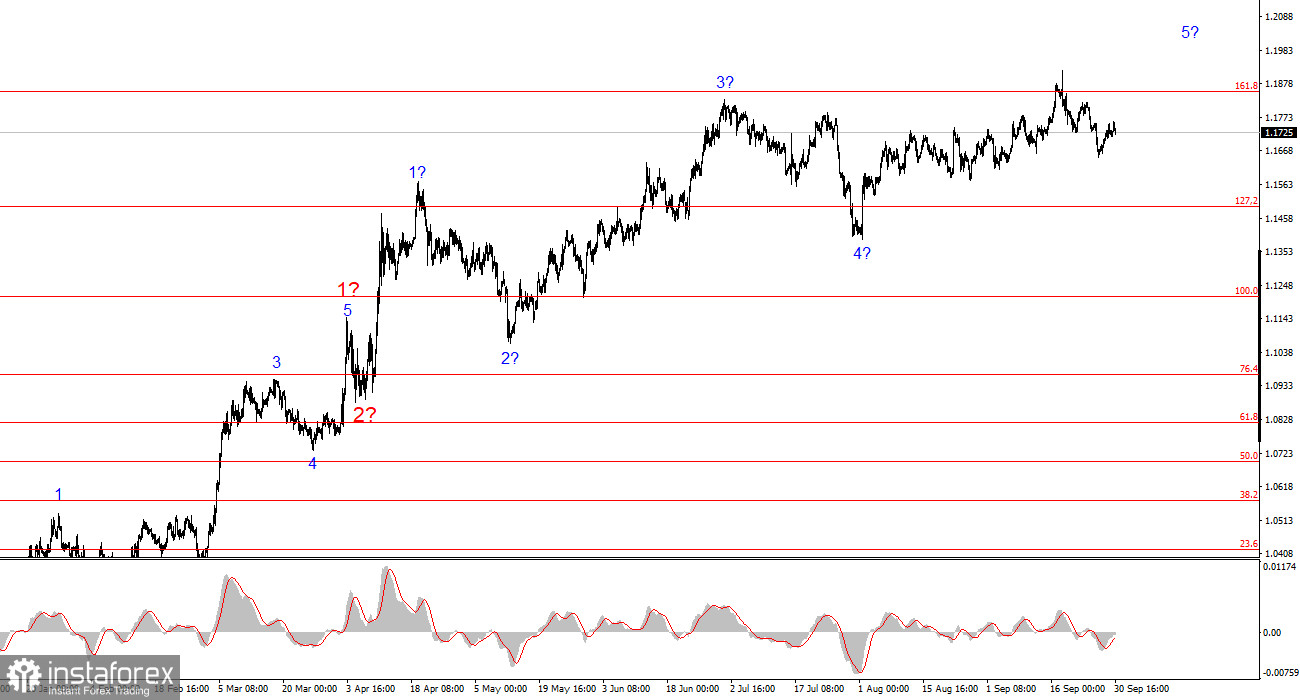

The wave structure on the 4-hour chart for EUR/USD has not changed for several months, but in recent days it has started to look more complicated. It is still too early to conclude that the upward section of the trend is canceled, but further complication of the wave pattern is quite possible.

The upward section of the trend continues to form, and the news background continues to support mostly not the dollar. The trade war launched by Donald Trump continues. Confrontation with the Fed continues. The market's dovish expectations for the Fed rate are growing. Market participants rate the results of Trump's first six to seven months in office very poorly, even though economic growth in Q2 was almost 4%.

At this point, it can be assumed that impulse wave 5 continues to form, with targets potentially extending up to the 1.25 level. Within this wave, the internal structure is complex and ambiguous, but its larger scale does not raise major questions. Currently, three upward waves are visible, which suggests that the instrument is building wave 4 of 5, which is taking the form of a three-wave correction and may already be complete. A stronger decline in quotes would require adjustments to the current wave count.

The EUR/USD rate barely changed on Tuesday, although in the first half of the day the market increased demand for the European currency. I cannot say this was related to economic data, even though there was plenty released today — and not all of it yet. From Germany alone, four important indicators were published. Retail sales fell by 0.2% month-on-month in August against higher forecasts. The unemployment rate remained unchanged at 6.3%. The number of unemployed in September rose by 14,000 compared with market expectations of +7,000. Inflation reached 2.4% in September.

