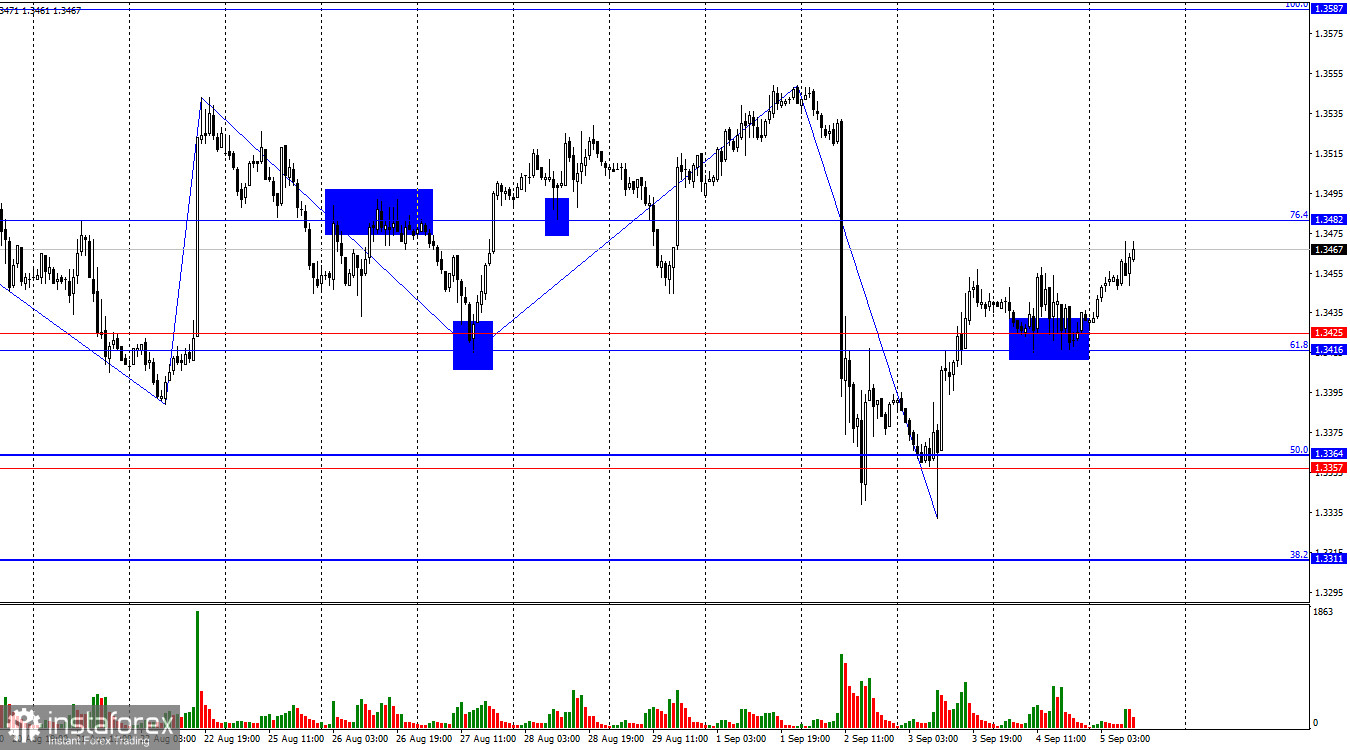

On the hourly chart, the GBP/USD pair on Thursday made two rebounds from the support zone at 1.3416–1.3425, turned in favor of the pound, and started a new rise toward the 76.4% retracement level at 1.3482. A rebound from this level will favor the U.S. currency and some decline toward the 1.3416–1.3425 zone. Consolidation above 1.3482 will increase the likelihood of further growth toward the next 100.0% Fibonacci level at 1.3587.

The wave picture remains "bearish." The last completed upward wave broke the peak of the previous wave by only a few points, while the last downward wave broke through two previous lows. The news background has played a huge role in forming the waves we've seen in recent weeks. In my opinion, the news flow is not "bearish," though certain events still lend support to the bears.

On Thursday, bear traders failed to regain the initiative. The U.S. services PMI allowed for hopes of closing the pair below the 1.3416–1.3425 level, but the bears lacked strength. This morning, the UK retail sales report showed growth of 0.6% m/m, higher than forecasts. As a result, bulls launched a new, quite natural offensive. Today, we will also learn U.S. labor market and unemployment data, but recently, while the dollar has been struggling to gain ground against the pound and the euro, I still believe this is a temporary phenomenon. Hanging over the dollar is the Fed's September 17 rate decision. Most likely, the rate will not only be cut by 0.25% but will mark the first move in an entire easing cycle. Thus, in the coming months, and possibly years, the Fed's monetary policy will only become more dovish. The Bank of England will also eventually lower rates, but it has already done so three times in 2025. Its room for further cuts is smaller.

