Trade Review and Advice on Trading the British Pound

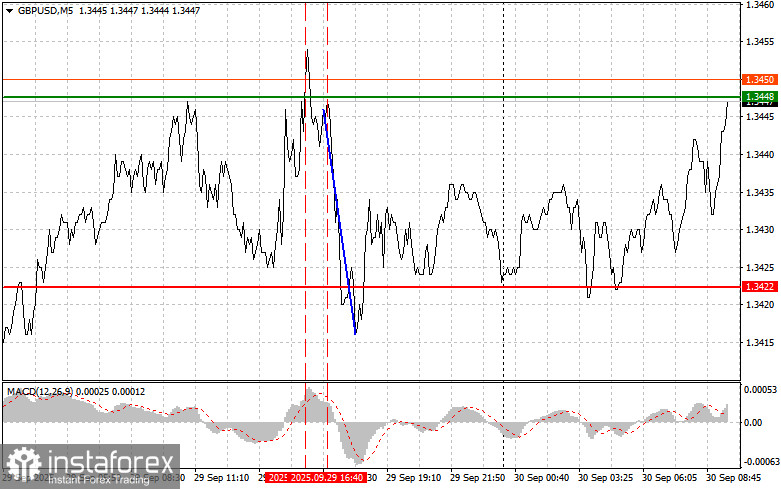

The test of the 1.3448 price level occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upside potential. For this reason, I decided not to buy the pound. A second test of the same level coincided with the MACD being in the overbought zone, which validated sell Scenario #2, resulting in a 30-pip drop.

The absence of consensus among U.S. politicians due to major ideological differences negatively impacted the value of the U.S. dollar yesterday, leading to a modest strengthening of the British pound. Investors are increasingly concerned about the potential consequences of political instability on the overall economic stability of the United States. If Congress fails to reach an agreement, government agencies will be forced to suspend operations. A prolonged government shutdown could have severe consequences for the dollar, undermining trust in the U.S. economy and increasing the likelihood of a credit rating downgrade.

However, in the first half of the day, traders will closely monitor the release of key economic indicators from the UK. Of particular focus are the UK's Q2 GDP growth rate, the current account balance, and speeches from several Bank of England officials. Weak GDP figures could reinforce concerns about a slowing British economy, which would likely reduce investor interest in the pound. A negative current account reading—indicating that imports exceed exports—would further highlight structural weaknesses in the UK's economy. Additionally, speeches by members of the Bank of England's Monetary Policy Committee, especially Catherine L. Mann, could have a significant impact. Her comments on the economic outlook and future monetary policy could shift investor sentiment. Should she express concern about inflation or suggest maintaining high interest rates, it would likely support the pound.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

Buy Scenario

Scenario No. 1: I plan to buy the pound today upon reaching an entry point near 1.3455 (green line on the chart), targeting a rise to the 1.3480 level (thicker green line on the chart). Around 1.3480, I intend to exit buy trades and open sell trades in the opposite direction, expecting a move of 30–35 pips downward from the current level. Pound strength can be expected to continue today if strong UK data is released. Important! Before buying, ensure the MACD indicator is above the zero line and is just starting to rise from it.

Scenario No. 2: I also plan to buy the pound today in the case of two consecutive tests of the 1.3430 level when the MACD indicator is in the oversold zone. This would limit the downside potential of the pair and lead to a market reversal to the upside. A rise toward the opposite targets of 1.3455 and 1.3480 can be expected.

Sell Scenario

Scenario No. 1: I plan to sell the pound today after a breakout of the 1.3430 level (red line on the chart), which could trigger a rapid decline in the pair. The main target for sellers will be 1.3396, where I plan to exit shorts and open a buy trade in the opposite direction, expecting a 20–25 pip rebound from that level. Pound sellers may show up at any moment. Important! Before selling, ensure the MACD indicator is below the zero line and just starting to fall from it.

Scenario No. 2: I also plan to sell the pound today if there are two consecutive tests of the 1.3455 level while the MACD is in the overbought area. This will limit the pair's upward potential and could trigger a reversal to the downside. A decline toward the 1.3430 and 1.3396 levels can be expected.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.