We discussed the results of the September Fed meeting in the previous review—I recommend reading it. Now it's time to look at Jerome Powell's press conference. The Fed Chair made a few important and interesting remarks.

First, Powell stated that the impact of import tariffs on inflation may be short-lived.

Second, Mr. Powell said that the main blow from the trade war would be felt by companies that stand between exporters and end consumers. Here, I must disagree with the FOMC Chair, since all retailers and manufacturing companies, without exception, always pass additional costs on to end consumers. No business will operate at a loss for long. Ultimately, it's American businesses and consumers who will bear the cost of Trump's tariffs.

Third, Powell admitted he has no idea what shape the U.S. economy will be in three years from now—a thinly veiled reference to the length of Donald Trump's presidential term. You might even take this as a jab at the U.S. President, who, for his part, never hesitates to voice his criticism. With this comment, the Fed Chair seemingly hinted that the economic situation could worsen significantly, and that Trump would bear responsibility.

Fourth, according to Powell, even though the unemployment rate has been rising over the past year, it remains quite low. The economy has gone through many "darker" times and is generally coping well with new challenges.

Fifth, Powell stated that there was no support within the FOMC for a 50 basis point rate cut—conveniently "forgetting" about Stephen Miran's vote. The entire FOMC "welcomed" the new governor, "as is always the case."

Taking all this into account, Powell sent a clear message to the markets: \Miran is considered an "odd man out" by the Committee. Miran can vote for a 2% rate cut if he likes, but all the other governors are still loyal to the Fed's mandate and continue making balanced decisions based on economic data. The Fed still isn't going to rush things or follow a predetermined pace of policy easing. Decisions will be made meeting by meeting, without being tied to previous outcomes.

In my view, the Fed's stance at the September meeting hasn't changed. The increased demand for the U.S. dollar may be short-term and accidental. I don't see any reason for market participants to have changed their attitude towards the dollar from negative to positive last night. Most likely, we'll see another corrective wave on both instruments, followed by a further move upward.

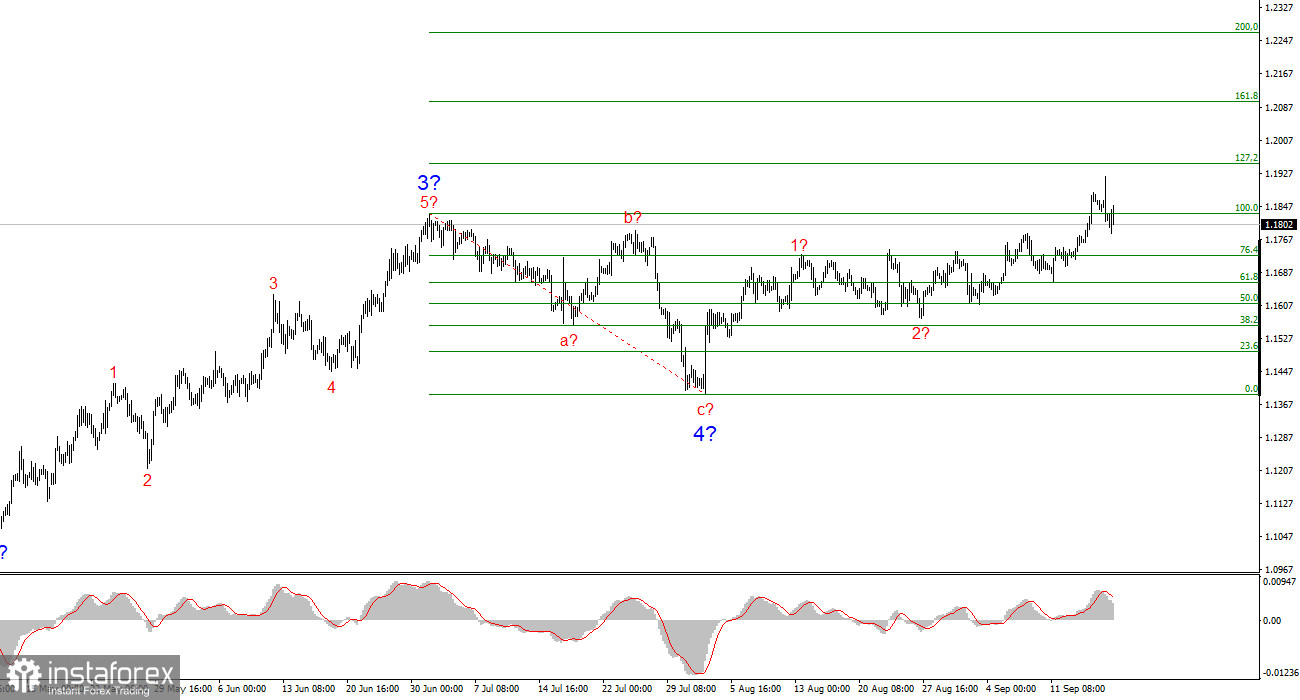

Wave outlook for EUR/USD:

