Trade review and tips on trading the European currency

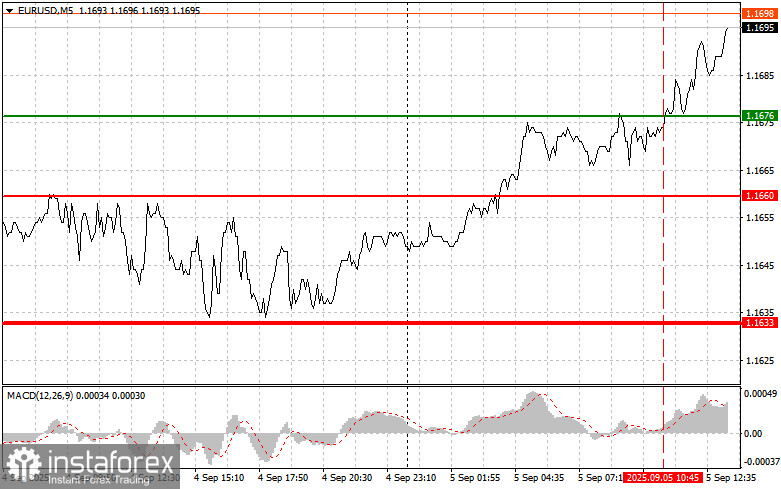

The price test of 1.1676 coincided with the MACD indicator already being well above the zero line, which limited the pair's upward potential. For this reason, I did not buy the euro.

The European currency showed resilience despite less-than-optimistic German data and eurozone GDP. Market participants likely expect that after the release of the latest labor market data, the Fed will ease its monetary policy, which is why they are pricing in further euro growth. Nevertheless, key factors such as economic growth and inflation will continue to play a decisive role in shaping the euro's future dynamics. Investors should carefully analyze economic data from both the eurozone and the U.S., as well as statements from central bank officials, to make informed decisions.

The second half of the day is rich in key U.S. labor market releases that can significantly influence investor sentiment and the Fed's future monetary policy course. Special attention will be paid to changes in nonfarm payrolls, the unemployment rate, average hourly earnings, and private sector employment.

Experts forecast a slowdown in nonfarm payrolls growth, which is negative for the dollar. The unemployment rate has also recently shown signs of rising, which is concerning. An increase in unemployment may signal a slowdown in economic growth and potentially force the Fed to adjust its strategy.

As for the intraday strategy, I will rely more on scenarios #1 and #2.

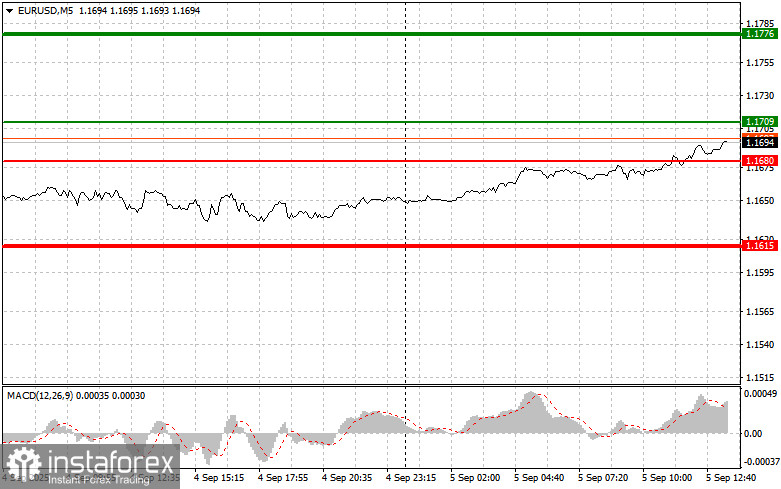

Buy signal

Scenario #1: Today, buying the euro is possible at around 1.1709 (green line on the chart) with a growth target at 1.1776. At 1.1776, I plan to exit the market and also sell the euro in the opposite direction, expecting a 30–35 point pullback from the entry point. Strong euro growth today will be possible after weak U.S. labor market data. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1680 level, at the moment when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. Growth toward the opposite levels of 1.1709 and 1.1776 can be expected.

Sell signal

Scenario #1: I plan to sell the euro after reaching the 1.1680 level (red line on the chart). The target will be 1.1615, where I plan to exit the market and immediately buy in the opposite direction, expecting a 20–25 point pullback from the level. Pressure on the pair will return today in the case of strong reports. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1709 level, at the moment when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reversal downward. A decline toward the opposite levels of 1.1680 and 1.1615 can be expected.

What's on the chart:

- Thin green line – entry price for buying the trading instrument;

- Thick green line – estimated price for setting Take Profit or closing profit manually, as further growth above this level is unlikely;

- Thin red line – entry price for selling the trading instrument;

- Thick red line – estimated price for setting Take Profit or closing profit manually, as further decline below this level is unlikely;

- MACD indicator. When entering the market, it is important to follow overbought and oversold zones.

Important. Beginner traders in the Forex market must be very careful when making entry decisions. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, such as the one I presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.