Trade analysis and tips on trading the euro

The test of the 1.1783 price occurred when the MACD indicator had already moved far below the zero mark, which limited the pair's downward potential. For this reason, I did not sell the euro. I also did not get any other entry points into the market.

The German IFO expectations index showed a decline. The contraction in IFO indicators clearly points to growing concern within Germany's business community. The euro reacted immediately. Investors responded to the disappointing figures by reducing trading volumes in the single currency, which led to its depreciation against the U.S. dollar and other major currencies. However, the IFO index decline is just a single indicator, and other factors affecting Germany's economy must also be taken into account.

Today, during the U.S. trading session, the release of key data on new home sales and a speech by FOMC member Mary Daly are expected. The state of the primary housing market is an important barometer of the overall economy. Higher sales indicate buyer optimism and willingness to take on long-term financial commitments. Lower sales, on the other hand, may signal economic problems, rising interest rates, or fears of job losses. In light of current high inflation and measures undertaken by the Federal Reserve, housing data will help assess the effectiveness of the Fed's actions and their impact on economic development.

The speech by FOMC member Mary Daly will also be closely monitored by market participants. The FOMC plays a decisive role in shaping U.S. monetary policy. Daly's remarks on the current economic situation, inflation, and prospects for rate changes may influence investor sentiment.

As for intraday strategy, I will rely mainly on Scenarios No. 1 and No. 2.

Buy signal

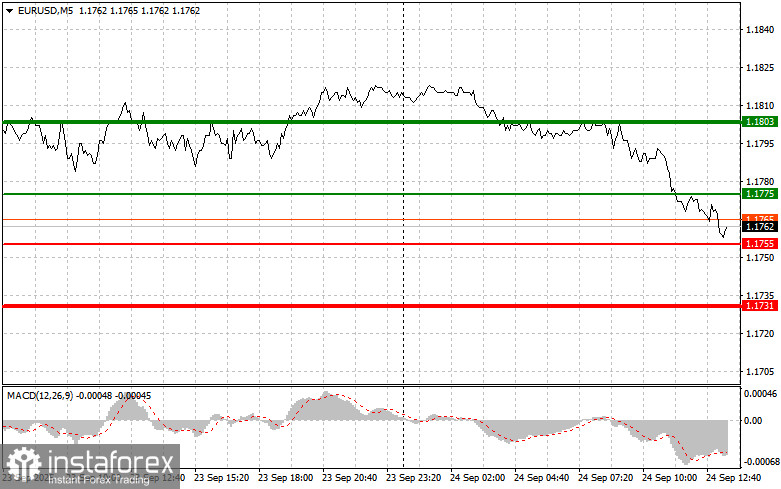

Scenario No. 1: Today, I plan to buy the euro at an entry price around 1.1775 (green line on the chart), targeting 1.1803. At 1.1803, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30–35 point move from the entry point. Counting on euro growth will only be possible after dovish comments from policymakers. Important! Before buying, make sure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario No. 2: I also plan to buy the euro today in the case of two consecutive tests of 1.1755 when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal upward. Growth can be expected toward the opposite levels of 1.1775 and 1.1803.

Sell signal

Scenario No. 1: I plan to sell the euro after it reaches 1.1755 (red line on the chart). The target will be 1.1731, where I intend to exit the market and immediately open long positions in the opposite direction (aiming for a 20–25 point reversal from the level). Pressure on the pair will return today in case of strong U.S. data. Important! Before selling, make sure the MACD indicator is below the zero mark and just starting to decline from it.

Scenario No. 2: I also plan to sell the euro today in the case of two consecutive tests of 1.1775 when the MACD indicator is in the overbought area. This will limit the pair's upward potential and trigger a reversal downward. A decline can be expected toward the opposite levels of 1.1755 and 1.1731.

What's on the chart:

- Thin green line – entry price for buying the instrument;

- Thick green line – estimated price for setting Take Profit or fixing profit manually, as further growth above this level is unlikely;

- Thin red line – entry price for selling the instrument;

- Thick red line – estimated price for setting Take Profit or fixing profit manually, as further decline below this level is unlikely;

- MACD indicator. When entering the market, it is important to use overbought and oversold zones as guidance.

Important: Beginner forex traders must be very cautious when making entry decisions. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp swings in price. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you ignore money management and trade with large volumes.

And remember, successful trading requires a clear trading plan, like the one I have outlined above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.