So, the Federal Reserve made a decision that was entirely expected and not at all surprising. The interest rate was lowered by 25 basis points, but this is precisely what the market anticipated. There were far more questions about the central bank's next moves amid a weakening labor market and rising inflation. But, as was easy to predict, there were no specifics from the Fed or from Jerome Powell himself.

Powell's entire speech can be interpreted in any way you like. The Fed chair didn't say "no" to a 50 basis point cut by the end of the year, but he didn't announce one either. The dot plot showed a slightly more "dovish" mood for the coming year, but only marginally so. The overall reduction in rate expectations among FOMC members could simply be a margin of error or reflect a shift of expectations forward by one quarter. So, overall, the Fed's stance hasn't really become more "dovish." It remains "data-dependent."

A "data-dependent" stance means the Fed will continue making decisions based on the state of the labor market and inflation. So, only the next sets of data on these metrics will help form a more or less accurate forecast for the Fed's actions on October 29 and December 10. The market, as usual, interpreted Powell's speech as the most dovish possible, immediately ramping up expectations for a rate cut in October to 85.5%, and in December to 75% (according to the CME FedWatch tool). Simply put, the market is now sure the Fed will carry out two more rounds of monetary policy easing this year.

In my view, however, everything will depend on the economic data. For example, the labor market could start to recover from its summer slump precisely because the fed funds rate was cut in September. The Fed may cut rates again in October, and that will be enough to stabilize Nonfarm Payrolls at least around 100,000 new jobs per month.

We shouldn't forget about inflation, as Powell also reminded us at the press conference. It remains persistently elevated. In the view of Fed officials, inflation could have been much higher under the influence of tariffs, and these tariffs should only put upward pressure on prices for a limited period, which may already be coming to an end. Nevertheless, high inflation will not allow the Fed to lower rates recklessly. Based on the September meeting, I wouldn't rush to draw "dovish" conclusions. And if the markets have indeed become more "dovish," then why is the dollar rising?

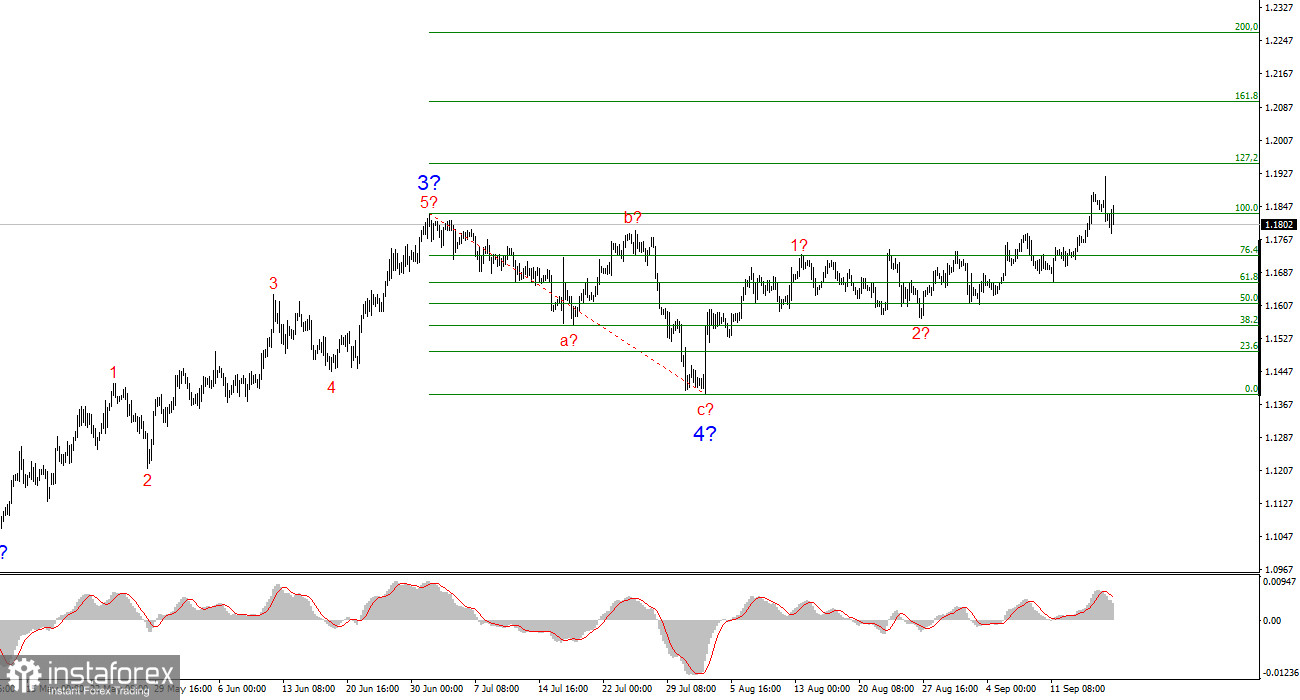

Wave outlook for EUR/USD:

