Since everything Trump does is "Great," the shutdown will likely be Great as well — albeit with a negative side. This time, Trump has decided not to simply send federal workers home while he and his team attempt to negotiate with the Democrats. Instead, he's opted for a more dramatic move: to fire government employees — and blame the Democrats for it. It may look and sound absurd, but let's not forget that Trump is a gambler. And gamblers love to bluff. I believe this is just that — a bluff — and no one is actually going to be fired. However, Trump will play this card as a trump (no pun intended) in his standoff with the Democrats.

Without a doubt, he will announce loudly to the nation that he is working tirelessly toward a Great Future for America, while the Democrats are putting up roadblocks by refusing to approve the 2026 budget along with the passage of "one big and beautiful law." It's worth remembering that this very law includes major cuts to healthcare and welfare programs for the economically disadvantaged. If the shutdown begins tomorrow, Trump won't miss the opportunity to proclaim that he was "forced" to fire government employees — and to blame the Democrats for it.

Yesterday, an emergency meeting was held between Congress and the White House to reach an agreement on at least temporary government funding through November 21. Unsurprisingly, the parties failed to reach a consensus. But frankly, that's no surprise. Just recall all of Trump's ultimatums to various nations around the world! Trump doesn't enter negotiations — he issues demands that the other side is expected to comply with. So any talks with Trump are hardly negotiations in the traditional sense of the word.

The Republicans wanted an unconditional extension of government funding, intending to discuss healthcare and social welfare programs only afterward. The Democrats rightly saw a trap in this "fairy-tale offer": once funding is secured, Trump would no longer be incentivized to consider the Democrats' demands.

Let's also be clear — a shutdown is not just a "national vacation." It is another direct blow to the economy. And while the U.S. economy grew by a record 3.8% in the second quarter, many economists are skeptical of this growth. Depending on its duration, a shutdown could shave off several tenths of a percentage point from U.S. GDP growth.

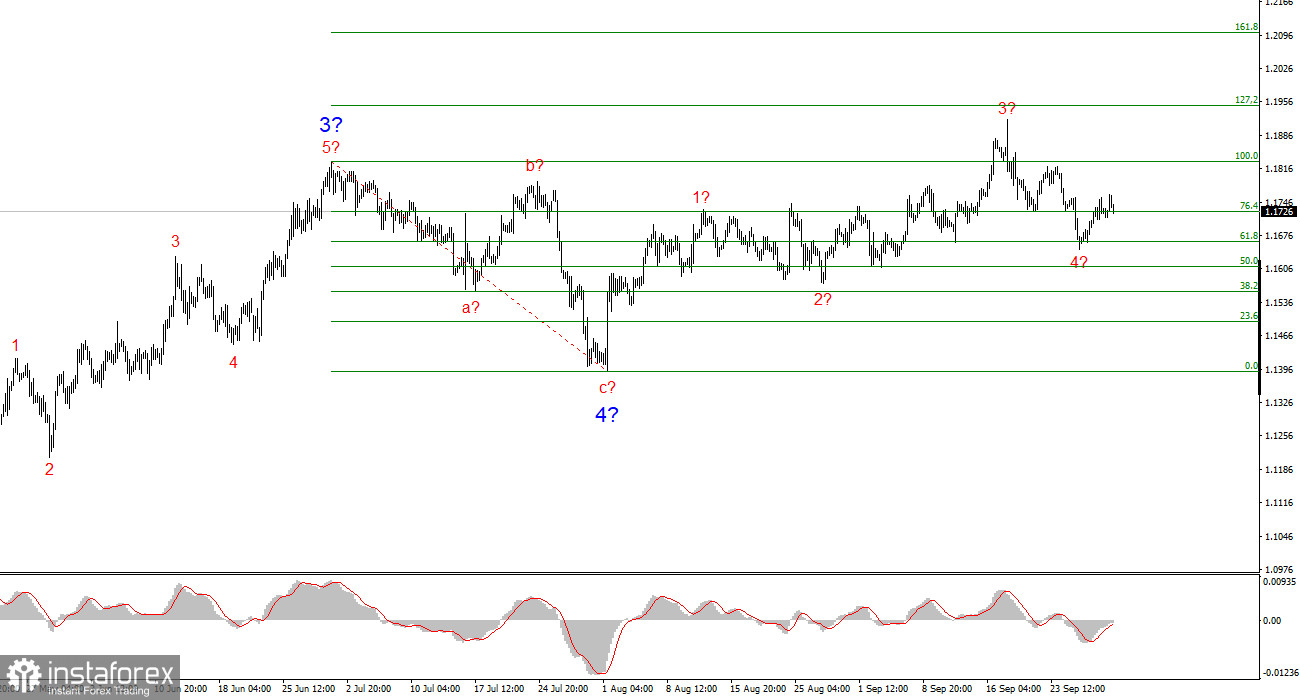

Wave Pattern on EUR/USD:

