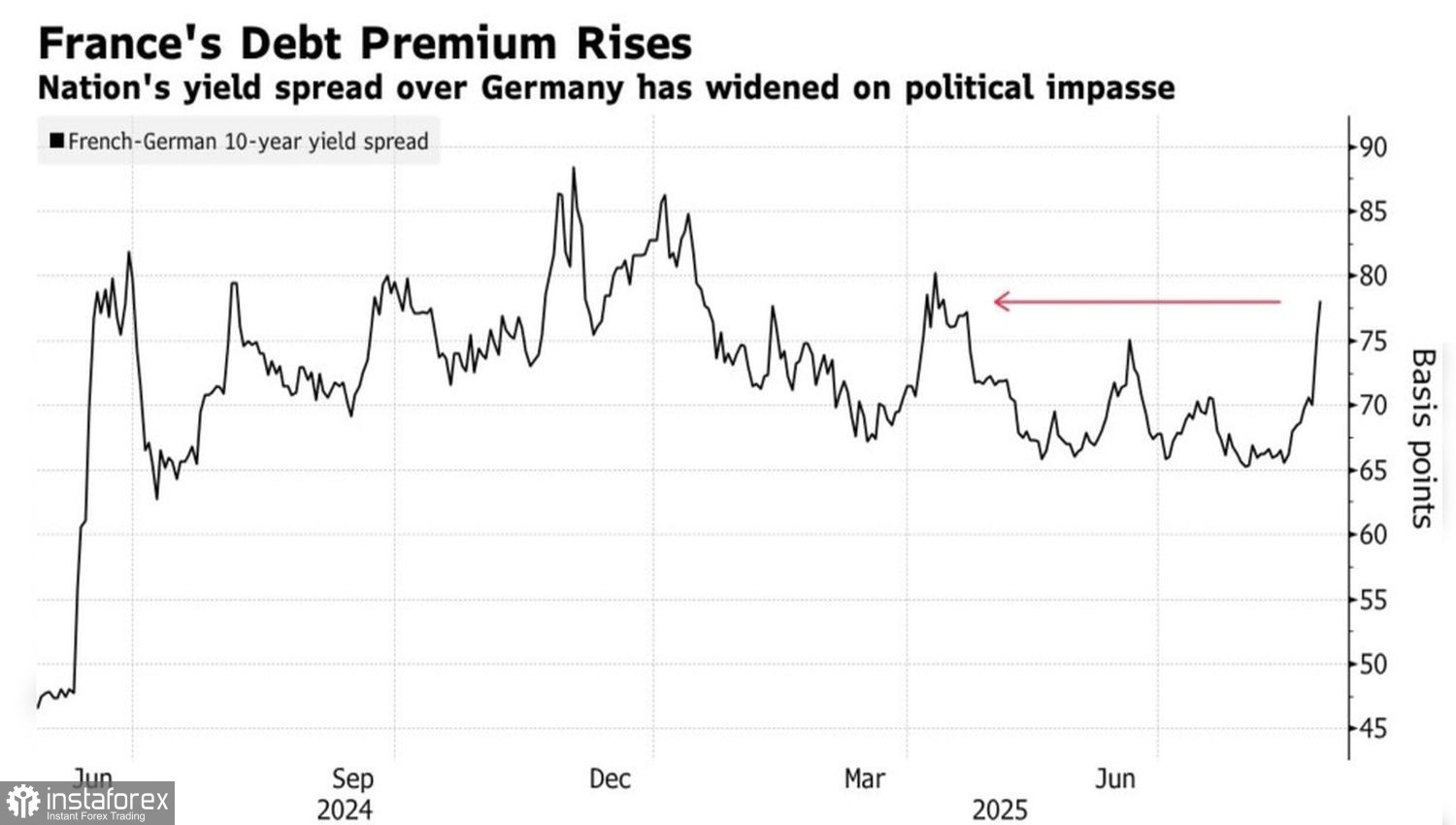

French politics is once again in turmoil. The government of Francois Bayrou has lasted much longer than its predecessors, the teams of Francois Barnier. Nevertheless, the dominant parties in parliament are demanding his resignation. Assets of the second-largest economy in the eurozone are being sold off en masse. The story uncannily resembles last year's events, when rising political risks put serious downward pressure on the euro.

Something similar is happening at the end of this summer. The chances of a vote of no confidence are rising, and Emmanuel Macron is facing a difficult choice: change the government or call snap elections? The yield differential between French and German bonds, a key indicator of European risk, has jumped to its highest levels since April. It's as if weights have been tied to EUR/USD.

Dynamics of the France-Germany Bond Yield Spread

The euro is also not helped by the story of Lisa Cook. Donald Trump announced that he had fired the first Black woman from the position of FOMC Governor for alleged mortgage fraud. She is prepared to defend her rights in court. If the judges side with the president, the independence of the Fed will suffer an irreparable blow. The central bank will be left without protection, turning into a puppet of the White House and starting to cut rates aggressively.