Based on my analysis, I conclude that EUR/USD continues to build an upward segment of the trend. The wave structure remains entirely dependent on news flow, particularly decisions made by Trump and the domestic and foreign policy of the new White House administration. The targets for the current leg of the trend could extend toward the 1.25 area. The news background remains the same, so I'm staying long, despite the first target near 1.1875 (which corresponds to 161.8% Fibonacci) already being worked out. By year-end, I expect the euro to rise to 1.2245, aligning with 200.0% Fibonacci.

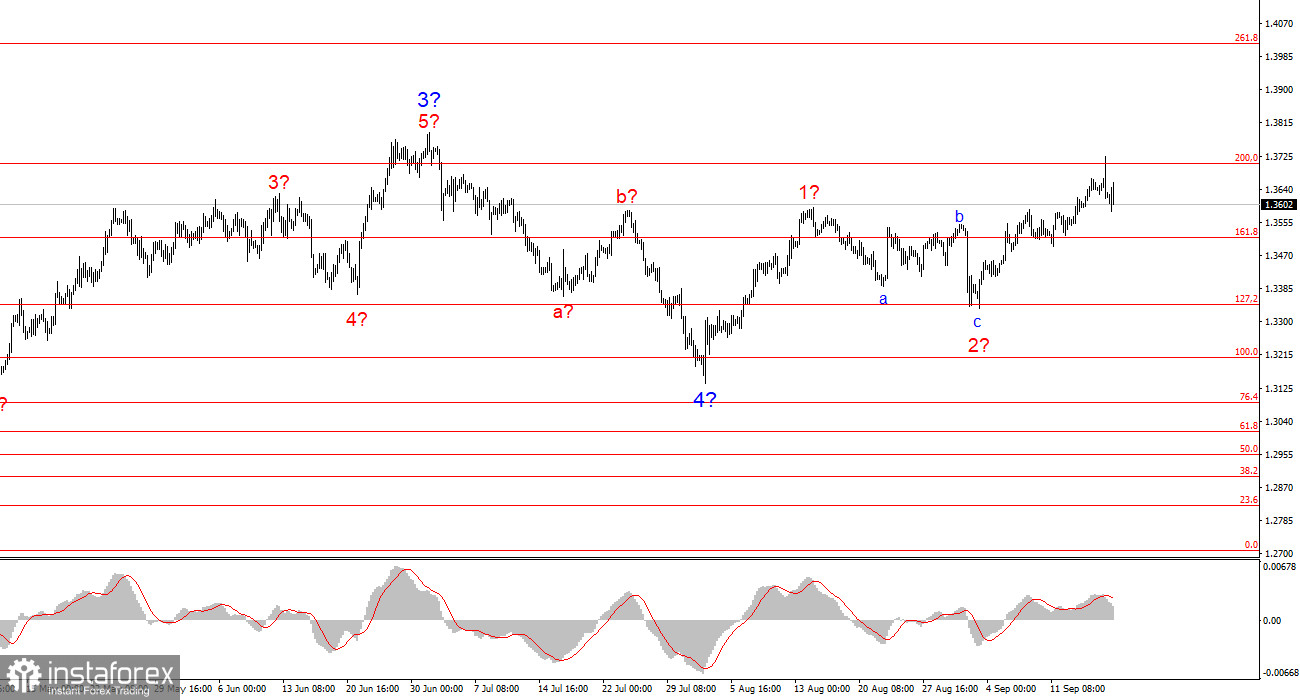

Wave outlook for GBP/USD:

The wave pattern for GBP/USD remains unchanged. We're looking at an upward, impulsive section of the trend. Under Trump, the markets may face plenty more upsets and reversals, which could seriously impact the wave picture, but for now, the working scenario remains intact, and Trump's policy is consistent. The targets for the upward move are around the 261.8% Fibonacci. At this point, I expect the quotes to keep increasing in wave 3 of 5, targeting 1.4017.

Main principles of my analysis:

- Wave structures should be simple and easy to understand. Complex structures are harder to trade and often signal changes.

- If you aren't confident in what's happening on the market, it's better not to enter.

- There can never be 100% certainty about market direction. Always use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.