By the end of yesterday, US stock indices closed mixed. The S&P 500 rose by 0.51%, while the Nasdaq 100 gained 1.01%. The industrial Dow Jones lost 0.05%.

Index futures advanced after weak US job openings data strengthened expectations of a Federal Reserve rate cut at the end of this month. The Job Openings and Labor Turnover Survey showed a decline in vacancies, indicating some cooling in the labor market. This, in turn, may push the Fed toward a more dovish monetary policy. Rate cut expectations support equities, as lower borrowing costs stimulate economic growth and boost corporate earnings. In addition, lower rates make stocks more attractive compared to bonds, whose yields decline along with interest rates.

Futures on the S&P 500 and Nasdaq 100 rose by 0.02% to 0.03%. The Euro Stoxx 50 futures contract was unchanged. Treasury bonds and the US dollar also showed little change. Gains in Asian indices slowed amid continued selling in Chinese equities. The MSCI regional equity index added 0.2% after a 0.7% rise. Japanese bond futures continued to climb after a closely watched 30-year government bond auction met demand broadly in line with the 12-month average.

Meanwhile, selling in Chinese equities persisted: the CSI 300 index fell by 1.8%. This came after reports that the country's financial regulators are considering a range of measures to curb the stock market due to concerns over the pace of its $1.2 trillion rally since early August.

The US labor market report will be released tomorrow. Economists forecast that about 75,000 jobs were created in August, while the unemployment rate will stand at 4.3%. Four consecutive months of job growth below 100,000 would mark the weakest stretch since the start of the pandemic in 2020.

A significant decline in labor market data could lead to a sharp rate cut, given concerns over the Fed's labor mandate. In addition, Federal Reserve Governor Christopher Waller stated in an interview yesterday that the central bank should begin cutting interest rates in September and carry out several more reductions in the coming months, adding that officials may discuss the exact pace of easing during the September meeting.

In commodity markets, oil is falling for the second straight day as traders fear that OPEC+ may increase supply, while industry estimates point to rising inventories at a key storage hub. Global benchmark Brent crude fell to $67 per barrel, while West Texas Intermediate dropped below $64. According to Goldman Sachs Group Inc. analysts, Brent prices will fall to $50 per barrel next year due to a global surplus.

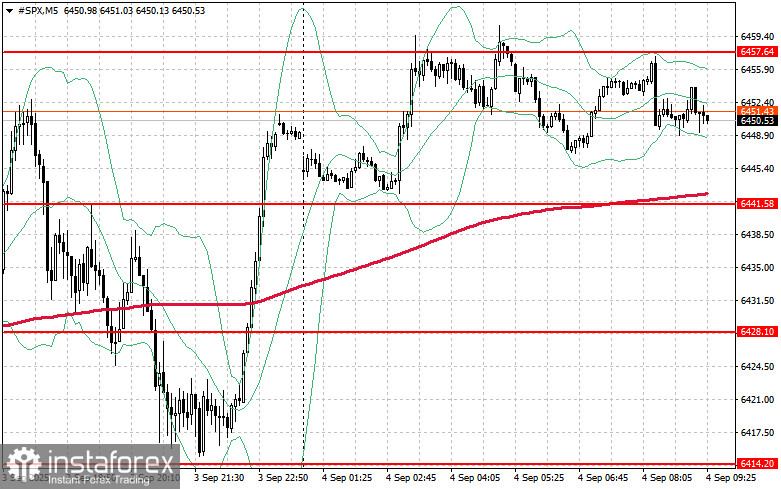

As for the technical picture of the S&P 500, the main task for buyers today will be to break through the nearest resistance level of $6,457. This would allow for further upside and open the way toward the next level at $6,473. An equally important objective for bulls will be to keep control over $6,490, which would strengthen buyers' positions. In case of a downside move amid weakening risk appetite, buyers will need to step in around $6,441. A breakout there would quickly push the instrument back to $6,428 and open the road toward $6,414.