Today, I tried trading the euro and the Australian dollar using the Mean Reversion strategy. With Momentum, I traded only the British pound, for which important data was released.

News that producer prices in Germany fell more than expected put pressure on the euro. The Producer Price Index declined by 0.5% month-on-month, exceeding analysts' forecasts. This was the most significant drop. The euro reacted to the news by falling against the US dollar and other major currencies. Investors fear that the drop in producer prices may lead the European Central Bank to adopt a more dovish stance, since there is no point in waiting—the economy needs stimulus. The fall in German producer prices is another sign that the European economy is more or less returning to normal after the record price surge of recent years.

The pound also fell against the dollar. The main reason for this decline was an unexpectedly sharp increase in government borrowing, creating serious risks for the country's economic development. The substantial rise in public debt, which turned out to be far above forecast levels, triggered investor concerns. Economists voiced doubts about the authorities' ability to manage finances effectively, which immediately affected the pound's positions. Currency traders, seeking to minimize potential losses, began actively selling the British currency, causing a significant depreciation.

There is no US data scheduled for release in the second half of the day, only a speech by FOMC member Mary Daly. However, the potential impact of this event should not be underestimated. Markets will closely monitor her rhetoric, looking for hints about the Fed's future policy. Comments on inflation trends and the outlook for further rate cuts will be particularly relevant. Any statements pointing to a more dovish stance could trigger dollar weakness.

In case of strong data, I will rely on the Momentum strategy. If there is no market reaction to the data, I will continue to use the Mean Reversion strategy.

Momentum strategy (breakout) for the second half of the day:

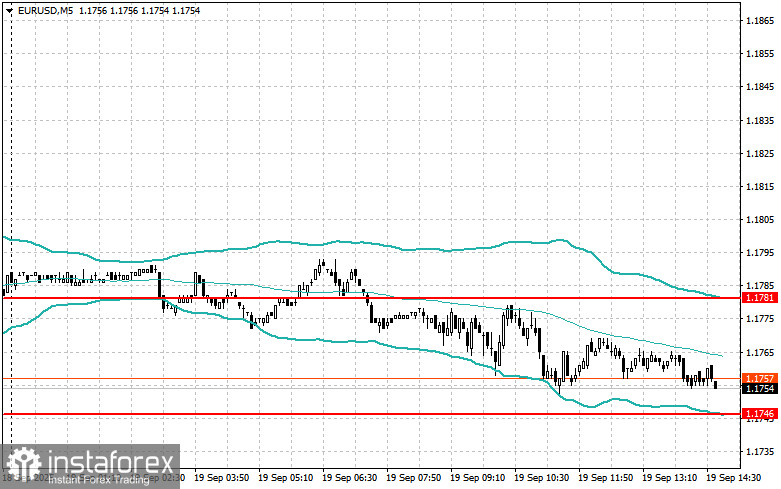

For EUR/USD

- Buying on a breakout of 1.1767 may lead to growth toward 1.1806 and 1.1847;

- Selling on a breakout of 1.1735 may lead to a decline toward 1.1700 and 1.1660.

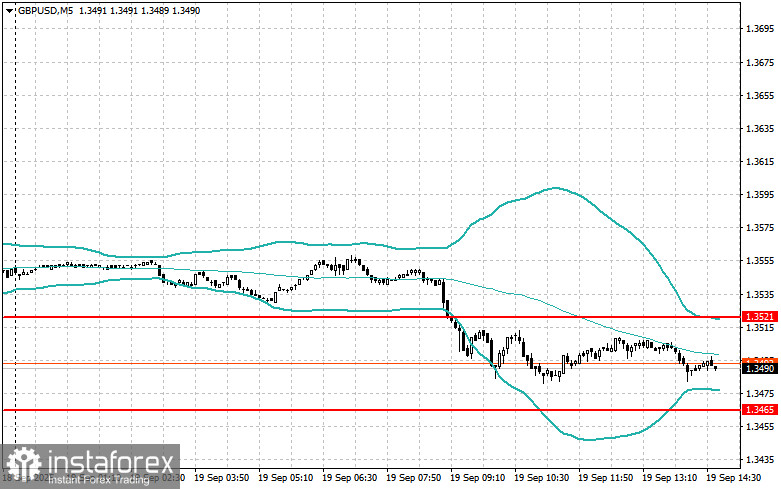

For GBP/USD

- Buying on a breakout of 1.3510 may lead to growth toward 1.3555 and 1.3605;

- Selling on a breakout of 1.3475 may lead to a decline toward 1.3445 and 1.3420.

