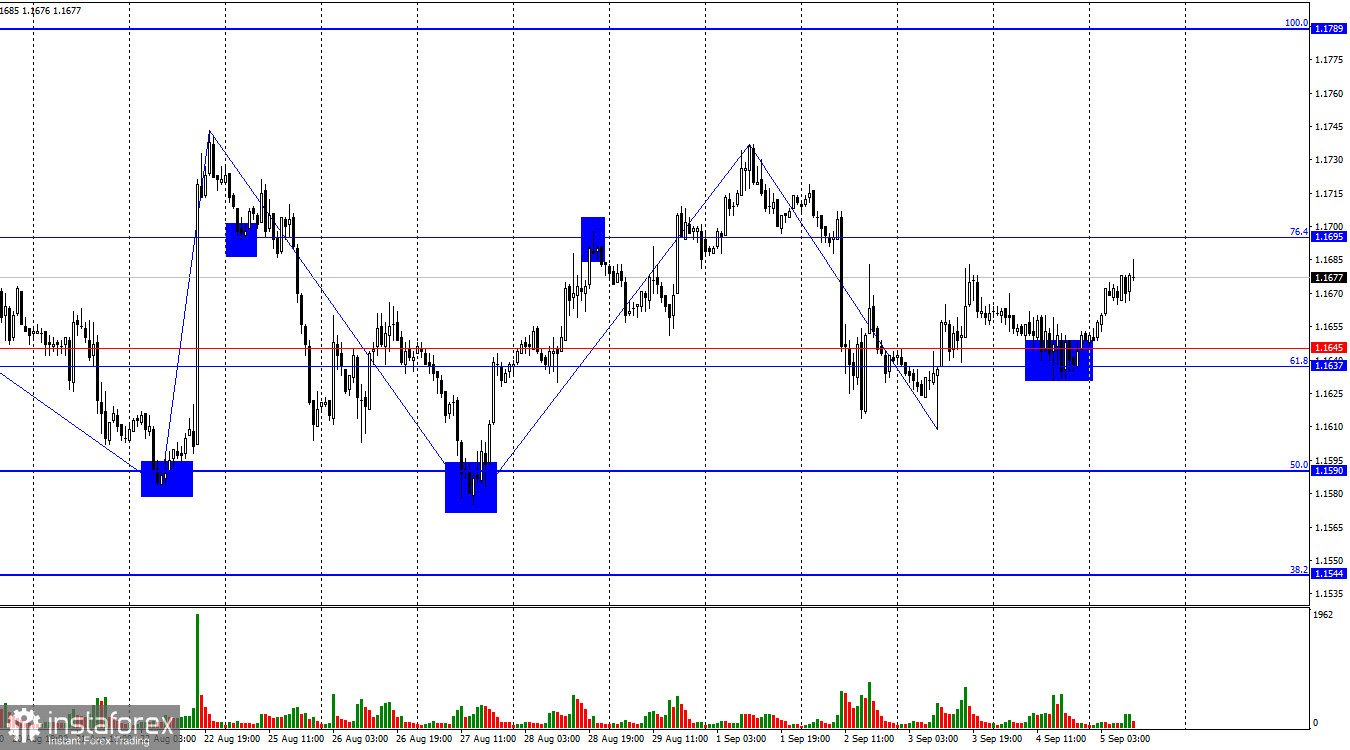

The wave picture on the hourly chart remains simple and clear. The last completed upward wave did not break the peaks of previous waves, and the last downward wave did not break the prior low. Thus, at this point, the trend may once again shift to "bullish," but the probability of continued sideways trading remains high. Recent labor market data and the changing Fed monetary policy outlook support the bulls.

On Thursday, traders' attention was only drawn to the U.S. ISM Services PMI, which pleased the bears. In August, activity in the services sector rose to 52.0, a result few had expected. However, the bears failed to break through the 1.1637–1.1645 level, and that was all the bulls needed. Recall that for three weeks now, bulls and bears have been tugging the rope within the 1.1590–1.1730 level. At present, neither side has enough strength to end the range. However, today may bring a chance for a breakout. In the second half of the day, the most important reports of the week will be released — U.S. unemployment, wages, and new jobs. Much depends on these reports, particularly Fed policy. Thus, we can expect a strong market reaction that may push the pair out of the horizontal channel. About an hour ago, euro area GDP was also released, showing nothing surprising — EU growth in Q2 came in at 0.1%.