History from the 1970s shows how this could end. Back then, Fed Chair Arthur Burns gave in to the persuasion of US President Richard Nixon and began to ease monetary policy. Inflation accelerated, and the US economy underwent a double recession. "After me, the flood." Trump understands that future generations will bear the consequences of his actions. He himself will go down in history as the man who sped up American GDP.

Erosion of trust in the Fed is bad news for the US dollar. There is no talk of safety. Investors will not keep their money in a country where the world revolves around the White House, which is turning into a developing market. Capital outflows from the United States would help EUR/USD resume its upward trend.

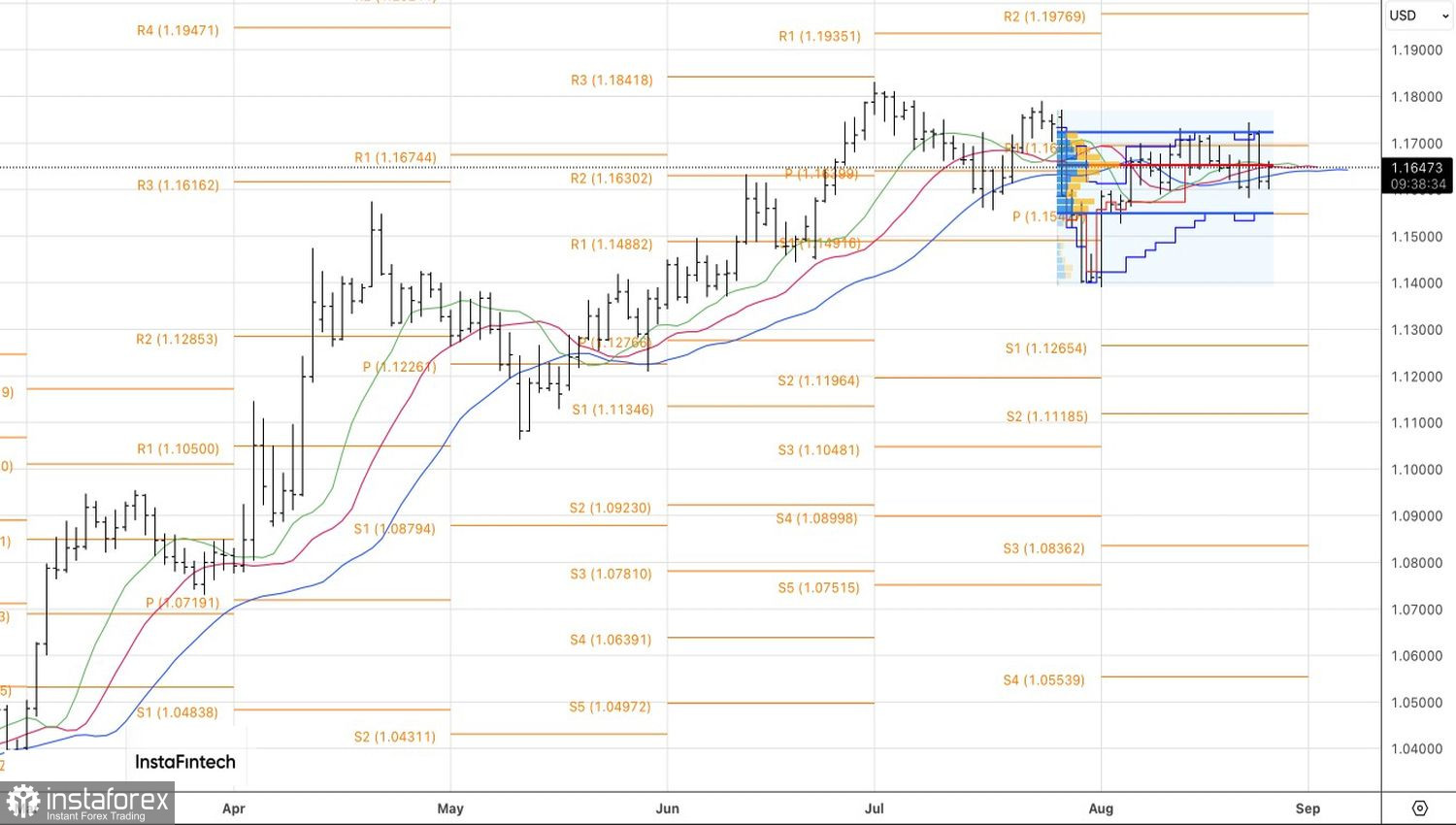

Technically, on the daily chart, the main currency pair is attempting a bullish return above its fair value at 1.1650. If EUR/USD buyers succeed, the risks of the inner bar playing out with a breakout above its high at 1.1725 will increase.