The upcoming week will be very important for the U.S. dollar. The currency will attempt to hold its ground, but it will be difficult to withstand the pressure from market participants. Most economists expect further weakening of the dollar, driven by instability in the U.S. economy, the threat of rising inflation, the dovish stance of the Federal Reserve, and Donald Trump's influence on the Fed. Therefore, the period of calm for the dollar has not yet arrived. Individual events in the U.K. or the Eurozone may put pressure on the euro and the pound, allowing the dollar to strengthen from time to time. However, the situation in the United States is of far greater concern to investors.

The new week will bring plenty of noteworthy events in the U.S. I will not list all the speeches of FOMC members – there will be more than 10 of them. Recall that only three members of the Committee hold an openly dovish stance, and just one policymaker is prepared to cut rates by 50 basis points at every meeting. Their votes can still be disregarded for now, since the majority of FOMC members evaluate the U.S. economy more realistically and keep both mandates of the Fed in mind.

Even without the FOMC speeches, there will be no shortage of news. On Tuesday, the JOLTS report on job openings for August will be released. Job openings fell steadily in June and July, and the trend may have continued in August. On Wednesday, the ADP employment report will be published, already posing potential problems for the dollar. That same day, the ISM Manufacturing PMI will be released, which will likely remain below the critical 50.0 level. On Friday, the Nonfarm Payrolls report, the unemployment rate, and the ISM Services PMI will be published. The services index is expected to remain above 50.0, unemployment could stay at 4.3%, but payrolls are once again forecast to be extremely weak – only 40,000 new jobs. For reference, at least 100,000 jobs per month are needed to maintain a stable labor market.

Given all of the above, the dollar may face new problems. However, it is important not to judge U.S. indicators by forecasts alone. Forecasts are only approximate values. The actual data could be entirely different.

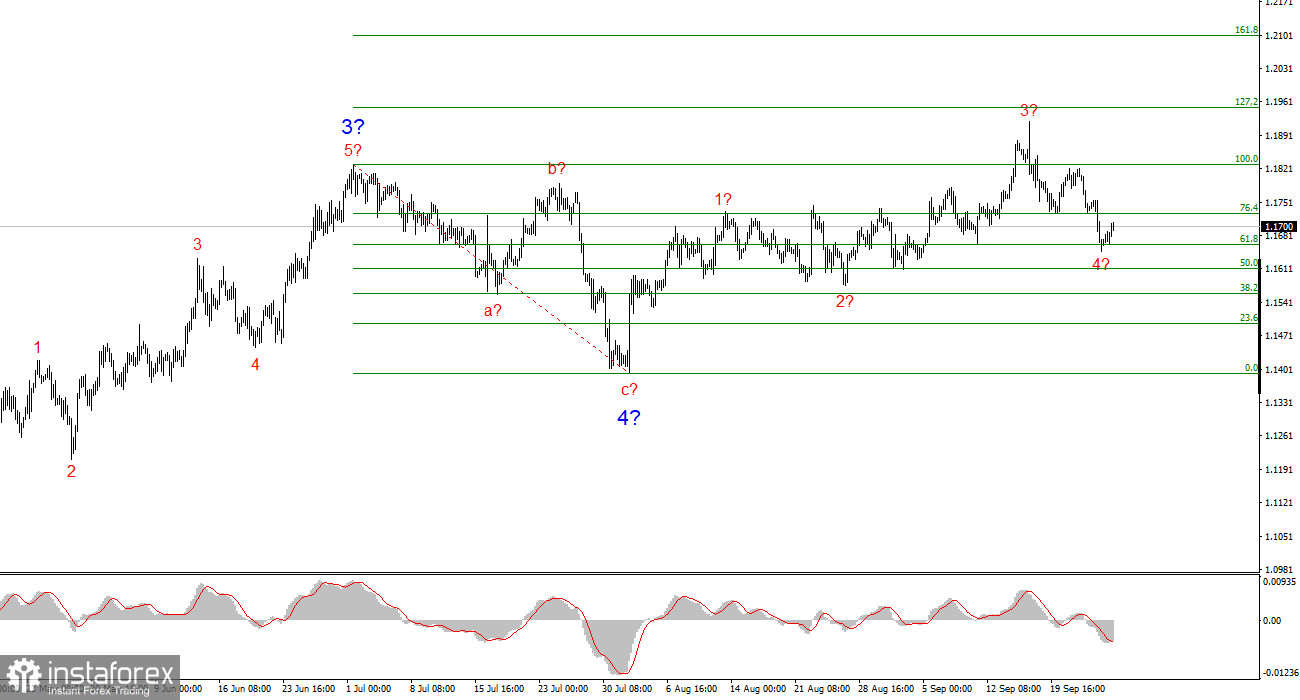

EUR/USD Wave Pattern:

