Gold prices continue to rise, directly linked to expectations of a more accommodative monetary policy from the US Federal Reserve. However, many other factors are also providing strong support for the metal.

As the data shows, in August, the People's Bank of China increased its gold reserves for the tenth consecutive month, continuing to diversify its holdings by reducing the share of US dollars. This strategic decision is part of a broader dedollarization trend seen in several countries seeking greater financial independence and protection against dollar exchange rate fluctuations.

The data indicate that China is not alone in its pursuit of gold. Many central banks worldwide are actively increasing their gold reserves, viewing this asset as a reliable store of value and a hedge against inflation. Gold has traditionally been regarded as a safe-haven asset during times of economic uncertainty, making it attractive to central banks looking to stabilize their reserves.

The increase in China's gold holdings can also be seen as part of its efforts to strengthen the renminbi's position as an international currency. Backing the currency with gold reserves could boost global confidence in the yuan and contribute to its broader use in international trade and finance.

According to data published Sunday, the gold reserves of the central bank increased by 0.06 million troy ounces last month to 74.02 million troy ounces. China began this round of gold purchases in November, having bought a total of 1.22 million troy ounces during this period.

In recent days, gold has reached record highs. Expectations of a US rate cut and criticism of the Fed from the White House have acted as fresh catalysts for the rally.

The price of precious metals has risen by more than 30% this year, exceeding $3,500 per ounce. This explosive growth reflects not only current economic instability, but also fears about the future of the financial system. The main factor driving the rise in precious metals prices is, without a doubt, declining trust in fiat currencies, especially the US dollar.

Goldman Sachs, like many other experts, highlights the critical role of the Fed's independence in maintaining trust in the dollar and the financial system as a whole. If the Fed becomes politically compromised or yields to government pressure, this could seriously undermine investor confidence and spark further moves into safe-haven assets like gold. In this case, according to Goldman Sachs analysts, gold could reach $5,000 per ounce, an unprecedented level.

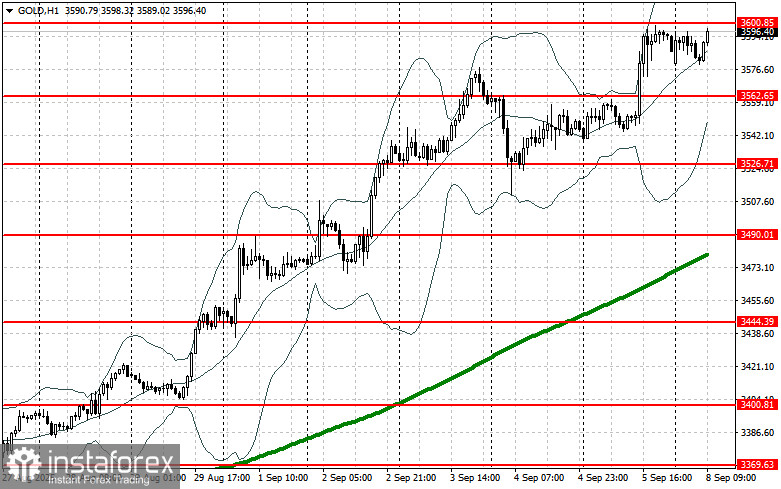

As for the current technical picture for gold, buyers need to take out the nearest resistance at $3,600. This will allow a move towards $3,641, above which it will be quite problematic to break through. The most distant target will be the $3,682 area. If gold falls, the bears will try to gain control over $3,562. If they succeed, a break of this range will deal a severe blow to the bulls' positions and drive gold down to a minimum of $3,526, with the prospect of reaching $3,490.