Trade Review and Advice on Trading the Japanese Yen

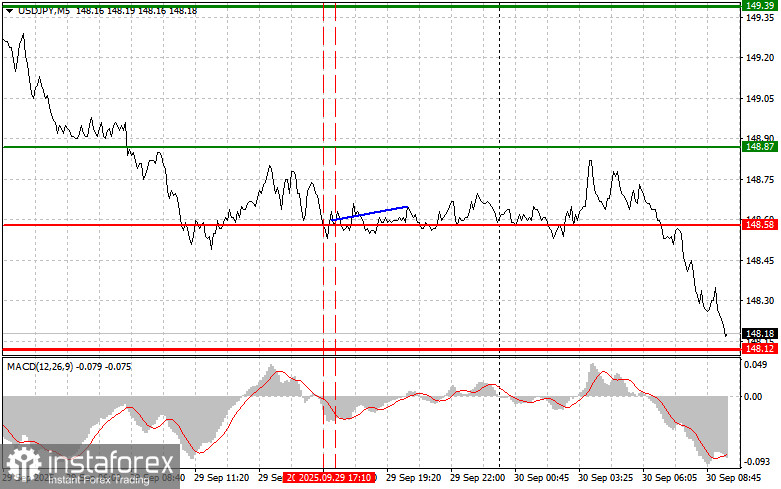

The test of the 148.58 price level occurred at a time when the MACD indicator had already moved well below the zero line. This limited the pair's downside potential, and as a result, I chose not to sell the dollar. The second test of the same level occurred while the MACD was in oversold territory, which triggered the implementation of Scenario #2 (Buy). However, this did not result in a significant upward move for the pair.

A U.S. government shutdown has become even more probable following yesterday's meeting between Democrats and Republicans. The failure to reach an agreement weakened the dollar and strengthened the yen. The potential economic consequences of a government shutdown have raised serious concerns across global financial markets. Investors, wary of the growing unpredictability of the political situation in Washington, are showing caution, which directly affects the position of the U.S. currency. The strengthening of the yen—a traditional "safe haven" asset—reflects the markets' shift toward safety amid rising uncertainty.

Today's sharp 1.2% decline in Japanese industrial production had no noticeable impact on the yen, which continues to enjoy steady demand. This phenomenon is particularly evident during periods of heightened geopolitical tension or concerns about slowing global economic growth.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

Buy Scenario

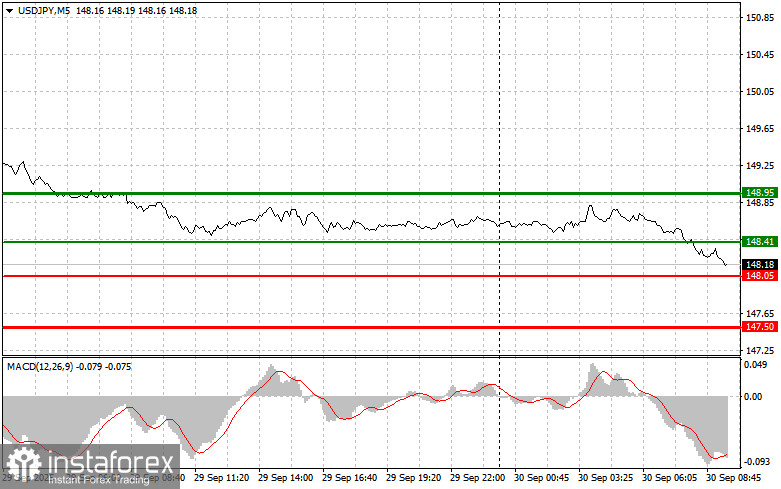

Scenario No. 1: Today, I plan to buy USD/JPY upon reaching the entry level around 148.41 (green line on the chart) with the target set at 148.95 (thicker green line on the chart). Around the 148.95 level, I plan to exit long positions and initiate short positions in the opposite direction, expecting a pullback of around 30–35 pips. It's best to buy the pair on corrections and deep price dips. Important! Before buying, ensure the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario No. 2: I also plan to buy USD/JPY today in the case of two consecutive tests of the 148.05 price level while the MACD is in the oversold zone. This would signal limited downside potential and a likely reversal back to the upside. A move toward the 148.41 and 148.95 resistance levels can be expected.

Sell Scenario

Scenario No. 1: I plan to sell USD/JPY today only after the 148.05 level (red line on the chart) is broken, which could trigger a sharp decline. The key target for sellers will be at the 147.50 level, where I plan to exit short positions and immediately open long positions in the opposite direction, expecting a rebound of 20–25 pips from that level. It is better to sell from higher levels whenever possible. Important! Before selling, ensure the MACD indicator is below the zero line and is just beginning to fall from it.

Scenario No. 2: I also plan to sell USD/JPY in the event of two consecutive tests of the 148.41 level while the MACD is in the overbought area. This will limit the pair's upward potential and likely lead to a downward reversal. A decline toward the 148.05 and 147.50 support levels may follow.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.