Based on my analysis of EUR/USD, I conclude that the instrument continues to build an upward segment of the trend. The wave layout remains entirely dependent on the news backdrop tied to Trump's decisions, as well as the internal and external politics of the new White House administration. The current trend segment could extend as far as the 1.25 area. At the moment, a corrective wave four is unfolding, which may already be complete. The upward wave structure remains intact. Therefore, in the near term, I'm only considering buying opportunities. By the end of the year, I expect the euro to rise to 1.2245, corresponding to the 200.0% Fibonacci.

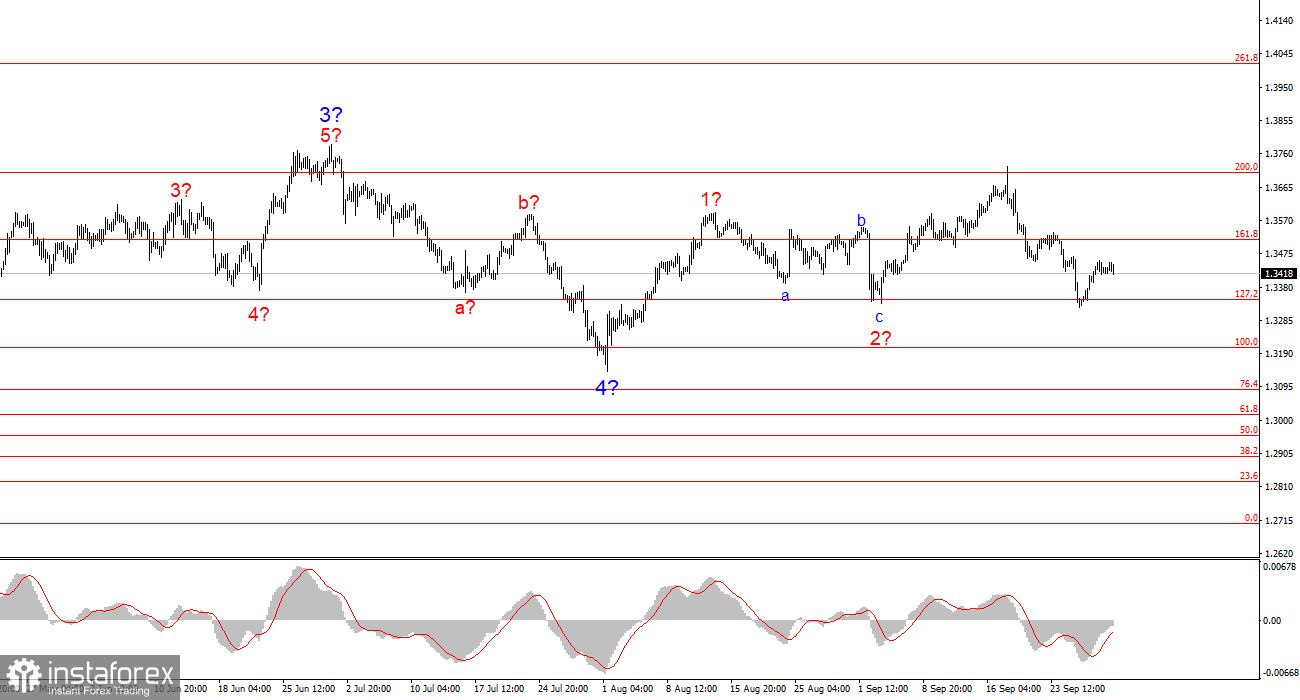

Wave Pattern on GBP/USD:

The wave pattern on GBP/USD has changed. We are still dealing with an upward, impulsive segment of the trend, but its internal structure is becoming harder to read. If wave 4 takes the form of a complex three-wave pattern, the structure will normalize, but even in that case, wave four would be far more complex and extended than wave 2. In my opinion, the best reference point right now is 1.3341, which corresponds to the 127.2% Fibonacci level. Two failed attempts to break this mark may indicate the market's readiness for new buying momentum.

Key Principles of My Market Analysis:

- Wave structures should be simple and clear. Complex structures are harder to trade and often signal a shift.

- If you're uncertain about what's happening in the market, it's better to stay on the sidelines.

- There is no 100% certainty in market direction, and it will never exist. Always use protective stop-loss orders.

- Wave analysis can and should be combined with other forms of analysis and trading strategies.