For USD/JPY

- Buying on a breakout of 148.35 may lead to growth toward 148.75 and 149.05;

- Selling on a breakout of 147.85 may lead to declines toward 146.70 and 146.31.

Mean Reversion strategy (pullback) for the second half of the day:

For EUR/USD

- I will look for sales after a failed breakout above 1.1781 and a return below this level;

- I will look for purchases after a failed breakout below 1.1746 and a return to this level.

For GBP/USD

- I will look for sales after a failed breakout above 1.3521 and a return below this level;

- I will look for purchases after a failed breakout below 1.3465 and a return to this level.

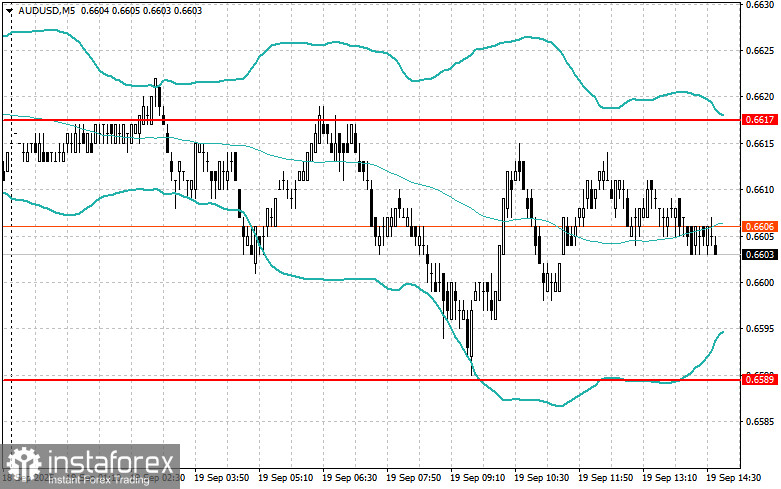

For AUD/USD

- I will look for sales after a failed breakout above 0.6617 and a return below this level;

- I will look for purchases after a failed breakout below 0.6589 and a return to this level.

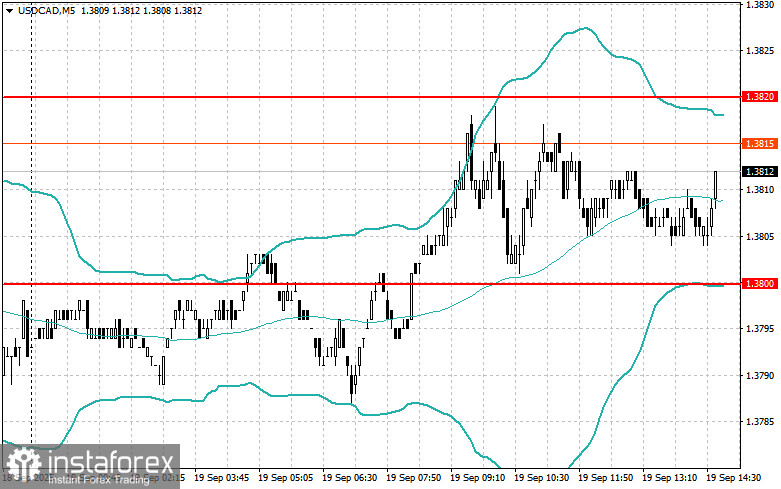

For USD/CAD

- I will look for sales after a failed breakout above 1.3820 and a return below this level;

- I will look for purchases after a failed breakout below 1.3800 and a return to this level.