Based on my analysis of EUR/USD, I conclude that the instrument continues to build an upward section of the trend. The wave pattern still depends entirely on the news background tied to Trump's decisions, as well as the domestic and foreign policy of the new White House administration. The targets of the current trend section may extend as far as the 1.25 area. At present, the instrument is declining within corrective wave 4, while the overall upward wave structure remains valid. Accordingly, I am considering only long positions in the near term. By year-end, I expect the euro to rise to 1.2245, which corresponds to 200.0% on the Fibonacci scale.

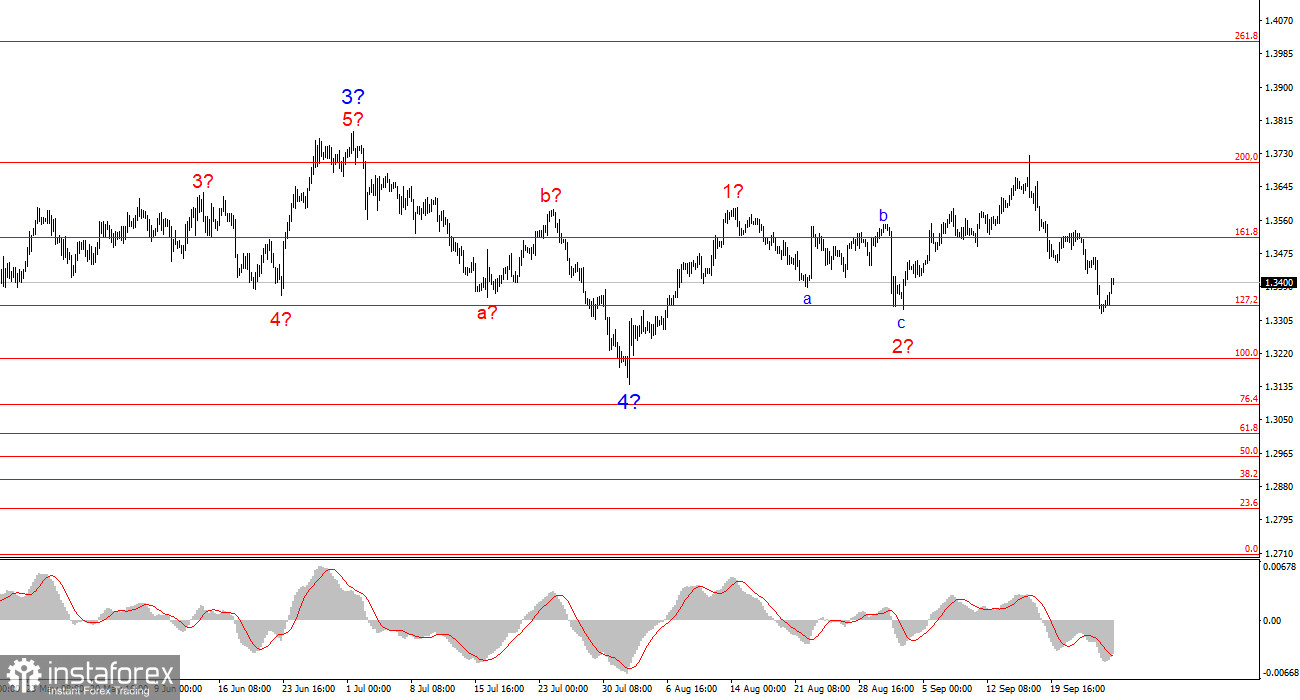

GBP/USD Wave Pattern:

The wave structure of GBP/USD has undergone a change in shape. We are still dealing with an upward impulsive section of the trend, but its internal wave pattern is becoming less readable. If wave 4 assumes a complex three-wave form, the structure will normalize; however, even in this case, wave four will be several times more complicated and extended than wave 2. In my opinion, it is best to work from the 1.3341 level, which corresponds to 127.2% of the Fibonacci. Two failed attempts to break this level may indicate the market's readiness for new buying.

My Core Principles of Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often shift.

- If there is no confidence in market developments, it is better not to enter.

- One can never have 100% certainty about market direction. Always use protective Stop Loss orders.

- Elliott Wave analysis can be combined with other forms of analysis and trading strategies.