Based on my analysis, I conclude that EUR/USD continues to build an upward segment of the trend. The wave structure remains entirely dependent on news flow, particularly decisions made by Trump and the domestic and foreign policy of the new White House administration. The targets for the current leg of the trend could extend toward the 1.25 area. The news background remains the same, so I'm staying long, despite the first target near 1.1875 (which corresponds to 161.8% Fibonacci) already being worked out. By year-end, I expect the euro to rise to 1.2245, aligning with 200.0% Fibonacci.

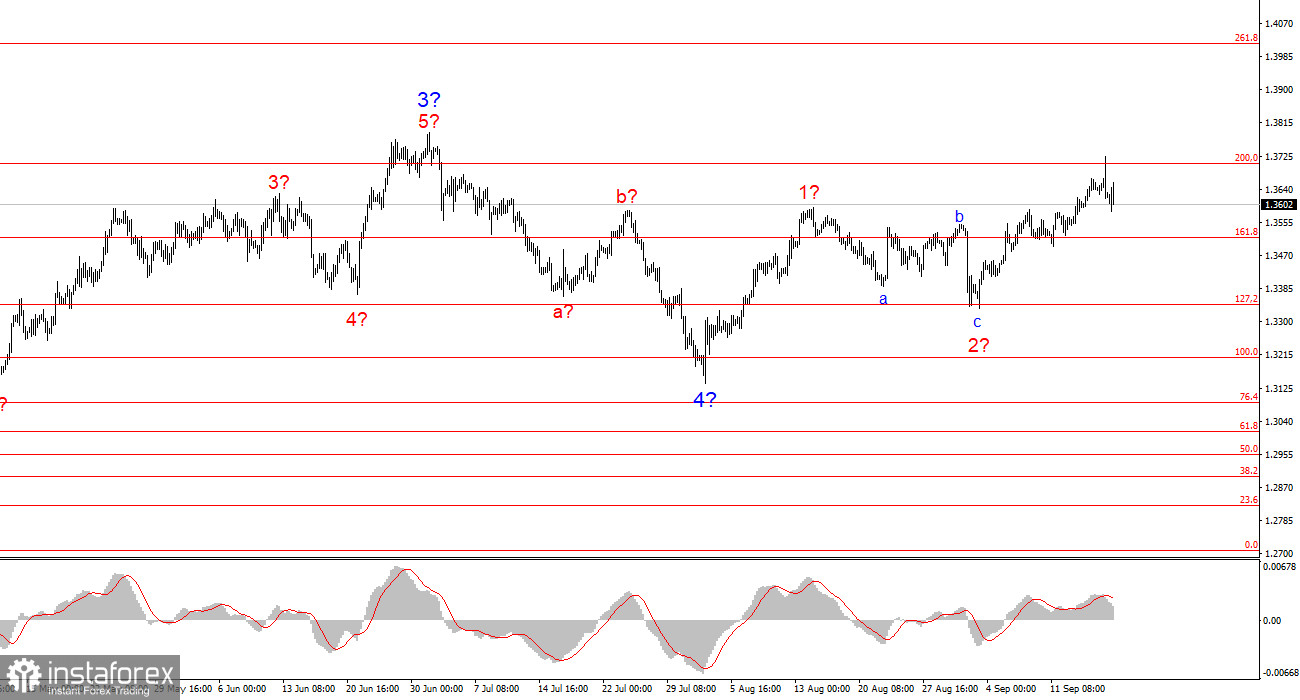

Wave outlook for GBP/USD:

The wave pattern for GBP/USD remains unchanged. We're looking at an upward, impulsive section of the trend. Under Trump, the markets may face plenty more upsets and reversals, which could seriously impact the wave picture, but for now, the working scenario remains intact, and Trump's policy is consistent. The targets for the upward move are around the 261.8% Fibonacci. At this point, I expect the quotes to keep increasing in wave 3 of 5, targeting 1.4017.

Main principles of my analysis:

- Wave structures should be simple and easy to understand. Complex structures are harder to trade and often signal changes.

- If you aren't confident in what's happening on the market, it's better not to enter.

- There can never be 100% certainty about market direction. Always use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.