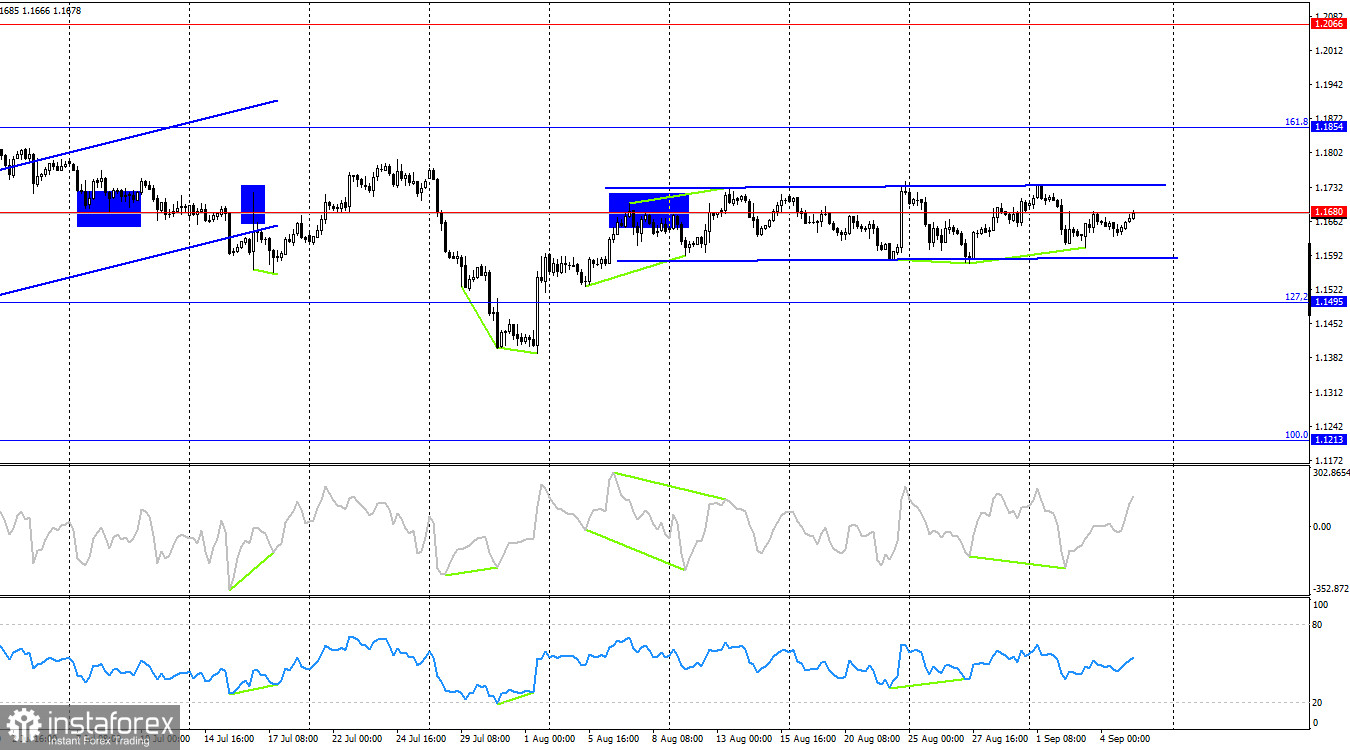

On the 4-hour chart, the pair continues to trade within the sideways channel, which traders have been unable to escape for several weeks. Thus, the sideways pattern persists. A "bullish" divergence has formed on the CCI indicator, signaling possible growth soon — but within the channel. Consolidation above or below the range will open the way for trend movement.

