The U.S. dollar continued to lose ground rapidly against risk assets at the start of the week, with objective reasons for this decline.

The likelihood of a government shutdown increased further after yesterday's meeting between Democrats and Republicans with Trump. Traders are concerned about how political uncertainty may impact the U.S. economy and are seeking safer assets, which is putting pressure on the dollar. The situation is aggravated by the approaching deadline for passing the budget for the new fiscal year. If Congress fails to reach a compromise, government agencies will be forced to suspend their operations. This would lead to a reduction in public services, slower economic growth, and heightened chaos in financial markets. A prolonged shutdown could have serious consequences for the dollar, as it would undermine confidence in the U.S. economy and increase the risk of a downgrade to the U.S. credit rating.

As for statistics, today's releases include Germany's unemployment change, unemployment rate, retail sales, and consumer price index. European Central Bank President Christine Lagarde's speech will also attract attention. Traders are particularly interested in Germany's labor market data. Any deviations from expectations could trigger significant market volatility, particularly affecting the euro. A decline in unemployment and stability in the unemployment rate would signal economic strength and support the single currency. As for retail sales, the focus is on momentum: an increase points to consumer confidence and a healthy economy. Inflation, measured by the consumer price index, is also a key indicator monitored by the ECB. Accelerating inflation could prompt the ECB to adopt tighter monetary policy, which in turn could strengthen the euro.

In the UK, today's focus will be on weak Q2 GDP data, along with a speech from MPC member Catherine L. Mann. Markets are closely watching the UK's economic indicators, which could have a notable impact on the pound. The expected weak GDP recovery, combined with an anticipated negative current account balance, will put pressure on the British currency.

If the data matches economists' forecasts, it is preferable to use the Mean Reversion strategy. If the data is significantly higher or lower than expected, the Momentum strategy will be more effective.

Momentum Strategy (Breakout):

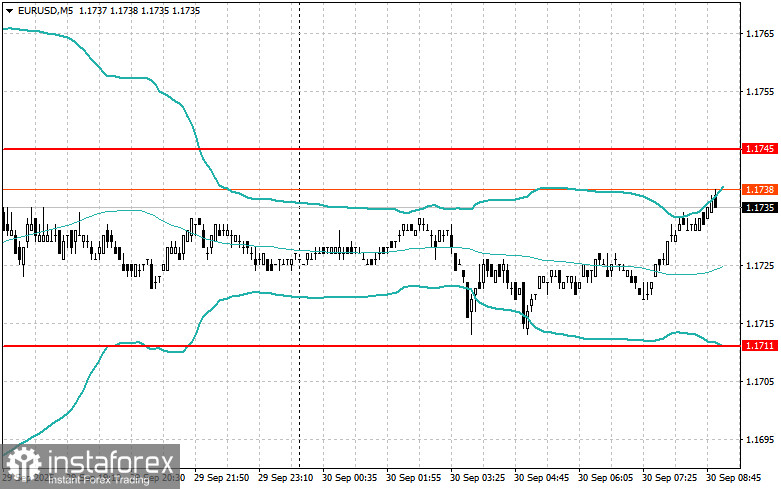

EUR/USD

Buying on a breakout above 1.1750 may lead to growth toward 1.1785 and 1.1800.

Selling on a breakout below 1.1725 may lead to a decline toward 1.1700 and 1.1670.

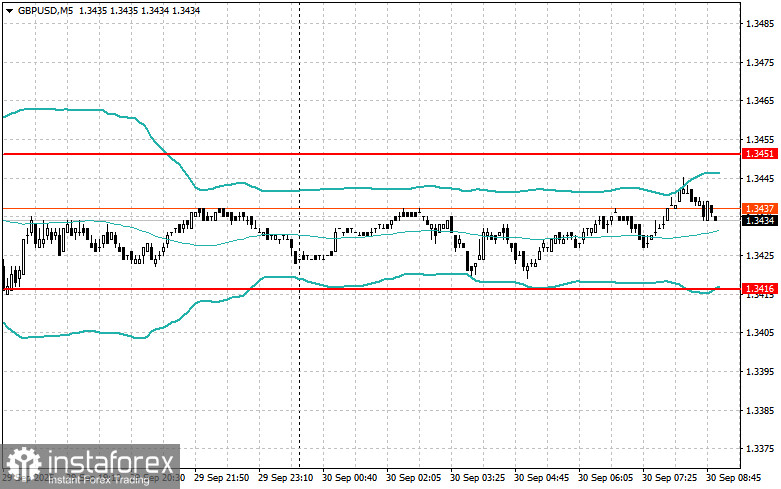

GBP/USD

Buying on a breakout above 1.3450 may lead to growth toward 1.3470 and 1.3499.

