GBP/USD

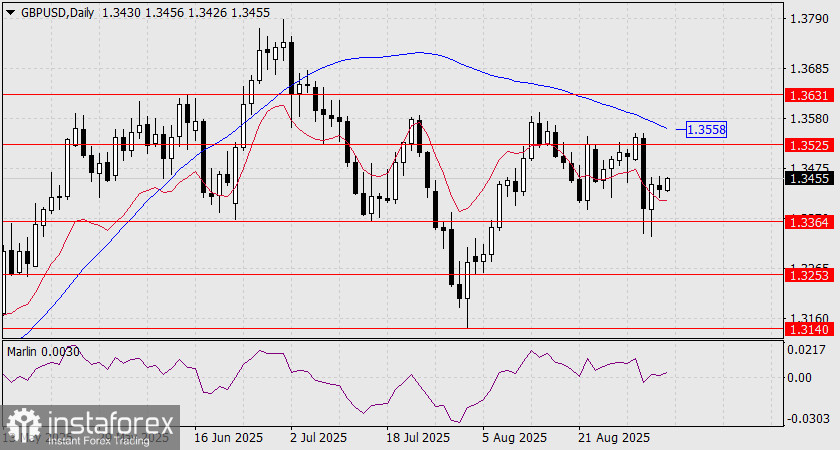

On the daily chart, the price has consolidated above the balance indicator line, and the Marlin oscillator remains in positive territory. These are preconditions for growth toward the nearest target at 1.3525. However, there is an important factor—today, US employment data will be released, and strong figures could push the price below the support level at 1.3364, as happened on September 2.

"Weak" data could trigger an attack on the MACD line in the 1.3558 area. Afterwards, the market would look for a Fed rate cut in the 1.3525–1.3631 range.

Overall, the price is in a free-ranging band between 1.3364 and 1.3525, waiting for the release of key data.

On the four-hour chart, the price is pulling toward the MACD line around 1.3470. The Marlin oscillator is moving into positive territory. If the price breaks above the MACD line but then returns after the release of US data, this would be considered a false breakout and an independent signal of further price decline.