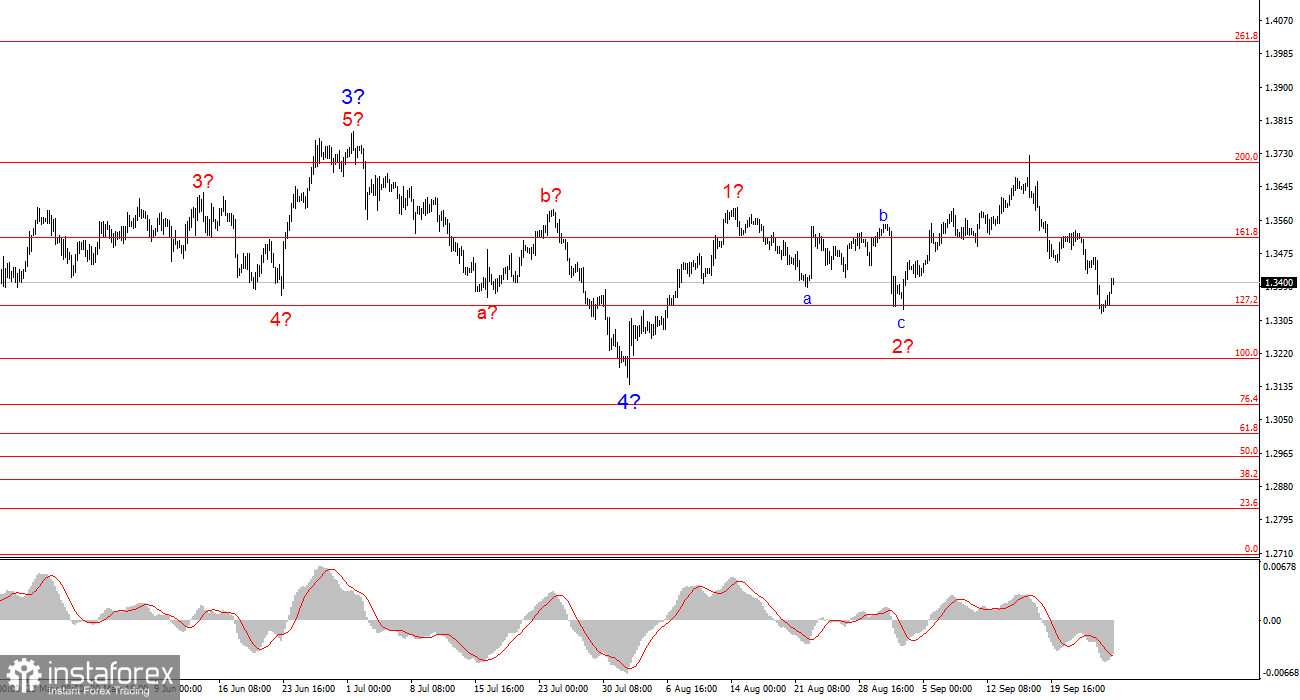

The British pound lost more than the euro over the past week, so its wave pattern now looks ambiguous. Recall that complex wave structures have one major drawback – they are extremely difficult to identify in the early stages of formation. Simply put, if the structure is not classical, it is almost impossible to understand what it represents at the beginning. In my analysis, I avoid working with non-standard structures because, as practice shows, such an approach has a low profitability ratio. Therefore, at the moment, the pound is unattractive for opening positions.

I rely on the euro's wave pattern. Its supposed waves 2 and 4 in wave 5 both took on a nearly identical three-wave form. Consequently, it can be assumed that the construction of wave 4 in wave 5 has been completed. If this is the case, the euro will resume its upward movement, and the pound sterling will follow. For me, the most significant level is now 1.3341. Two failed attempts to break it may lead to the formation of a new upward wave in GBP/USD.

The upcoming news background in the United Kingdom will be rather limited, with the most interesting reports already released. Nevertheless, on Tuesday the final Q2 GDP report will be published. Growth in the UK economy is expected at 0.3%, though the actual figure may come in lower. Final September business activity indices will also be released. In my view, even the data on the placement of government bonds (given recent problems with yields and the budget) may carry greater weight for the market.

Even more significant, however, will be the U.S. news background. The pound has already priced in all its negative domestic factors, and now it is time for U.S. economic data, of which there will be plenty next week. In my opinion, the pound may resume forming an upward section of the trend despite its sharp decline and the disruption of the wave pattern.

