Markets continue to buy the dips—even in what is historically a terrible September for them. The spark for the S&P 500's recovery came from disappointing labor market data and positive news from tech giants Alphabet and Apple. Alphabet avoided harsh antitrust sanctions by a court ruling and managed to dodge selling off the Chrome browser. Apple, meanwhile, plans to launch an AI-based web search tool for Siri.

Given the significant weight of tech giants in the S&P 500, news from these companies can easily move the entire stock market, which lately has been at the mercy of US Treasury yields. Donald Trump's tariffs being deemed illegal has increased the risk that Washington may have to return billions of dollars and issue more Treasuries. All the while, fears of accelerating inflation have stoked the flames. Yields on 30-year Treasury bonds jumped to 5%, becoming a red flag for sellers of the broad equities index.

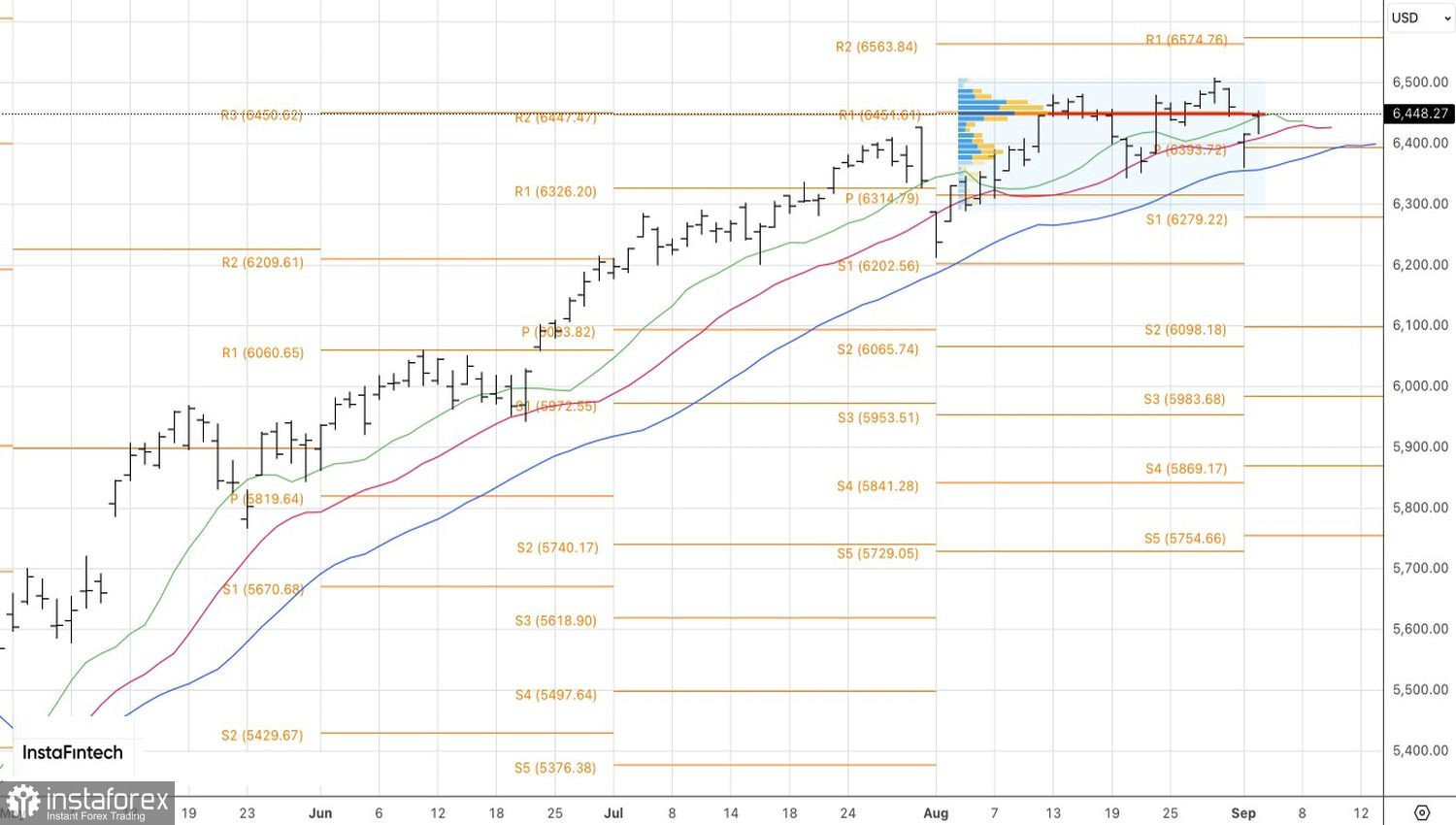

S&P 500 and US Treasury Yield Dynamics

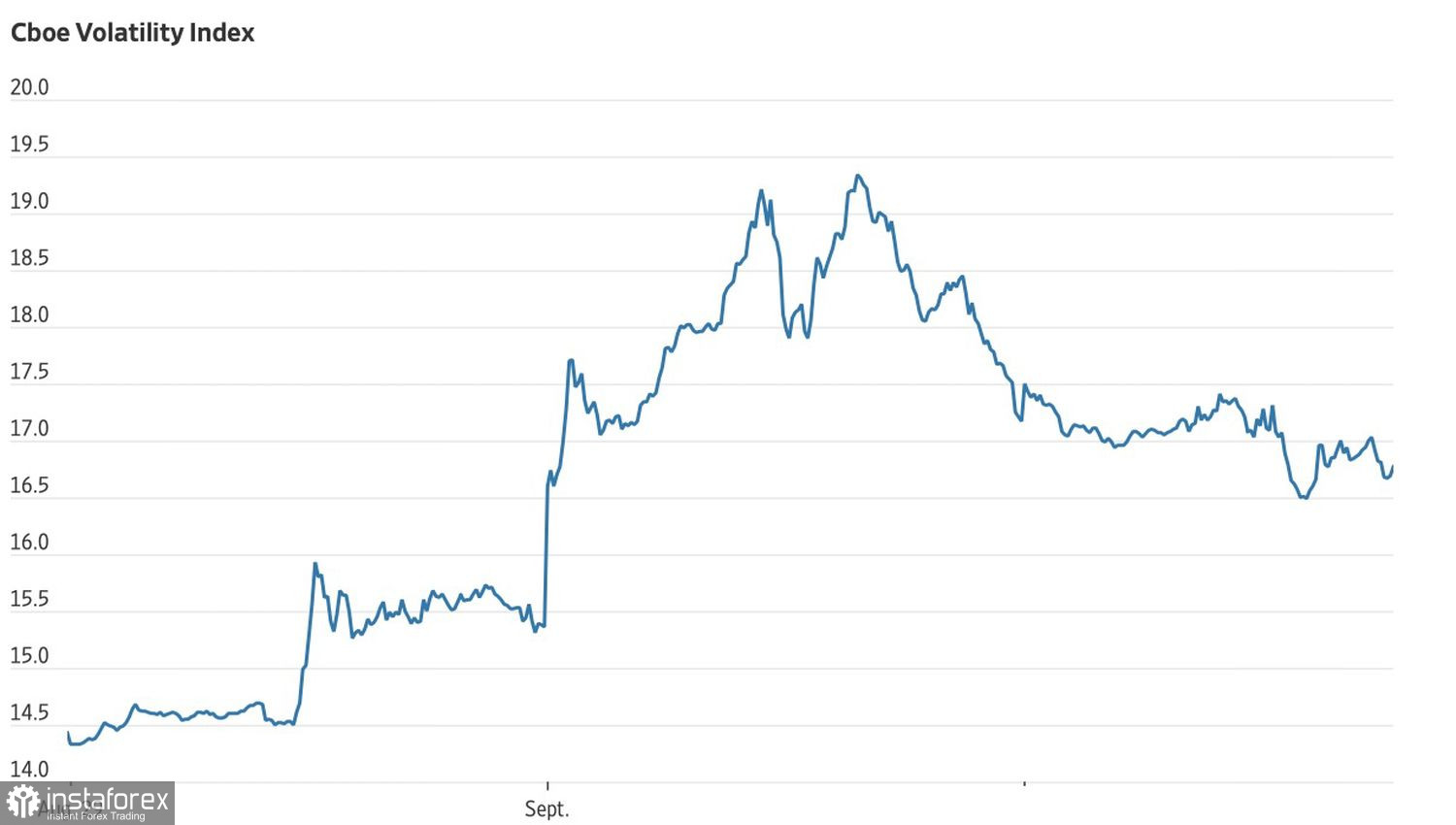

When yields on 30-year bonds surpassed that level in May, the S&P 500 quickly dropped 2.3%, and the VIX volatility index shot above 22. In September, a surprise from the US labor market contributed to a decline in the "fear index": The number of job openings unexpectedly fell to a 10-month low of 7.2 million in July, down from 7.4 million in June. Hiring slowed, and unemployed workers are taking longer to find new jobs.

Further signs of a cooling labor market sent the odds of a federal funds rate cut in September soaring to 99.6%. Derivatives now price in a 42% chance of three rate cuts by the end of 2025. Investors are convinced the Fed will throw a lifeline to the struggling economy. As a result, fear gives way to greed, the VIX falls, and the S&P 500 rises.

VIX Index Performance

According to Federated Hermes, which manages $850 billion, investors shouldn't worry about broad market declines. The stability of the US economy and corporate earnings makes the correction potential of equities limited. Previously, Evercore forecast a 20% S&P 500 rally by the end of 2026, while Morgan Stanley reaffirmed its bullish outlook.

Nevertheless, there's no shortage of pessimists. They point out that the broad stock index is trading at 22 times forward 12-month earnings, a level seen in the past 35 years only during the dot-com bubble and the pandemic. The higher the stocks climb, the greater the chance of a bubble.

On the daily S&P 500 chart, the index managed to return to its fair value of 6,450. The fight for this level continues. The bulls' inability to break higher may be a signal to open short positions. On the other hand, a successful breakout would provide a case for buying.