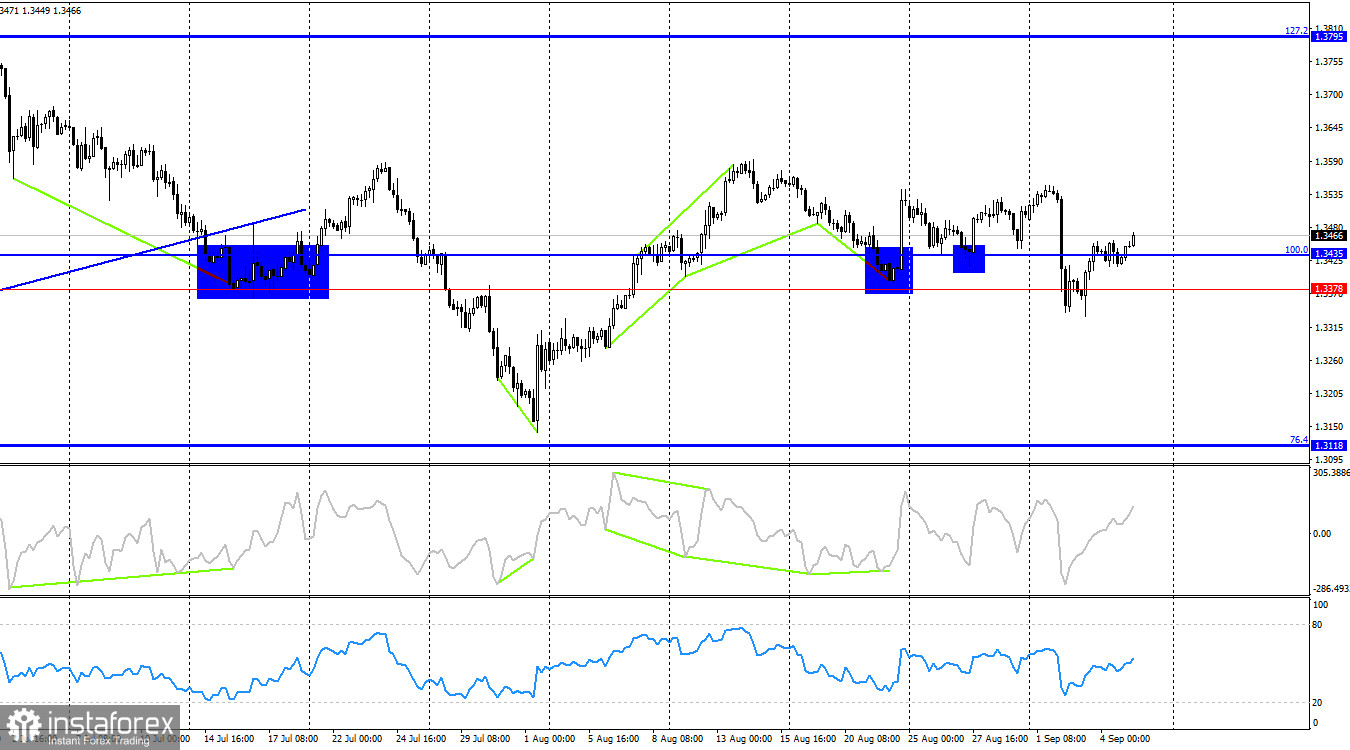

On the 4-hour chart, the pair made a new reversal in favor of the pound and consolidated above the support zone at 1.3378–1.3435. Thus, the growth process may continue toward the next 127.2% retracement level at 1.3795. The chart picture is currently mixed, with traders pushing the pair back and forth. At the moment, I advise paying more attention to the hourly chart. No divergences are forming on any indicator.

