Trade Review and Advice on Trading the Japanese Yen

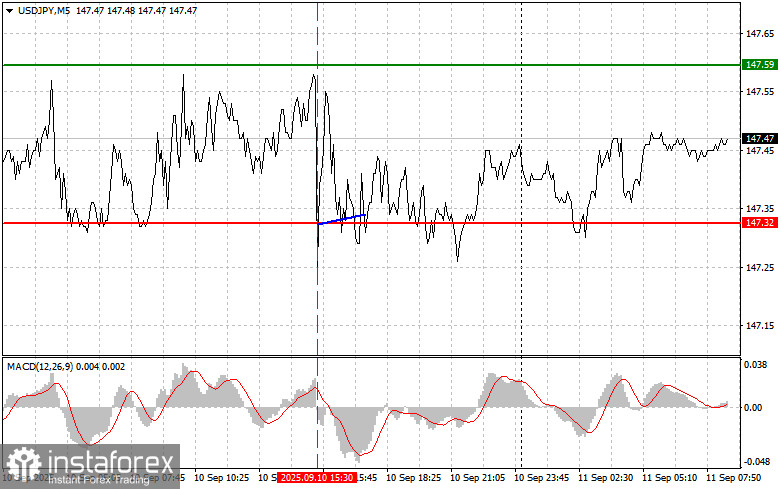

A test of the 147.32 price level coincided with the MACD indicator just starting to move down from the zero line—a good confirmation to sell the dollar. However, this did not lead to a significant drop in the pair.

The yen reacted with only a minor gain against the US dollar after news that US producer prices in August declined, not increased. This restrained reaction reflects a mix of factors, including ongoing concerns about Japan's economic outlook and the Bank of Japan's monetary policy. Despite dollar weakness from US data, investors remain cautious about the yen, given its sensitivity to global economic swings—weak domestic demand, an aging population, and export dependency leave the Japanese currency vulnerable to external shocks.

Today's strong BSI large manufacturers business conditions index data out of Japan did not impact the currency market at all. Moreover, the yen unexpectedly ignored such a positive signal of improving sentiment in a key sector. This anomaly highlights the complexity and contradictions currently shaping the market.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

Buy Scenario

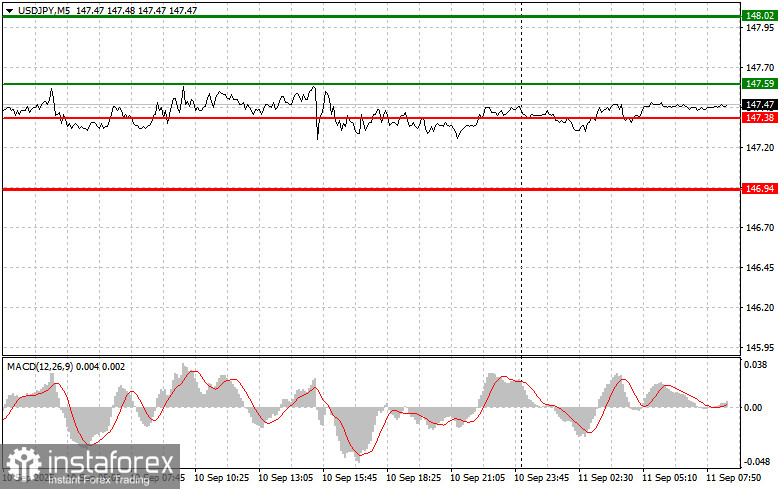

- Scenario #1: Plan to buy USD/JPY today at the entry area around 147.59 (green line on the chart), targeting a rise to 148.02 (thicker green line on the chart). Around 148.02, I'll exit longs and open a short for a move of 30–35 pips back. It's best to return to buying the pair on corrections or deep pullbacks in USD/JPY. Important: Before buying, make sure MACD is above zero and just starting to rise from there.

- Scenario #2: Buy USD/JPY if there are two consecutive tests of the 147.38 level while MACD is in the oversold zone. This should limit downside and prompt a reversal, targeting 147.59 and 148.02.

Sell Scenario

- Scenario #1: Plan to sell USD/JPY today only after a break below 147.38 (red line on the chart), which should trigger a rapid slide. The key downside target is 146.94, where I'll exit shorts and immediately look to buy for a 20–25 pip rebound. The higher the sell entry, the better. Important: Before selling, ensure the MACD is below zero and is just starting to fall.

- Scenario #2: Also plan to sell USD/JPY if there are two consecutive tests of 147.59 while MACD is in the overbought area. This will cap the upside and may prompt a reversal down to 147.38 and 146.94.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.