Trade review and tips on trading the British pound

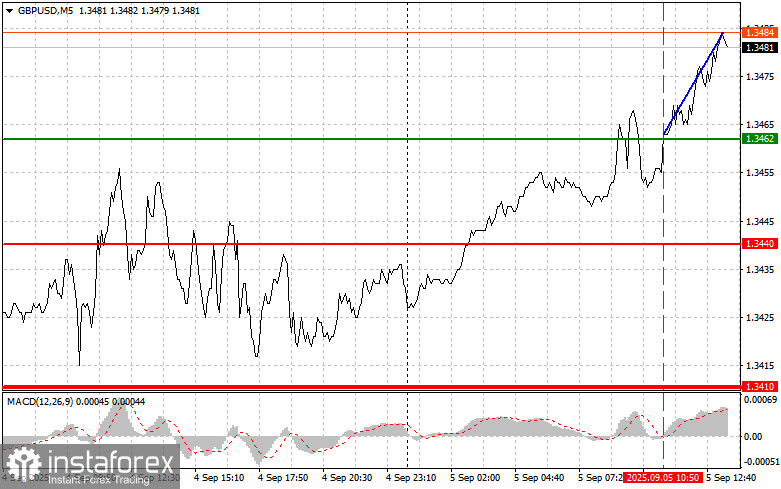

The price test of 1.3462 occurred when the MACD indicator was just beginning to rise from the zero line, confirming the correct entry point for buying the pound. As a result, the pair gained more than 20 points.

Strong retail sales growth data in the UK supported the pound in the first half of the day. However, the positive momentum was somewhat offset by the revised half-year figures.

Next, markets await U.S. data on nonfarm payrolls and unemployment. A sharp drop in employment will trigger dollar selling and pound growth. This potential scenario assumes that weak labor market data will push the Federal Reserve toward a softer monetary policy stance. Indeed, if new jobs come in well below forecasts, it could be interpreted as a sign of slowing U.S. economic growth. In this case, investors will likely start selling dollar assets, fearing rate cuts by the Fed.

To get a fuller picture of the U.S. labor market, reports on average hourly earnings and private sector employment will also be released. Rising average hourly earnings reflect both a shortage of skilled labor and stronger consumer activity. However, they may also fuel inflationary pressures, which the Fed has not yet fully resolved.

Taken together, the data will decisively shape the Fed's future monetary policy strategy and strongly influence the FX market, so traders should be prepared for sharp moves.

As for intraday strategy, I will rely more on scenarios #1 and #2.

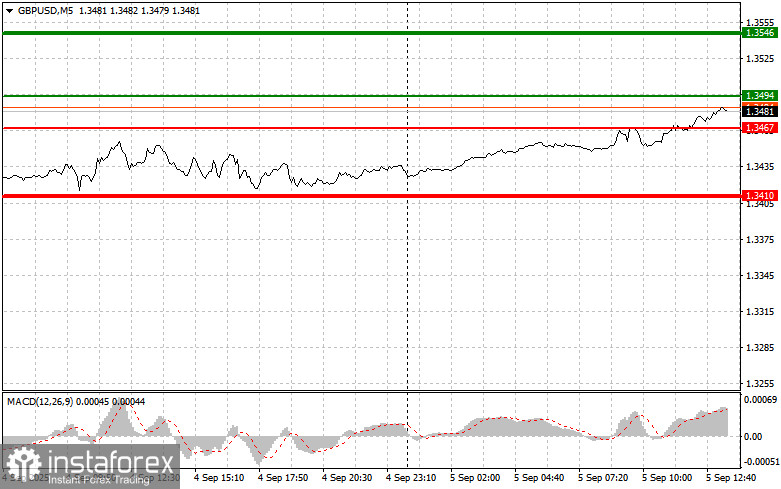

Buy signal

Scenario #1: I plan to buy the pound today at the entry point around 1.3494 (green line on the chart), with an upward target at 1.3546 (thicker green line on the chart). Around 1.3546, I will exit long positions and open shorts in the opposite direction, aiming for a 30–35 point pullback from the level. Strong pound growth today will be possible after weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of 1.3467, at a time when the MACD indicator is in the oversold area. This will limit the pair's downward potential and trigger a market reversal upward. Growth toward the opposite levels of 1.3494 and 1.3546 can be expected.

Sell signal

Scenario #1: I plan to sell the pound today after a breakout of 1.3467 (red line on the chart), which will lead to a quick decline of the pair. The key target for sellers will be 1.3410, where I will exit shorts and immediately open longs in the opposite direction, aiming for a 20–25 point pullback from the level. Strong U.S. data will lead to renewed pair weakness. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of 1.3494, at a time when the MACD indicator is in the overbought area. This will limit the pair's upward potential and trigger a reversal downward. A decline toward the opposite levels of 1.3467 and 1.3410 can be expected.

What's on the chart:

- Thin green line – entry price for buying the trading instrument;

- Thick green line – estimated price for setting Take Profit or manually fixing profit, as further growth above this level is unlikely;

- Thin red line – entry price for selling the trading instrument;

- Thick red line – estimated price for setting Take Profit or manually fixing profit, as further decline below this level is unlikely;

- MACD indicator. When entering the market, it is important to follow overbought and oversold zones.

Important. Beginner traders in the Forex market must be very cautious when making entry decisions. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, such as the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for an intraday trader.