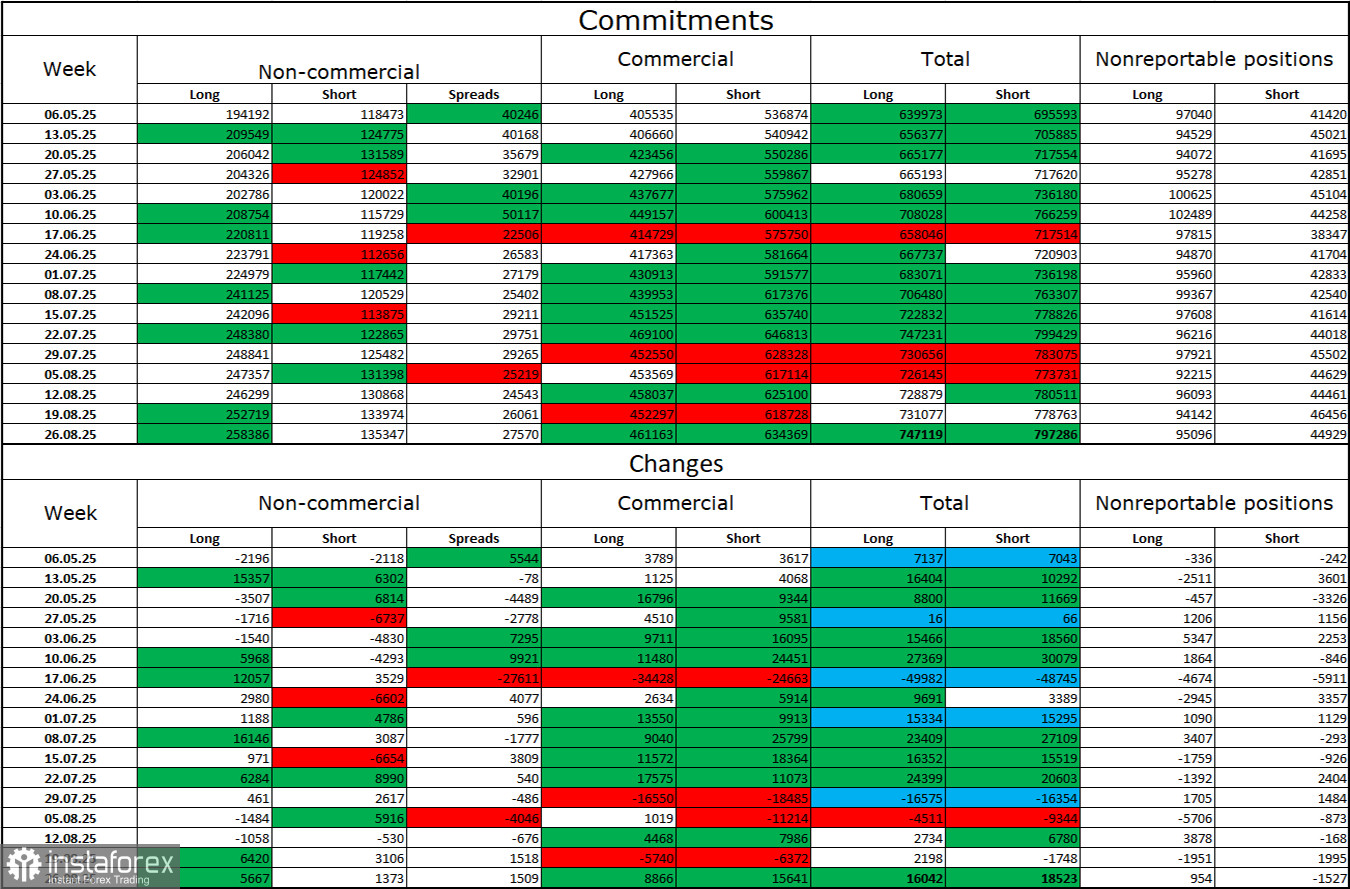

Commitments of Traders (COT) report:

Over the last reporting week, professional players opened 5,667 long positions and 1,373 short positions. The sentiment of the "Non-commercial" group remains bullish thanks to Donald Trump and is strengthening over time. The total number of long positions held by speculators now stands at 258,000, compared with 135,000 short positions — nearly a twofold gap. Also note the number of green cells in the table above, showing strong increases in euro positions. In most cases, interest in the euro is growing, while interest in the dollar is falling.

For 29 consecutive weeks, large traders have been reducing shorts and increasing longs. Donald Trump's policies remain the most significant factor for traders, as they may trigger problems with long-term and structural consequences for America. Despite the signing of several important trade agreements, some key economic indicators continue to decline.

News calendar for the U.S. and EU:

- Eurozone – GDP change in Q2 (09:00 UTC).

- U.S. – Nonfarm Payrolls (12:30 UTC).

- U.S. – Unemployment rate (12:30 UTC).

- U.S. – Average hourly earnings (12:30 UTC).

On September 5, the economic events calendar includes four entries, at least two of which — Payrolls and unemployment — are important. The influence of the news background on market sentiment on Friday may be strong, especially in the second half of the day.

EUR/USD forecast and trading advice:

Sales of the pair are possible today on a rebound from 1.1695 on the hourly chart with a target at 1.1637–1.1645. Buying was possible yesterday on rebounds from 1.1637–1.1645 with a target at 1.1695. Today, these positions can be kept open. A close above 1.1695 will allow holding longs with a target at 1.1789.

Fibonacci grids are built from 1.1789–1.1392 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.