Selling on a breakout below 1.3430 may lead to a decline toward 1.3405 and 1.3370.

USD/JPY

Buying on a breakout above 148.30 may lead to growth toward 148.66 and 149.00.

Selling on a breakout below 148.15 may trigger a decline toward 147.60 and 147.30.

Mean Reversion Strategy (Pullbacks):

EUR/USD

Look for selling opportunities after a failed breakout above 1.1745 with a return below this level.

Look for buying opportunities after a failed breakout below 1.1711 with a return above this level.

GBP/USD

Look for selling opportunities after a failed breakout above 1.3451 with a return below this level.

Look for buying opportunities after a failed breakout below 1.3416 with a return above this level.

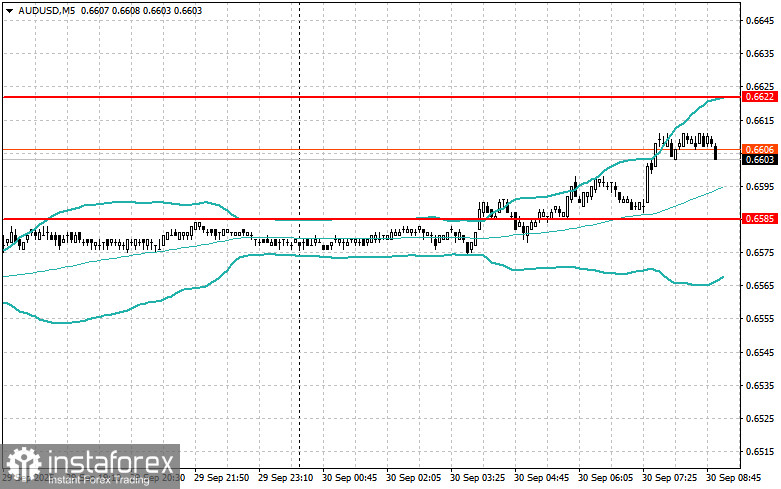

AUD/USD

Look for selling opportunities after a failed breakout above 0.6622 with a return below this level.

Look for buying opportunities after a failed breakout below 0.6585 with a return above this level.

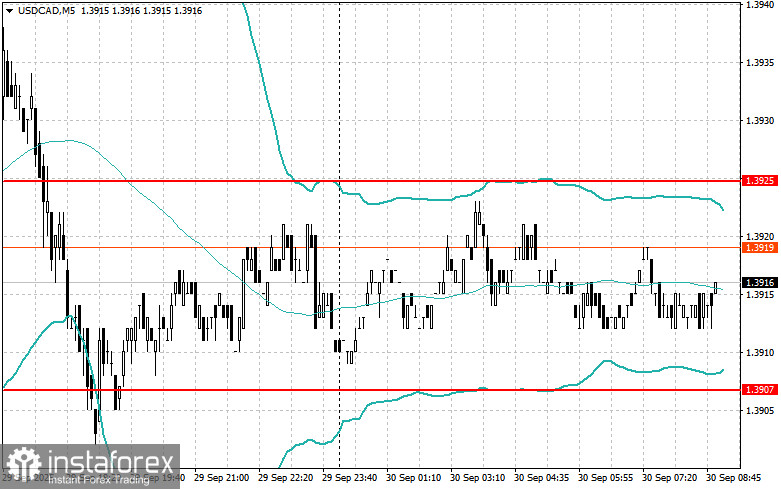

USD/CAD

Look for selling opportunities after a failed breakout above 1.3925 with a return below this level.

Look for buying opportunities after a failed breakout below 1.3907 with a return above this level.