Traders could interpret this data in either direction. Two of the four reports came in weaker than expected, but the most important ones — unemployment and inflation — showed solid results. Unemployment did not rise, while inflation increased. What is good about higher inflation? It means the ECB will maintain a neutral stance in the near future and certainly will not be considering new monetary easing. Recall that the ECB has carried out eight rounds of rate cuts. Since inflation has been rising in recent months, another round is currently off the table. And if inflation keeps rising, monetary policy tightening is even possible, which would undoubtedly be very favorable for the euro. At the same time, the Fed is almost guaranteed to continue easing.

General conclusions

Based on the EUR/USD analysis, I conclude that the pair continues building an upward section of the trend. The wave pattern still depends entirely on the news background, tied to Trump's decisions and the foreign and domestic policies of the new White House administration. Targets for the current trend section may reach the 1.25 level. At the moment, a corrective wave 4 is forming, which may already be complete. The upward wave structure remains valid. Therefore, in the near term I consider only buying opportunities. By year-end, I expect the euro to rise to 1.2245, corresponding to 200.0% on Fibonacci.

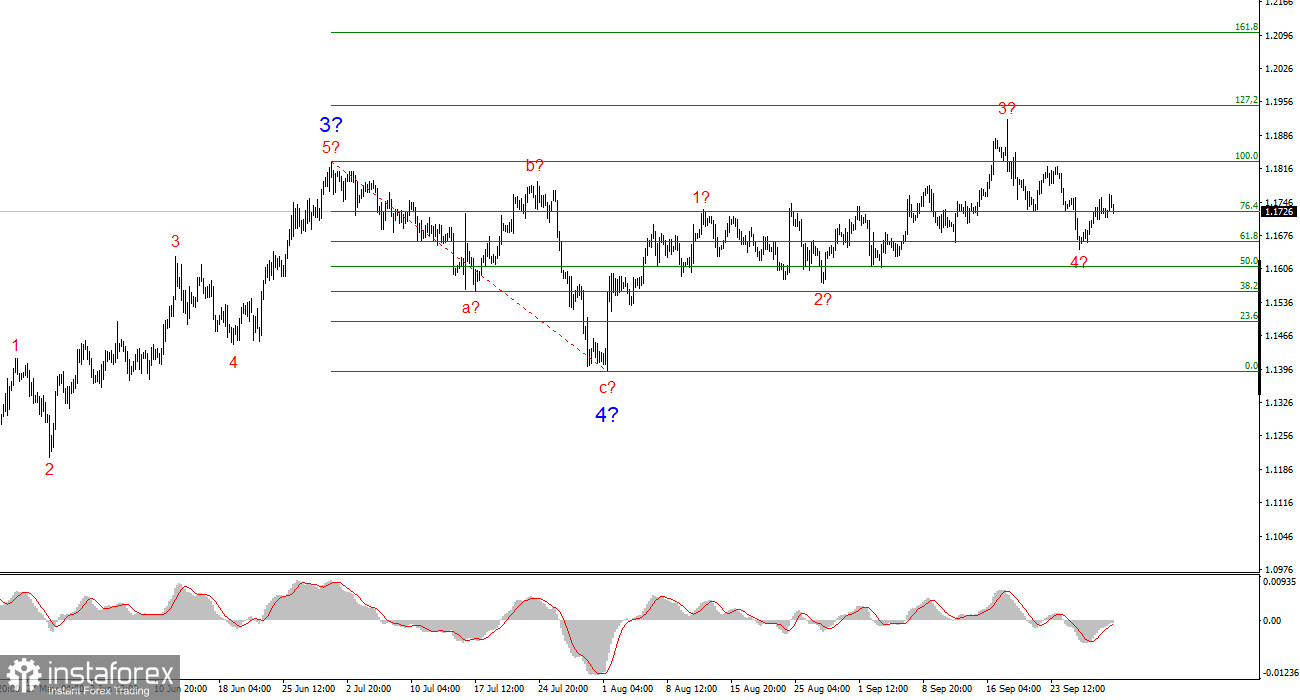

On a smaller scale, the entire upward section of the trend is visible. The wave structure is not the most standard, as corrective waves differ in size. For example, the larger wave 2 is smaller than the internal wave 2 of 3. However, this also happens. I remind you that it is best to isolate clear structures on charts rather than trying to account for every wave. Currently, the upward structure raises almost no questions.

Key principles of my analysis:

- Wave structures should be simple and clear. Complex structures are hard to trade and often require adjustments.

- If there is no confidence in what is happening on the market, it is better to stay out.

- Absolute certainty about market direction does not and cannot exist. Always use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.