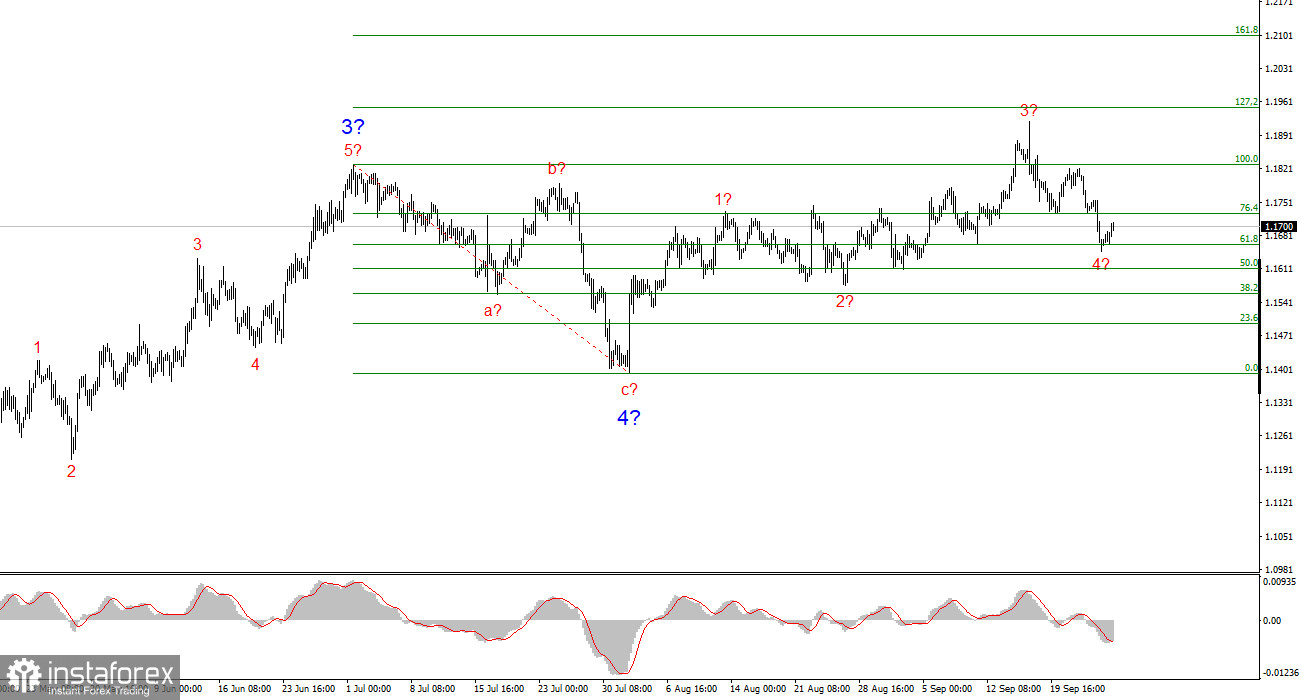

EUR/USD Wave Pattern:

Based on my analysis of EUR/USD, I conclude that the instrument continues to build an upward section of the trend. The wave pattern still depends entirely on the news background tied to Trump's decisions, as well as the domestic and foreign policy of the new White House administration. The targets of the current trend section may extend as far as the 1.25 area. At present, the instrument is declining within corrective wave 4, while the overall upward wave structure remains valid. Accordingly, I am considering only long positions in the near term. By year-end, I expect the euro to rise to 1.2245, which corresponds to 200.0% on the Fibonacci scale.

GBP/USD Wave Pattern:

The wave structure of GBP/USD has undergone a change in shape. We are still dealing with an upward impulsive section of the trend, but its internal wave pattern is becoming less readable. If wave 4 assumes a complex three-wave form, the structure will normalize; however, even in this case, wave four will be several times more complicated and extended than wave 2. In my opinion, it is best to work from the 1.3341 level, which corresponds to 127.2% of the Fibonacci. Two failed attempts to break this level may indicate the market's readiness for new buying.

My Core Principles of Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often shift.

- If there is no confidence in market developments, it is better not to enter.

- One can never have 100% certainty about market direction. Always use protective Stop Loss orders.

- Elliott Wave analysis can be combined with other forms of analysis and trading strategies.