Bitcoin slid to $110,400 and is taking a breather. Ethereum is also slightly correcting but its bullish potential remains intact

Meanwhile, an interesting report from QCP Capital caught the eye, stating that we are currently witnessing a drop in the US Dollar Index (DXY) to a half-century low, which has fueled price growth in both gold and Bitcoin.

It is clear that institutional players are actively hedging against the potential further depreciation of the US dollar. At the same time, there is a massive sell-off of US Treasuries. This situation is highly unusual from a historical perspective — and Bitcoin is playing a significant role. The current landscape points to a loss of trust in traditional financial instruments and a resulting capital shift into alternative assets such as gold and cryptocurrencies. Bitcoin, in particular, is increasingly being viewed as digital gold, capable of preserving value during times of macroeconomic instability and inflation.

Nevertheless, it's important to understand that this trend primarily reflects growing interest in decentralized assets as a risk-hedging tool amid global economic uncertainty. Further market dynamics will depend on a range of factors, including the geopolitical environment, decisions by central banks, and the development of the regulatory framework for cryptocurrencies.

Intraday strategy for the crypto market

As we advance, I will continue to base my trading on any major dips in Bitcoin and Ethereum, expecting the medium-term bull market (which is still intact) to resume.

As for short-term trading, here is my strategy and the specific setups for today.

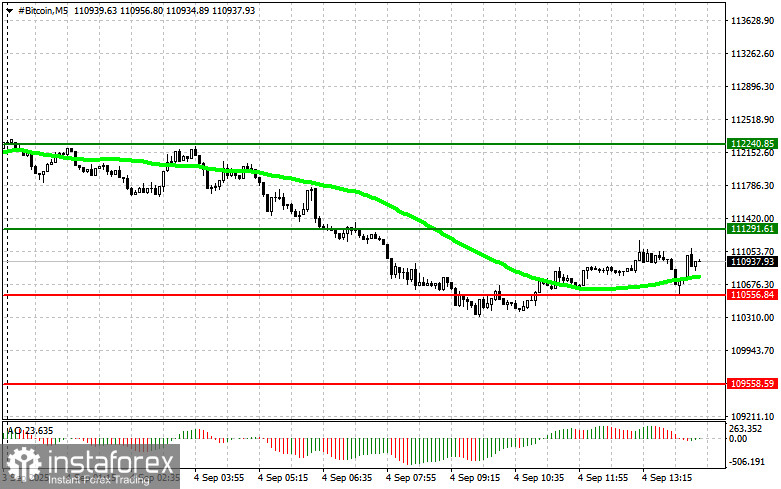

Bitcoin

Buy scenario

Scenario #1: I will buy Bitcoin today upon reaching the entry point around $111,200, targeting a rise to $112,200. I will exit long positions near $112,200 and open a short position on the bounce. Before a breakout buy, make sure the 50-day moving average is below the current price, and the Awesome Oscillator is in positive territory.

Scenario #2: Buying Bitcoin from the lower border at $110,500 is also possible if there is no strong bearish reaction to a false breakout. The targets would then be $111,200 and $112,200.

Sell scenario

Scenario #1: I will sell Bitcoin today upon reaching the entry point around $110,500, targeting a decline to $109,500. I will exit short positions near $109,500 and open long positions during a dip. Before breakout selling, make sure the 50-day moving average is above the current price, and the Awesome Oscillator is in negative territory.

Scenario #2: Selling Bitcoin from the upper border at $111,200 is also possible if there is no bullish reaction to a false breakout. The targets would then be $110,500 and $109,500.

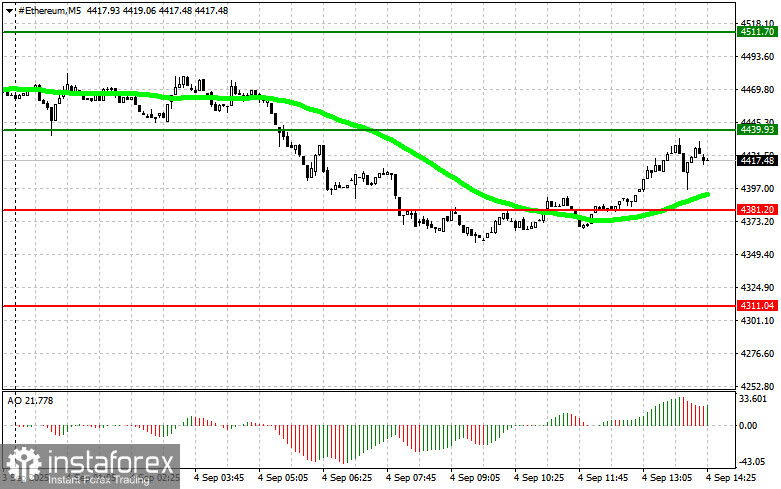

Ethereum

Buy scenario

Scenario #1: I will buy Ethereum today upon reaching the entry point around $4,439, targeting a rise to $4,511. I will exit long positions near $4,511 and open short ones during a bounce. Before breakout buying, make sure the 50-day moving average is below the current price, and the Awesome Oscillator is in positive territory.

Scenario #2: Buying Ethereum from the lower border at $4,381 is also possible if there is no bearish reaction to a false breakout. The targets would be $4,439 and $4,511.

Sell scenario

Scenario #1: I will sell Ethereum today upon reaching the entry point around $4,381, targeting a drop to $4,311. I will exit short positions near $4,311 and open long ones during a dip. Before breakout selling, make sure the 50-day moving average is above the current price, and the Awesome Oscillator is in negative territory.

Scenario #2: Selling Ethereum from the upper border at $4,439 is also possible if there is no bullish reaction to a false breakout. The targets would then be $4,381 and $4,311.