Yesterday, US stock indices closed mixed. The S&P 500 rose by 0.30%, while the Nasdaq 100 added 0.03%. The industrial Dow Jones fell by 0.48%.

Futures on US and European equities showed stability ahead of the highly anticipated US inflation data, due today, while the Asian session was marked by gains in technology giants.

Euro Stoxx 50 futures were little changed, while S&P 500 and Nasdaq 100 futures pared losses during Asian trading. Japan, South Korea, and mainland China's major stock indices advanced, while Australian and Hong Kong indices declined. The MSCI Asia-Pacific regional index was flat after five straight days of gains. US Treasuries stabilized after broad-based curve gains on Wednesday. The US dollar index was little changed, and the yen held steady against the greenback.

Yesterday's report showed that US producer prices unexpectedly fell in August for the first time in four months. This eased concerns that high inflation would create difficulties for policymakers trying to prevent labor market weakness ahead of today's US inflation release, due in the afternoon. The decline in producer prices is undoubtedly a positive signal for the economy, pointing to potential easing of inflationary pressure. However, it is important to note that this is only one indicator, and drawing final conclusions about long-term trends is premature. The market is closely watching today's inflation release to gain a fuller picture of the current economic situation.

It is worth noting that the decline in producer prices may be driven by various factors, including lower energy prices, slower consumer demand growth, or improvements in supply chains. A detailed analysis of these elements will allow for a more accurate assessment of the reasons behind the drop and its potential impact on the economy as a whole. In the context of Federal Reserve policy, weaker inflationary pressure may give policymakers more room to maneuver when making decisions on interest rates.

Today also brings a meeting of the European regulator, where the bank is expected to keep interest rates unchanged.

As for commodities, gold prices edged lower after gains in the previous session, while oil prices also dipped slightly after three days of increases, as investors weighed Trump's next steps to pressure Russia, raising concerns over crude supply.

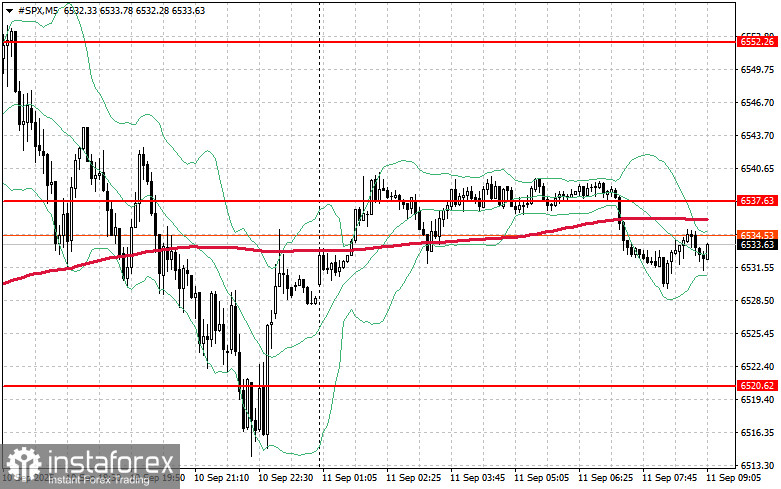

As for the technical picture of the S&P 500, the main task for buyers today will be to break through the nearest resistance level of $6,537. This would allow for further upside and open the way toward the next level at $6,552. An equally important objective for bulls will be to keep control over the $6,563 mark, which would strengthen buyers' positions. In case of a downside move amid weakening risk appetite, buyers will need to step in around $6,520. A breakout below this level would quickly push the instrument back to $6,505 and open the road toward $6,490.