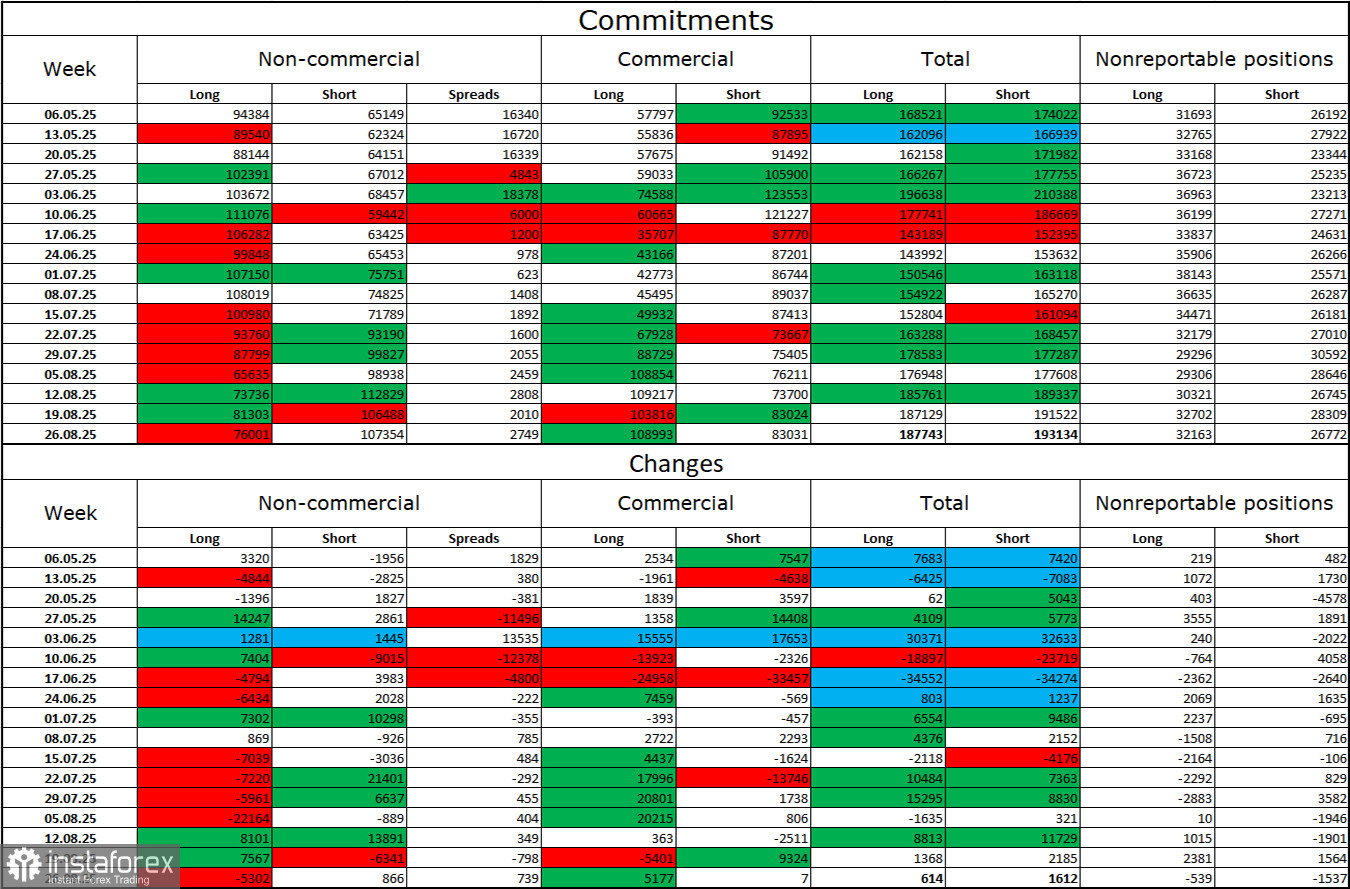

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" category became more bearish over the last reporting week. The number of long positions held by speculators decreased by 5,302, while the number of short positions increased by 866. The gap between long and short positions is now roughly 76,000 versus 107,000. But, as we see, the pound is leaning more toward growth, and traders toward buying.

In my view, the pound still has downward prospects. The news background for the dollar in the first six months of the year was terrible but is slowly starting to turn positive. Trade tensions are easing, key deals are being signed, and the U.S. economy in the second quarter will recover thanks to tariffs and various types of investment in the U.S. At the same time, expectations of Fed monetary easing in the second half of the year have already created serious pressure on the dollar. Thus, I do not yet see grounds for a "dollar trend."

News calendar for the U.S. and UK:

- UK – Retail sales volumes (06:00 UTC).

- U.S. – Nonfarm Payrolls (12:30 UTC).

- U.S. – Unemployment rate (12:30 UTC).

- U.S. – Average hourly earnings (12:30 UTC).

On September 5, the economic events calendar includes four entries, at least two of which (Payrolls and unemployment) are important. The news background's influence on market sentiment on Friday may be strong, especially in the second half of the day.

GBP/USD forecast and trading advice:

Sales of the pair are possible today on a rebound from 1.3482 on the hourly chart with a target at 1.3416–1.3425. Buying was possible on rebounds from the 1.3357–1.3364 zone and from the 1.3416–1.3425 zone. Today, these positions can be held with a target at 1.3482. If the pair closes above this level, the next target will be 1.3587.

Fibonacci grids are built from 1.3586–1.3139 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.